The US housing market looks very different from its shape in 2008. It reached a breaking point and nearly cratered the financial system after mortgages were approved for too many people that were least likely to pay back on time.

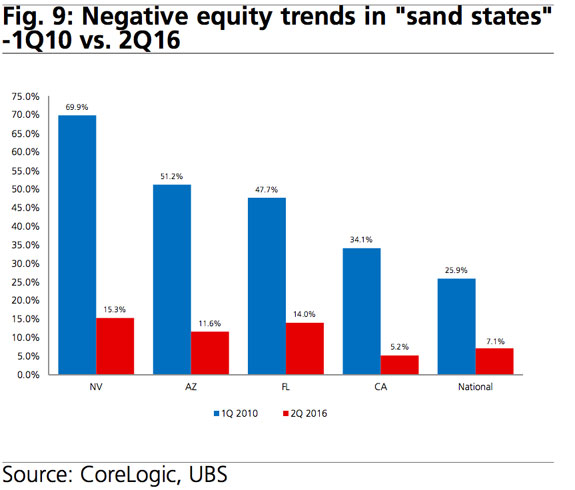

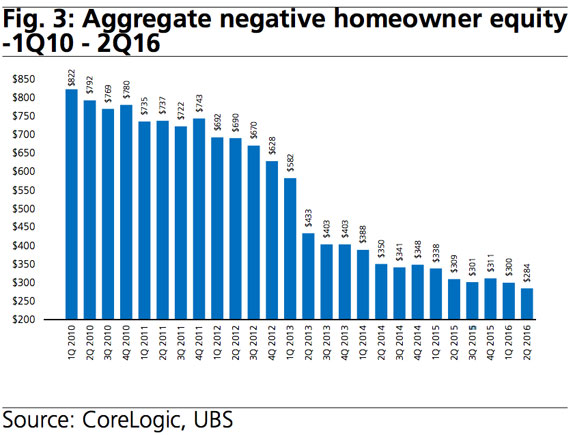

The crash left a lot of homeowners with negative equity — a situation where the value of their homes became less than the balance of the mortgage. But from the start of 2010 through the second quarter of 2016, the percentage of homes with a mortgage that went underwater — when the outstanding loan becomes higher than the value of the home — plunged from 25.9 percent to 7.1 percent, noted Jonathan Woloshin, a strategist at UBS.

This happened as home prices recovered from their trough in the early 2010s, and could hold the key to solving the housing market’s current problem.

The resurgence in home prices underscored a broader issue in the market — there aren’t enough homes. As the economy recovered and the unemployment rate fell, the demand for housing rose, putting even more upward pressure on house prices. This supply shortfall and affordability constraint is a ‘new crisis’ for housing.

“A number of factors have likely contributed to the paucity of available inventory,” Woloshin said.

“Of those factors, the one that poses the most significant conundrum (at least to us) has been the steep decline in negative equity not freeing up more inventory.”

That’s because homeowners can’t sell when the money they owe the bank is more than their property’s value.

That’s because homeowners can’t sell when the money they owe the bank is more than their property’s value.

“We believe the significant degree of negative equity that developed after the housing bubble burst was a huge

impediment to home sales,” Woolshin said.

And so, as more homes recover from being underwater, Woolshin argues, the inventory on the market could improve.

Negative equity is improving even in the states that suffered the most in the housing crash. The four so-called “sand states” — Nevada, California, Arizona and Florida — which suffered the most in the housing crisis, have sharply fallen. California, Woolshin noted, had a lower percentage of mortgaged homes underwater than the national level in the second quarter.

We believe many homeowners did not want to suffer the stigma and negative credit implications of defaulting on their loans,” Woolshin said.

“We are hopeful that the combination of declining negative equity and continued job creation will increase the mobility of homeowners, which should ultimately lead to increased supply.”

Zillow noted in a report in March that underwater homes were most prevalent among lower-priced homes.

That also happens to be the end of the market where demand is strongest. But the incomes of prospective homebuyers there have not risen at the same pace as shelter costs.

Ultimately, the best-case scenario would be to finally see a decent pickup in wage growth alongside the drop in negative equity.