South Florida renters may finally be getting a break.

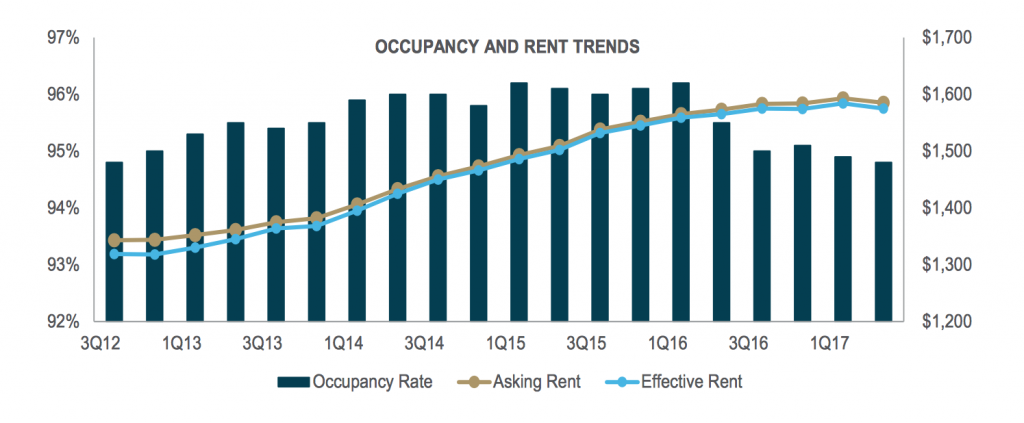

The supply of new inventory has outpaced demand so far this year, according to a Berkadia multifamily report. And although asking rents in South Florida increased 0.9 percent to nearly $1,600 a month in March, rent growth is slowing. Landlords are also expanding average concessions on rent by 10 basis points to 0.6 percent of asking rent, according to the report.

Year-to-date, 5,677 new units were delivered in the tri-county region and 3,211 apartments were absorbed. South Florida’s occupancy rate averaged 94.8 percent, down slightly from the previous quarter.

Multifamily construction is booming across the U.S. This year alone, nearly 13,500 new apartments will be delivered in South Florida, marking the fifth most active city in the country for multifamily construction, according to a report from RentCafe. By the end of 2019, more than 18,500 new units will come online, according to Berkadia. The bulk of new units were delivered in Miami, Boca Raton East and the Miami Airport West submarkets.

In the Boca East submarket, rents fell 2.8 percent year-over-year to $1,841 during the second quarter. In the city of Miami, rents increased 3.1 percent to $1,942; and in Airport West, rents were up 0.7 percent to $1,792. In all three markets, more than 1,100 new units were delivered so far this year for a combined 4,480 apartments.

Mitch Sinberg, a senior managing director of Berkadia, said in a release that the market is “still playing catch up from the recession,” which is why the slate of new units “hasn’t put much of a dent in occupancy or rental rates.”

Asking rents fell slightly from about $1,600 during the first quarter of this year to $1,585, according to the report. During the second quarter, asking rents ranged from $1,000 a month in South Dade and Homestead to $2,086 a month in Fort Lauderdale.

Berkadia cited the development of All Aboard Florida’s Brightline stations as a demand driver. The high-speed rail service is expected to start later this year as the mixed-use stations begin opening in West Palm Beach, Fort Lauderdale and Miami.