Last month, Miami-Dade County’s property appraiser released an estimate that said 2016 was already a record year for property values in the county.

Now, the official tally is in — and those initial figures received a modest boost of a little more than $1 billion.

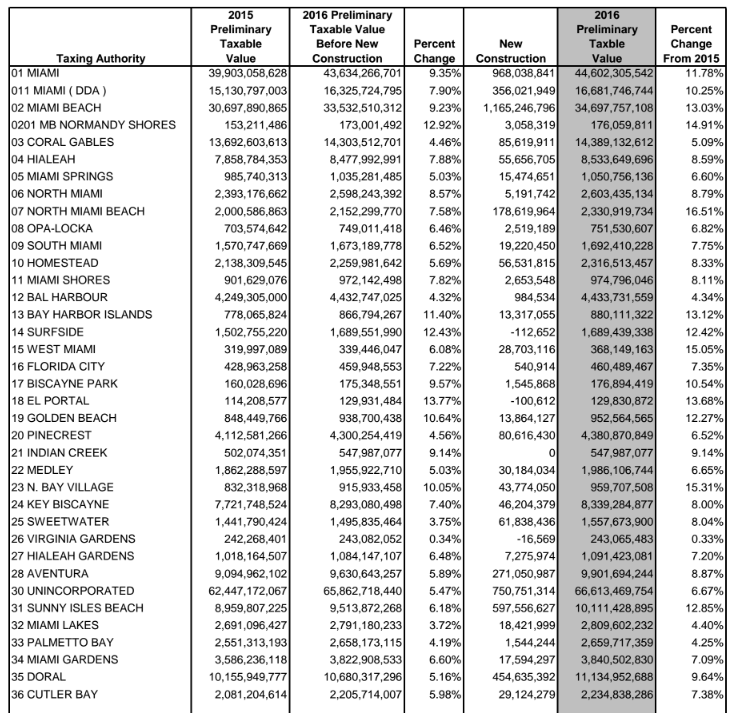

The final numbers shifted values for most of Miami-Dade’s municipalities by less than a percentage point. Surfside saw the largest change between the estimate and finalized numbers, with its property values rising by 12.42 percent instead of 10.6 percent.

North Miami Beach also kept its title as the city where values grew the most this year, with its total taxable properties rising 16.51 percent to $2.33 billion in June. Behind that city was the enclave of North Bay Village, where property values spiked 15.31 percent to $959 million.

The previous estimate of negative construction in Bal Harbour — which at the time was the only municipality to see property values fall in the new construction column — has been reversed. Now the report shows Bal Harbour has seen $984,534 worth of new construction in the past 12 months, with its total property values hitting $4.43 billion.

Other municipalities have taken Bal Harbour’s place: El Portal, Surfside and Sweetwater all had more demolition activity than new construction.

Miami-Dade’s total taxable real estate surged to $251.3 billion as of July, marking a $5 billion increase in values since they last peaked before the crash in 2008, according to the report.

The more telling figure shows just how far the county has come since the depths of the market bust: taxable real estate values in Miami-Dade have risen by $64 billion since they bottomed out in 2011.

“Miami-Dade County continues to see a surge in the real estate market,” Pedro Garcia, the county property appraiser, said in the report. “While property values have risen higher than ever before, the difference this time is that certain segments show signs of a more sustained growth.”

New construction played a significant role in that recovery, though not as much as you might expect. Miami-Dade saw a little more than $5 billion worth of added property values in the form of new construction since July 2015, according to the report.

The town that saw the biggest share of that, unsurprisingly, is Miami Beach. Developers raised values there by $1.165 billion in addition to the 9.23 percent hike in taxable property values year over year.

Recent reports show developer dollars are still flowing to South Florida’s construction industry, with new residential contracts already outpacing 2015.

Check out the full list of municipalities and their values below: