Every day, The Real Deal rounds up South Florida’s biggest real estate news, from breaking news and scoops to announcements and deals. We update this page throughout the day. Please send any tips or deals to tips@therealdeal.com

This page was last updated at 9 a.m.

The trade war could put a damper on the industrial real estate boom. Net industrial leasing activity for the next two years will be less than the past two years, according to a new report from trade group NAIOP. Trade and manufacturing activity have been impacted by new tariffs, but demand for last-mile logistics facilities has stayed strong thanks to the spread of e-commerce. [WSJ]

Hurricane Dorian never made landfall in Florida, but the near miss still had a sizable impact on Florida’s hospitality industry around Labor Day weekend. Demand for hotels in the Florida Keys fell by 50 percent and revenue per available room dropped by 59 percent during a seven-day period from Aug. 30 through Sept. 5, according to a report from the hotel data company STR. [TRD]

Condo sales in Miami continued recovering following the disruption caused by Hurricane Dorian in early September. A total of 99 condos sold for $45.7 million in Miami-Dade County last week, up from $27.5 million in sales volume for 69 units the previous week. Condos last week sold for an average price of about $461,000 or $324 per square foot. [TRD]

After a major data breach, Corcoran attempts a lockdown. But agents are talking. Less than two hours after emails with agents’ commissions and other sensitive information were sent to the Corcoran Group’s agents and staff, the firm shut down its email system while the IT department removed the leaked files from the firm’s server. Agents were warned not to share the attachments — which Corcoran has assured do not contain client information. [TRD]

The White House blames NYC housing regulations for increasing homelessness. A study from the Trump administration’s Council of Economic Advisers says the city’s homeless population could be 23 percent less if not for “over-regulation of local housing markets,” including things like zoning rules, rent control and energy-efficiency laws. [NYP]

Margaritaville Hollywood developer Lon Tabatchnick is planning a mixed-use hotel complex in downtown West Palm Beach. Tabatchnick, president of the Lojeta Group, scored approval from a city committee last week for the 22-story, 400,000-square-foot development at 145 South Dixie Highway with 204 hotel rooms, 143 apartments and a rooftop bar, according to the Palm Beach. The site was previously home to Russo’s Submarine Shop, which closed in 2016. [Palm Beach Post]

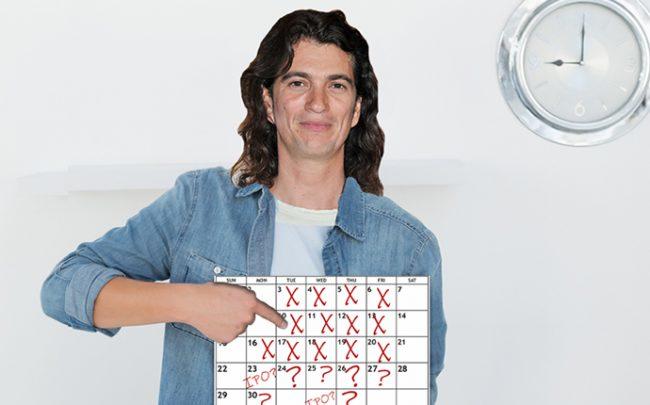

Adam Neumann. WeWork’s co-founder and CEO (Credit: Getty Images, iStock)

WeWork parent company’s IPO is expected to be postponed. The company, which said it would list shares on the Nasdaq the week of Sept. 23, announced it would postpone its public offering until at least next month. [TRD]

Dolphin Capital Partners and Baywood Hotels closed on the site of a planned Moxy by Marriott hotel in Wynwood. The partners paid $11 million, or $670 per square foot, for the 16,400-square-foot site at 255 Northwest 25th Street, according to Tony Arellano and Devlin Marinoff of Dwntwn Realty Advisors. David Grutman’s Groot Hospitality will handle the food and beverage operations for the hotel’s 15,000 square feet of restaurant space, including a ground-floor restaurant and rooftop concept. [TRD]

Global Horizons Group sold a 24-unit apartment building in North Miami to a company managed by broker Michael Wiesenfeld. The property at 770 Northeast 123th Street sold for about $3 million, or $127,000 per unit and $353 per square foot, according to MSP Group brokers Deme Mekras and Elliot Shainberg. They represented the seller, while Wiesenfeld brought the buyer.

Compiled by Katherine Kallergis