Every day, The Real Deal rounds up South Florida’s biggest real estate news, from breaking news and scoops to announcements and deals. We update this page at 9 a.m. and 4 p.m. ET. Please send any tips or deals to tips@therealdeal.com

This page was last updated at 4 p.m.

Jacob Sudhoff and Scott Durkin (Credit: Sudhoff Companies, Emily Assiran, iStock)

Douglas Elliman is launching in Texas. The brokerage announced on Tuesday a joint venture with Sudhoff Companies, a real estate marketing and sales company based in Houston that specializes in new development. The firm plans to expand its resale division early next year and eventually move into Dallas and Austin. [TRD]

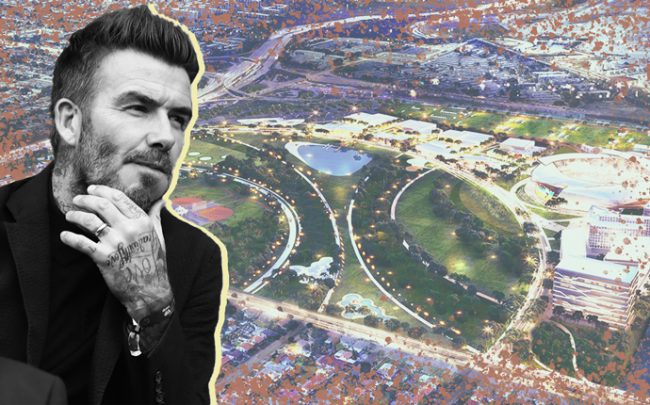

David Beckham and Miami Freedom Park (Credit: Getty Images)

David Beckham’s plans to develop a Major League Soccer stadium in Miami hit another snag. An environmental analysis for the planned site for the Inter Miami team reported high arsenic contamination levels and surface-level soil samples containing debris that pose a “physical hazard,” according to the Miami Herald. [TRD]

Praxis of Deerfield Beach Apartments and MRK Partners CEO Sydne Garchik

A partnership between MRK Partners and R4 Capital bought a Deerfield Beach senior living facility for $24 million. The partnership purchased the 224-unit Praxis of Deerfield Beach Apartments for about $107,000 per unit. Reston, Virginia-based SJM Partners sold the property. [TRD]

Edwards Companies scored a $45 million investment for its Atlantic Crossing mixed-use project in Delray Beach. The Columbus, Ohio-based real estate firm closed on the preferred equity investment from Pearlmark Real Estate Partners. The funds will go toward building the project, which will include 261 apartment units, 91,000 square feet of office and retail space, 82 condominium units and parking. [TRD]

President Donald Trump (Credit: Getty Images, Mar-A-Lago Club)

Companies tied to President Trump could pay nearly $1.5 million in property taxes in Palm Beach County this year. In terms of market value, Mar-a-Lago was valued at $26.6 million, according to the Palm Beach Post, citing estimates from the county’s property appraiser. In all, 10 Trump properties were valued at nearly $80 million. [TRD]

Investor Philip Knoll is looking to sell a piece of land in Wynwood for $5.25 million. A company tied to Knoll is listing the 13,345-square-foot corner lot – the only piece of land not owned by the Salvation Army on the block – at 2210 Northwest Miami Court with Miguel Pinto of Apex Capital Realty. The site, which includes a renovated Class A office building, allows for up to 85,000 square feet of development, a 45-unit multifamily building or a 90-room hotel, according to Pinto. Knoll also owns the Veza Sur Brewing building about three blocks away.

Rotem Rosen wants $103 million from the estate of his former father-in-law, Tamir Sapir. Court documents cite a “falling out” between Rosen and Alex Sapir, his former business partner, brother-in-law and executor of Tamir Sapir’s estate. Rosen, who was once CEO of the Sapir Organization, alleges he is owed the money for his role in steering the family’s real estate empire through the financial crisis a decade ago. [TRD]

Property Markets Group and its partner Greybrook Realty Partners are planning their first development in Wynwood. The two firms closed on a $46 million purchase of the 1.6-acre assemblage at 2431 Northwest Second Avenue that they plan to transform into an apartment, hotel and retail complex. [TRD]

A federal jury determined that the previous owners of the Seabonay Beach Resort in Pompano Beach fraudulently muscled out a former partner. Last week, jurors awarded Los Angeles-based real estate investor Arturo Rubenstein and his company Fab Rock Investments $3.5 million in damages stemming from his lawsuit against Yoram and Sharona Yehuda and the BH3 affiliates BNH LLC and 1159 Hillsboro Mile LLC. The previous owners sold the 69-key hotel to affiliates of BH3 for $13.5 million in 2017. [TRD]

Compiled by Katherine Kallergis