Trending

Downtown Fort Lauderdale booming, but risks are on the horizon: DDA report

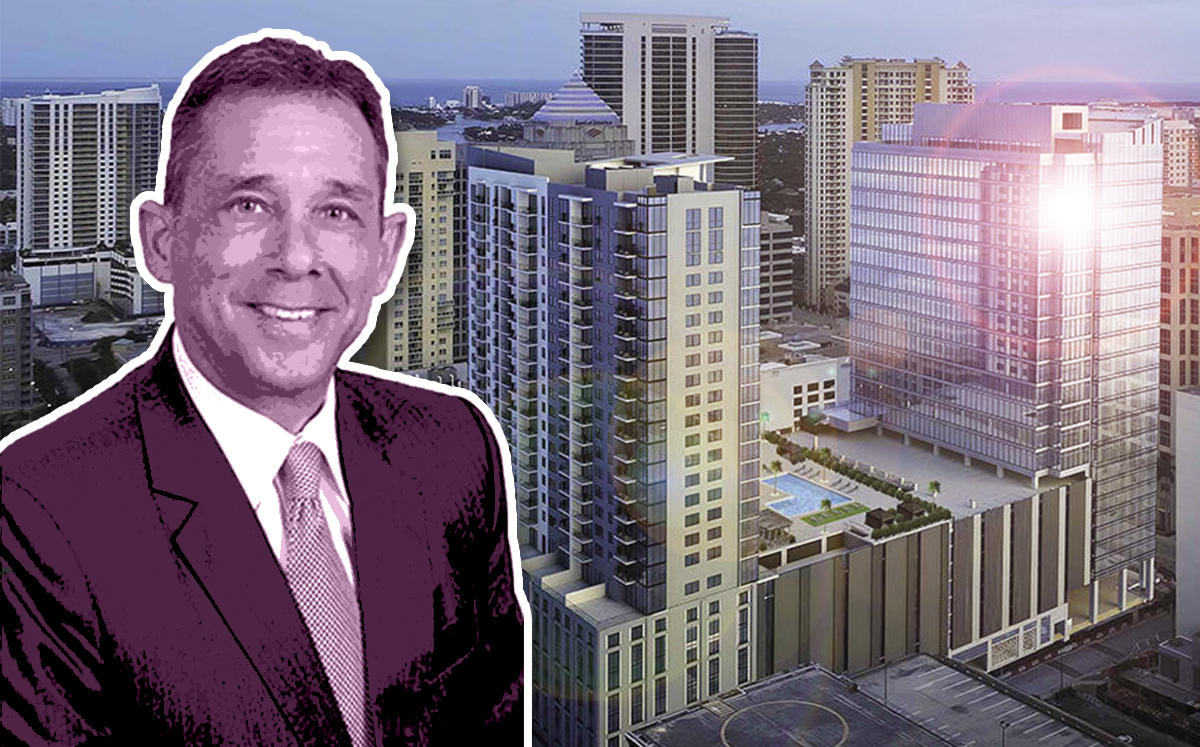

Apartment, office and retail rents are hitting peak prices as several major mixed-use projects get underway, including Main Las Olas

Amid the redevelopment of downtown Fort Lauderdale, lease rates for apartments, offices and retail shops have jumped over the last five years, according to a recently released report by the Fort Lauderdale Downtown Development Authority.

However, rising construction costs, skilled labor shortages and sea-level rise now pose a “huge impediment” and a “near-term risk” to the record-setting pace of development in downtown Fort Lauderdale, Ken Krasnow, South Florida executive managing director for Colliers International, told attendees at an Urban Land Institute forum on Monday.

“These are some things out there that could bring a damper to the growth,” Krasnow said. “We expect a pull back in 2020.”

Downtown Fort Lauderdale is in the midst of a boom that is introducing micro-unit apartment buildings to the area and the first new office project in more than a decade, Krasnow said. Colliers prepared the 2019 state-of-the-market report for the Fort Lauderdale Downtown Development Authority.

According to the report, office rents skyrocketed from an average of $10 per square foot in 2013 to $34 per square foot in 2018. The average rent per month for a one-bedroom apartment increased by $200 to $1,954 during the same time period, and retail landlords are scoring an average of $36 per square foot triple net rent, representing a 170 percent growth rate since 2013.

“We are at the top of the market, but we still believe this market has a lot of runway,” Krasnow said. “People want to work here. People want to rent here. The retail market is extremely strong. More importantly, the investor demand is there.”

During a panel discussion about Main Las Olas, the mixed-use project that features a new office tower, speaker Mark Portner affirmed Krasnow’s assessment of downtown Fort Lauderdale. Portner is a managing director with Shorenstein Company, the real estate investment firm that has partnered with Stiles Corp. to build Main Las Olas, a 2.7 acre project that includes land leased from Broward College. The development entails 357,000 square feet of Class A office space, a 341-unit apartment tower, restaurants and retail space. About 85,000 square feet has already been leased to Akerman LLP, Berger Singerman LLP and BBX Capital.

“We have been following the whole urbanization of downtown,” Portner said. “The hotels, offices and new residences are all the ingredients that bring workers downtown. Even though Fort Lauderdale is smaller than other commercial business districts we invest in around the country, we jumped on the opportunity.”