Major stakeholders are split on whether the market has already hit its peak, according to a survey conducted by one of the country’s largest commercial real estate trade groups.

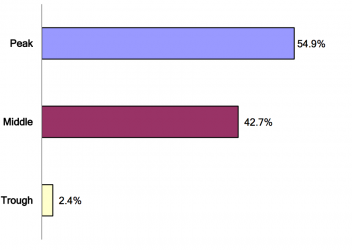

The report from the Commercial Real Estate Finance Council (CREFC), whose members include giant asset managers like BlackRock and New York developers like Fisher Brothers, noted that 55 percent of respondents at the group’s annual conference concluded that the real estate market has already passed its high point, while another 43 percent said the market is still moving through the middle of the cycle.

“Any further movements in pricing will have to come through increased performance, which might be difficult until we see real growth in the economy,” one respondent concluded.

But the majority of respondents also said they expected the greater U.S. economy to be at least “somewhat better” in 2017 than last year. That optimism is shared by CREFC’s executive director, Lisa Pendergast, who told The Real Deal in an interview that there was no question that the presidential election outcome was behind this recent mood swing.

“Regardless of anyone’s political views, there’s very little argument that the election of Donald Trump [TRDataCustom], with an undivided House, Senate and White House that are now aligned, has revived the animal spirits of the market place,” she said. Pendergast cited increased business investment during 2016’s fourth quarter, which accounted for higher than expected GDP growth. Still, that growth remains low at only 1.9 percent, she noted.

Also in CREFC’s survey, a plurality of respondents said they expected total CMBS issuance to fall between $75 billion and $100 billion in 2017, up from the underwhelming $67.2 billion that Trepp analytics is currently projecting as the final figure for 2016. Additionally, 72 percent of respondents said rising interest rates would affect their performance, but less than 10 percent said that impact would be significant.

Stakeholders perception of the real estate cycle (Source: CREFC)

While the majority of respondents said the availability outlook for commercial real estate debt would be at least somewhat favorable, one member cited Dodd-Frank as the “wildcard” for how much financing would realistically be available this year.

As TRD reported, some in the industry are hoping that the Republican-controlled Congress takes a hatchet to the risk-retention rules for commercial mortgage-backed securities included in the Dodd-Frank financial regulations. The rules, which took effect in December, require CMBS issuers to retain five percent of the credit risk on the securities they sell.

In CREFC’s survey, however, the majority of CMBS investors and lenders said that the general effect of overall regulations on their competitiveness would either be the same or in some cases even better than last year. And only 8.3 percent of high-yield and distressed real estate investors said regulations were now making them less competitive.

By contrast, 50 percent of balance sheet bank lenders, which retain their loans instead of selling them off, concluded that general regulations are affecting their competitiveness more than before.

Another interesting survey response was on the topic of multifamily housing, in which nearly two-thirds of respondents said they believed that the supply of multifamily assets in their respective markets will negatively affect rent growth and property values. Overbuilding and rent flattening on the high-end of the market were the top cited reasons for this pessimistic outlook. Some economists even worry about a multifamily bubble forming, as TRD reported.