UPDATED Jan. 3, 5:50 p.m.: Greater Downtown Miami will see more rental apartments delivered than condominiums in 2017 for the first time ever, as developers focus on the multifamily market amid slumping condo sales, according to newly released report.

And that influx of inventory means rental rates are dropping, the Downtown Development Authority’s study shows.

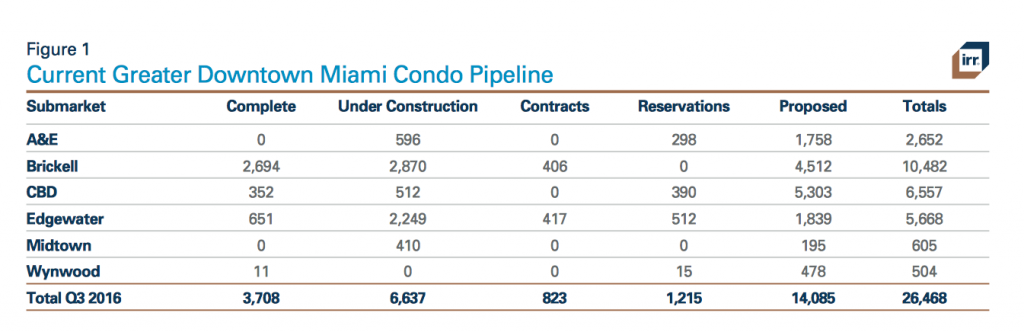

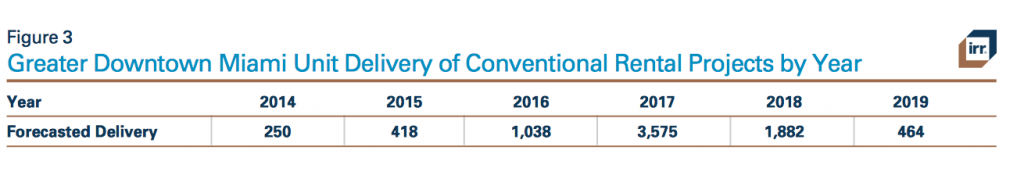

The DDA’s Greater Downtown Miami Residential Market Study “Flash Report” found that 3,575 rental units will be delivered in 2017, compared to 2,774 condos, as developers wind down their condo construction in 2017 and beyond, until possibly 2019. No new major condo projects commenced construction during the third quarter, though some projects began taking reservations, as they position for a 2019 delivery, according to the report, which tracks activity through October 2016.

Developers, like the Related Group, are holding off on construction amid a slowdown in condo sales, as foreign buyers contend with economic turmoil and currency fluctuations. Related has delayed construction on Auberge Residences & Spa Miami until at least 2018.

Developers, like the Related Group, are holding off on construction amid a slowdown in condo sales, as foreign buyers contend with economic turmoil and currency fluctuations. Related has delayed construction on Auberge Residences & Spa Miami until at least 2018.

“This year, 2017, marks a turning point in condo deliveries, where condo deliveries are going to decline,” Anthony Graziano, senior managing director of Integra Realty Resources Miami, who authored the report, told The Real Deal.

Meanwhile, Greater Downtown rental apartment deliveries have risen each year since 2014, and are expected to peak in 2017, then decline again to 1,882 in 2018 and 464 in 2019. Among the rental projects slated for delivery in 2017: Midtown Five, Panorama Tower, Broadstone at Brickell, and possibly Met Square and MiamiCentral, Graziano said.

The rash of deliveries already has put downward pressure on rents downtown. Average condo leasing prices are down from 2 percent to 4 percent in the third quarter, quarter-over-quarter, after a flat first and second quarter, according to the report. Rental building rents are up nearly 3 percent, with the exception of 1-bedroom units.

“2017 is going to be a big year for proving out the depth of the apartment market downtown, and also in terms of attracting new people to rent downtown,” Graziano said. As rental competition heats up, he expects to see higher vacancies.

The surge in rentals is not only hitting Greater Downtown Miami. A Marcus & Millichap report released in August 2016 found that by the end of 2016, developers were slated to deliver the largest influx of new inventory in Miami-Dade County in the past 17 years.

Miami-Dade saw 2,100 new apartments open their doors during the first quarter of 2016, nearly matching in three months the 2,440 units that were delivered in all of 2015. The Marcus & Millichap report said another 4,640 apartments were in the pipeline, marking the biggest inventory spike since 1999. As noted in the report, a lack of land for single-family housing has brought multifamily projects into prominence over the past year. And a flood of new condos — 11,000 in Miami-Dade’s pipeline for the next two years — could also end up as rentals, potentially leading to an oversupply of apartments.

Miami-Dade saw 2,100 new apartments open their doors during the first quarter of 2016, nearly matching in three months the 2,440 units that were delivered in all of 2015. The Marcus & Millichap report said another 4,640 apartments were in the pipeline, marking the biggest inventory spike since 1999. As noted in the report, a lack of land for single-family housing has brought multifamily projects into prominence over the past year. And a flood of new condos — 11,000 in Miami-Dade’s pipeline for the next two years — could also end up as rentals, potentially leading to an oversupply of apartments.