A heap of issues regarding payouts for properties that repeatedly flood are spilling out, as revisions to the National Flood Insurance Program make their way through the U.S. House of Representatives.

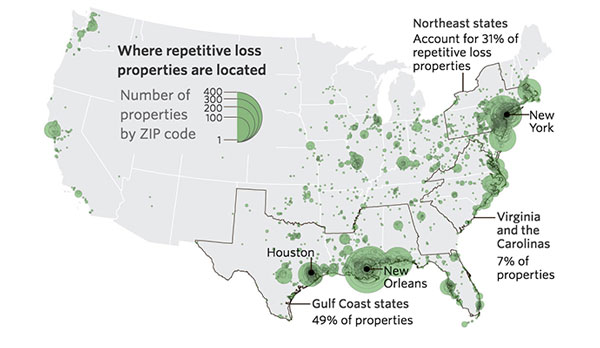

Over the years, 750 properties in coastal area like Houston, New Orleans, South Florida, the Florida Keys and New York have contributed $800 million in losses, or an average of about $1 million per asset, according to government data pulled together by The Wall Street Journal.

(Credit: Wall Street Journal. Data provided by the Natural Resources Defense Council via FEMA)

The federal program is designed to protect homeowners from the financial risks of flooding, but has racked up almost $25 billion in debt, according to Politico.

About 1.8 million homeowners in Florida hold NFIP policies.

In the event of a hurricane, flood insurance rates are expected to spike. This year, property losses due to Hurricanes Harvey and Irma are estimated to cost billions. According to FEMA, Hurricane Irma resulted in more than 20,000 federal flood insurance claims in Florida. [WSJ] – Amanda Rabines