Saying it’s already uncovered a bevy of suspect activity, the federal government announced Wednesday that it’s expanding the highly controversial tracking of secretive luxury homebuyers to six major markets — including Broward and Palm Beach counties.

The announcement comes at the tail end of what amounts to a trial run for the so-called “Geographic Targeting Orders,” which required title insurers to reveal the true players behind shell companies that pay cash for homes worth more than $1 million in Miami-Dade County and $3 million in Manhattan.

Launched by the treasury’s Financial Crimes Enforcement Network in March, the targeting orders were meant to gather information for 180 days about the practice of laundering illegal money through high-end U.S. real estate.

On Wednesday, a month before the original order’s expiration date, FinCEN officials announced they plan to broaden the coverage zones in hopes of better understanding how vulnerable U.S. real estate markets are to money laundering.

Beginning August 28 and lasting again for 180 days, shell companies paying $1 million cash in Broward and Palm Beach will fall under FinCEN’s reporting requirements. All of New York City’s boroughs have also been included, as have the California counties where San Diego, Los Angeles, San Francisco and San Jose are located. Bexar County in Texas, which covers San Antonio, was also thrown in.

FinCEN officials said the new zones were included due to their attractiveness to foreign buyers, prevalence of shell companies purchasing real estate, and information from law enforcement agencies.

Besides the expanded coverage, two other major changes were announced: all U.S. title insurance companies, instead of the select few originally tapped, will be responsible for reporting transactions. And personal or business checks, forms of payment not included in the original rules, will now trigger a reporting requirement. Wire transfers are still not scrutinized, nor are commercial real estate purchases.

The announcement also seems to suggest that FinCEN is altering its practices based on movement in the marketplace. Agents in Miami had said buyers could easily circumvent the regulation by purchasing a home in Broward of Palm Beach counties — a loophole that’s now closed. During the press conference, one FinCEN official likened the agency’s observations to a DUI checkpoint: if a driver turns around before hitting the checkpoint, it raises a red flag.

“By expanding the GTOs to other major cities, we will learn even more about the money laundering risks in the national real estate markets, helping us determine our future regulatory course,” FinCEN Acting Director Jamal El-Hindi said as part of the announcement.

Many in Miami and Manhattan’s real estate community were critical of the orders when they were first announced, saying the reporting requirements were an ineffective method for catching money launderers, and one attorney even taught a class for realtors on how to help their foreign clients avoid the rules.

But during a Wednesday telephone press conference, FinCen officials revealed information that contradicted those criticisms.

More than 25 percent of the transactions covered in the orders involved a beneficial owner who’s also the subject of a FinCen “suspicious activity report,” a FinCen official said during the conference call.

The investigation uncovered homebuyers who had also been affiliated with illicit activity, like $16 million worth of suspicious cash withdrawals, counterfeit checks and $7 million in suspect wire transfers from South America, the FinCen official said, declining to provide specifics.

As a result of the attention these orders are bringing to money laundering through real estate, the official said, banks have also started filing more suspicious activity reports.

“All of this suggests that we are on the right track,” the official said.

The American Land Title Association, a national trade group of roughly 6,000 title insurance companies, released a statement quickly after the FinCEN announcement promising its support.

“As an independent party at the closing table for millions of real estate transactions each year, ALTA members take their responsibility seriously,” Michelle Korsmo, ALTA’s chief executive officer, said in the statement. “Once again, we are ensuring our members have the tools and information they need to properly comply with FinCEN’s reporting requirements.”

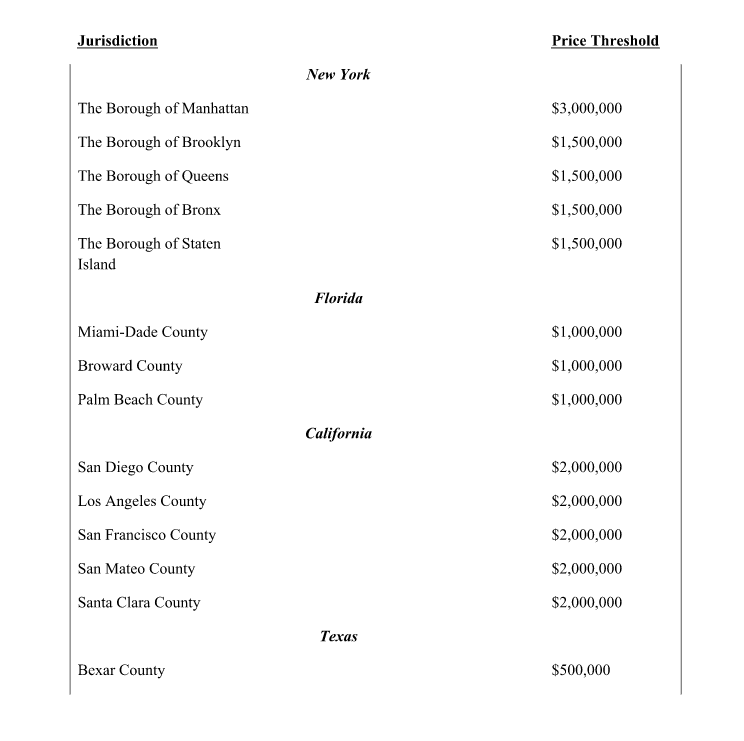

Check out a chart of the covered areas and their price thresholds below: