Millennials fretting over the high costs of buying a first home, fear no more: renting may be the better financial option anyway.

A new report shows the growth of home prices is outpacing that of rents across many major metropolitan areas in the United States, which could be yet another factor sinking the country’s historically low rate of homeownership.

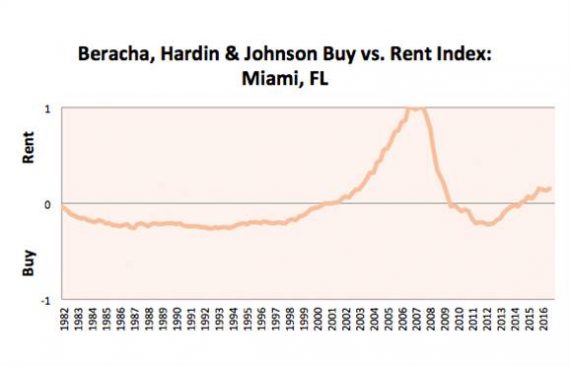

The Wall Street Journal reported that Florida International University and Florida Atlantic University just released their third-quarter housing index that compares housing prices and rents in 23 major cities, including Miami.

Of all 23, the Journal reported, homes were becoming more expensive faster than rents were rising. Nationwide, the cost of buying a home spiked 5.5 percent year-over-year September, while rents jumped only 3 percent.

Miami crossed the threshold for renters getting a better deal in 2014, according to the index, and the gap between housing costs and lease rates has continued to grow since then.

Buy versus rent chart for Miami

That trend doesn’t appear to be headed for a change in the near future, either: developers are about to deliver the largest influx of apartments in Miami-Dade County’s history this year — a supply boom that will likely keep rent growth at a moderate rate, experts say.

Meanwhile, the county’s rising home costs have showed no sign of stopping, even as brokers call for sellers to moderate their expectations and lower asking prices.

The trend has also brought the nation as a whole closer to the tipping point for being renter friendly, though it’s still on the home buying side of the chart for now.

Cities where buying is still the better option, according to the Journal: Atlanta, Boston, Chicago, Cleveland, Los Angeles, New York and Philadelphia. [Wall Street Journal] — Sean Stewart-Muniz