Whether they’re downtown skyscrapers wrapped in glass or sprawling campuses out in the ‘burbs, office properties make up a huge part of the real estate marketplace here in South Florida.

And while glitzy new condo projects often steal the limelight, The Real Deal is showcasing the five biggest office deals struck in South Florida during 2016, as well as the players who made them happen.

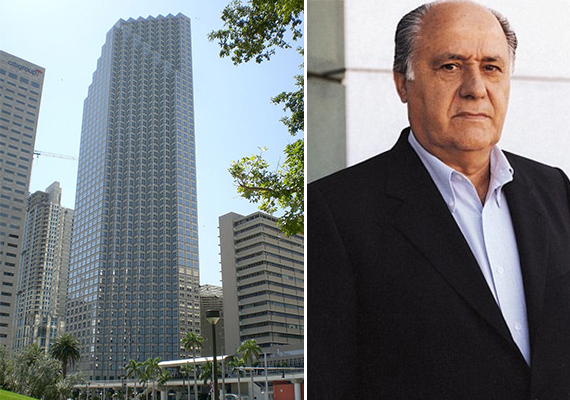

The Southeast Financial Center (Credit: Marc Averette) and Amancio Ortega

#1 Southeast Financial Center: $516.6M

Amancio Ortega, the world’s second-richest man and owner of clothing chain Zara, is not known for using half measures. The billionaire made a name for himself in Miami’s real estate scene when he bought a full block of Lincoln Road last year for $370 million in cash.

Then, in December, Ortega again blew the roof off the commercial market here when he bought downtown’s Southeast Financial Center for $516.6 million.

The tower is a landmark in the Miami skyline at 55 stories, making it Florida’s tallest office building. And with 1.2 million square feet of leasable space, it’s also downtown’s biggest office building by about 400,000 square feet.

Just like his other record-breaking purchases around the globe, Ortega paid cash for the building. The seller was JP Morgan Asset Management, which had started shopping the property with brokerage HFF this summer to cash out on its investment.

Even with the jaw-dropping price tag, the $430 per square foot Ortega paid was actually at a discount when comparing it to other office deals in the area. The building is 88 percent occupied, mostly by law firms and financial groups, and asking rents range between $22 and $47 per square foot.

The Miami Tower and Las Olas City Centre

#2/3 Tie between Miami Tower and Las Olas City Centre Plaza: $220M

Coming in second place is a tie between another two landmark buildings, both of which sold for a flat $220 million and signaled confidence in their respective cities from market watchers.

The first deal to close this year was in May, when Japanese trade conglomerate Sumitomo Corp. of Americas purchased the color-changing Miami Tower for roughly $367 per square foot.

Decked out with a $1.5 million LED light system, the 47-story tower is hard to miss in Miami’s skyline. It has 600,000 square feet of rentable space, 92 percent of which was occupied at the time of its sale with asking rents ranging from $38 to $52.50 per foot.

For some commercial brokers, the deal illustrated how far Miami has come since the late 2000s real estate crash threw property values in a tailspin. The seller, LaSalle Investment Management, had paid $105 million for the tower just six years prior. Sumitomo’s long-term bet on the Miami office market also meant the city’s profile among foreign investors was only getting better.

Four months later and roughly 30 miles to the north of Miami Tower, Fort Lauderdale enjoyed a similarly massive deal when Deutsche Bank bought the Las Olas City Centre office building for $220 million.

Unlike the Miami Tower, Las Olas City Centre is only 23 stories tall with 408,064 square feet of rentable space. But that size difference meant the Fort Lauderdale office building fetched a much pricier $539 per square foot for its seller, JPMorgan Asset Management. The property was almost entirely leased at the time of its sale, as well.

The deal marked Fort Lauderdale’s most expensive office sale in 2016, capping off a year of rising commercial property values in the city. JPMorgan had bought the tower for $164 million just five years earlier.

Datran Center and Gregg Schenker, president and co-managing partner of ABS

#4 Datran Center: $150M

Kendall, a sprawling suburban neighborhood relatively far from the action in downtown Miami, has become something of a hotspot for commercial investment this year.

That trend became all too easy to read in August, when an investment group led by ABS Partners Real Estate and Acre Valley Real Estate Capital bought the two-tower Datran Center office complex for $150 million. The seller was USAA Real Estate Co. and a Canadian real estate investment trust, who had placed the 18 and 20-story buildings on the market in July of last year.

Measuring just under 500,000 square feet, Datran’s sale broke down to roughly $300 per foot, rivaling the prices paid for more centrally located properties in the downtown area. Together, they’re about 80 percent occupied with rents ranging between $38 and $41 per square foot.

The towers’ distance from the downtown area was actually a selling point for the buyers, who said at the time that Datran was attractive because it was far from Miami’s “highly congested business district.” The buildings also neighbor the Dadeland South Metrorail station.

Much like this year’s other big-ticket commercial deals, the Datran sale also showed how South Florida’s office market is beginning to gain ground in the competition for investment dollars between other major U.S. metropolitan areas.

Courvoisier Centre

#5 Courvoisier Centre: $140M

While all of the above deals came down to a handshake, this last one is more akin to a marriage.

Parkway Properties, looking to squeeze value out of its Courvoisier Centre office complex in Brickell Key, sold an 80 percent stake in the property to a group of Spanish investors led by conglomerate Corporación Masaveu for $140 million.

The deal was particularly shrewd for Parkway: not only was it keeping a 20 percent ownership stake, Courvoisier’s sale also meant Parkway would recoup the $145.8 million it paid to acquire the property in 2014.

For Masaveu, whose real estate arm has a penchant for urban office buildings, the joint-venture translated to a major foothold in Miami’s preeminent commercial market: Brickell.

Courvoisier is composed of two office buildings totaling 385,841 square feet, plus a parking garage with 941 spaces.

The sale was announced in November 2015, though it closed sometime at the beginning of this year. At the time of the closing, Courvoisier was 88 percent occupied with rents ranging from $40 to $52 per square foot.

TRD Researcher Eda Kouch contributed to this report.