As the nation’s retail market struggles amid store closings and mounting pressure from online shopping, South Florida stands out as a top market for retail assets, according to a newly released report.

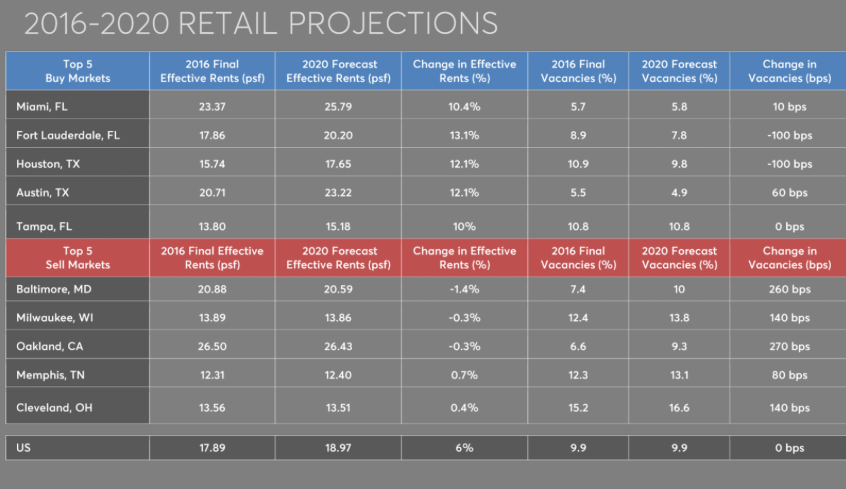

Ten-X’s Retail Market Outlook ranked Miami as the top long-term “buy” market, based on demand, followed by Fort Lauderdale, Houston, Austin and Tampa.

In Miami, retail vacancies dropped by 0.05 percent to 5.7 percent at the end of last year. Rents averaged $23.37, and are projected to rise to $25.79 by 2020, according to the report. Fort Lauderdale retail vacancies fell to 8.9 percent last year, with rents averaging $17.86. Rents in Fort Lauderdale are forecast to rise to $20.20 in 2020.

Ten-X ranked Baltimore, Milwaukee, Oakland, Memphis and Cleveland as the top “sell” markets, where shrinking or stagnating populations and weak demand could lead investors to consider selling retail properties, the report said.

Overall, retail vacancies were 9.9 percent nationwide at the close of 2016 and are projected to remain at that level in 2020.

Ten-X’s retail report