Florida’s economy is expected to surpass the $1 trillion mark in gross product by 2018, making the state’s economy the 16th largest in the world. And with declining unemployment and vacancy rates, South Florida’s real estate markets are projected to strengthen in 2017 as the economy continues to grow, according to a newly released report by Avison Young.

Michael T. Fay, principal and managing director of Avison Young Miami, sees opportunities in South Florida real estate this year. “South Florida continues to have great metrics across all three counties and in the office, retail and industrial markets,” he told The Real Deal.

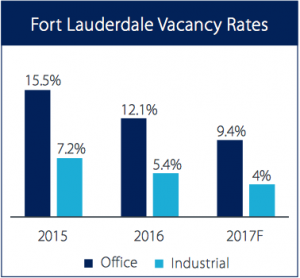

Fort Lauderdale vacancy rates

Broward County set to benefits from solid statewide and local economic factors

Amid a local unemployment rate of 4.6 percent, Broward County’s real estate market is projected to be strong due to the continued job growth, affecting demand for both office and industrial space.

Office vacancy rates dropped to 9.4 percent, and rental rates are expected to rise in competitive areas like Downtown Fort Lauderdale, Cypress Creek and Southwest Broward submarkets, according to the report.

Fay said Broward County will continue to see growth in these markets with an emphasis on retail and multifamily developments.

For the industrial market, added jobs in the transportation and logistics sectors also signify continued growth. As rental rates rise, and the vacancy rate declines past the current 4 percent, additional future developments could be necessary to fulfill the growing demand in Broward County’s real estate market, the report said.

Furthermore, the Avison Young report said rental and investment markets in Broward County are robust, with $122 million in total volume closed in the third quarter along with the Deutsche Bank purchase of Las Olas City Centre in Downtown Fort Lauderdale for $220 million.

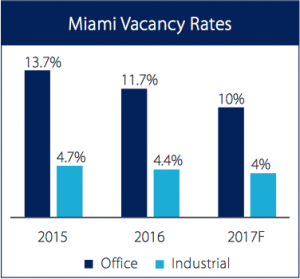

Miami vacancy rates

Development demand in Miami-Dade to continue in 2017

Miami-Dade’s demand for office and industrial development indicates sustained growth this year. According to Fay and the Avison Young report, an increasing population and local unemployment rate of 5.5 percent are driving construction activity and creating a high rate of pre-leasing.

As rental rates rise and market conditions tighten, Miami-Dade’s prominence in global commerce will continue to support the local economy in 2017 through new developments, Fay said.

“Stabilized vacancy rates create higher rental rates, which in turn increases development,” he told TRD. “Projects that were planned in 2016 will be finalized, and sites will be moved on to the next phase of development.”

Although vacancy rates at retail stores decreased in 2016, the Avison Young report said traditional brick-and-mortar stores experienced challenges competing with innovative retailers who have already invested in technologies for omni-channel shopping.

On the other hand, Miami-Dade’s investment market was successful in securing deals in 2016, and 2017 is expected to be no different. Avison Young reports the most significant Miami-Dade investment sale last year was Weingarten Realty’s acquisition of Palms at Town and Country for $285 million. It’s anticipated both domestic and international interest in Miami-Dade’s investment market will continue throughout 2017.

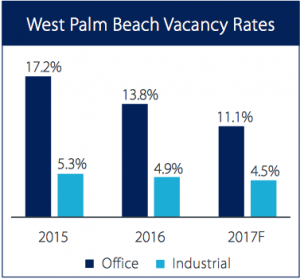

West Palm Beach vacancy rates

Palm Beach County’s growing real estate markets supported by healthy economy

Strong economic factors, like a local unemployment rate of 5.1 percent, are fueling Palm Beach County’s growth in all markets.

With a high demand for office space, the Avison Young report said new construction in Palm Beach County is expected this year, such as the Gardens Innovation Center, which incorporates green building features.

According to the report, Palm Beach County’s stable economy is a key factor in the growth in foreign and domestic investor interest. Fay said market conditions, including the growing demand for renting and a decreasing vacancy rate, are putting pressure on developers for new construction in 2017.

“The next cycle of condo development will begin this year as more people are desiring condos, and this will be evident across South Florida,” Fay told TRD.

With the heightened investment interest, it’s expected more deals will be secured in Palm Beach County’s office market this year, like RedSky Capital’s Esperante office building which traded for 125.8 million in July.