Every day, The Real Deal rounds up South Florida’s biggest real estate news, from breaking news and scoops to announcements and deals. We update this page throughout the day. Please send any tips or deals to tips@therealdeal.com

This page was last updated at 6:30 p.m.

Clockwise from left: Forever 21 at 1 World Trade Center NY, 6801 Hollywood Blvd in LA, 865 West North Ave in Chicago and 701 Lincoln Road in Miami (Credit: Gloria Tso for The Real Deal, Google Maps)

Forever 21 identified a trio of New York City stores on its list of 178 locations in the United States that the struggling retailer has slated for closure. The brand also slated 20 stores in the Los Angeles area, along with nine in Chicago and three in South Florida. [TRD]

Another downtown Miami office property hit the market, as owners of older buildings hope buyers will pay a premium to redevelop a property. The office building at 235 Southeast 1st Street is unpriced, but the brokers expect the sale price to be more than $30 million, according to a spokesperson. [TRD]

Rendering of Esplanade at Aventura and Industrious CEO Jamie Hodari (Credit: Seritage and Industrious)

Industrious, a co-working provider, signed a deal for its second location in South Florida. The firm will take nearly 30,000 square feet at Esplanade at Aventura, a mixed-use project under construction next to Aventura Mall. Seritage Growth Properties is developing the retail, restaurant and entertainment project. [TRD]

A Wellington woman wants a $57,000 refund from Miami Beach real estate investor Greg Mirmelli. She’s alleging he did not disclose that the Sunset Island house that she rented from him was in a neighborhood where short-term rentals are prohibited. [TRD]

Blackstone CEO Stephen A. Schwarzman and 5120 Northwest 165 Street

Blackstone acquired two industrial properties in Miami Gardens for $13.6 million, adding to its growing South Florida portfolio. The private equity giant bought the combined 122,078-square-foot industrial site at 5120 Northwest 165th Street from TA Realty. [TRD]

Airbnb is leaning towards a non-traditional path for its 2020 IPO. The San Francisco-based short-term rental startup is making preparations to conduct a direct listing, instead of raising capital by issuing new shares — a move which would save the company millions in underwriting fees. Uber and WeWork’s IPO-related struggles have served as cautionary tales for the startup, and other tech firms like Spotify and SoftBank-backed Slack have have also taken the direct listing route recently. [Bloomberg]

The oil price spike could mean “stagflation” is just around the corner. Rising oil prices resulting from last month’s attack on Saudi oil fields, combined with a slowing economy, could easily lead to the Federal Reserve’s nightmare scenario of stagflation, observers say, and additional trade shocks could make things worse. Such concerns are set to make Fed decisions surrounding further rate cuts even more difficult. [CNN]

Rendering of the Virgin Trains station in Aventura

Miami-Dade County Mayor Carlos Gimenez is pushing for a $76 million train station for Virgin Trains near Aventura Mall. The county would use the half-percent transportation tax to buy the land for the station, according to the Miami Herald. The train company, previously known as Brightline, would build the station using public money. Virgin Trains would give passengers headed to Aventura a discounted rate of $9.75 for a one-way ticket, 35 percent off today’s $15 cost. The commission could vote on the deal this week or next. [Miami Herald]

CoStar is buying STR in a deal valued at $450 million. The move gives the CoStar Group the hotel data company’s entire portfolio, including Hotel News Now, the annual Hotel Data Conference in Nashville, and STR Global Ltd., the company’s international business based in London. STR collects information on more than 66,000 hotels in 180 countries. The deal is expected to close in the fourth quarter of this year.

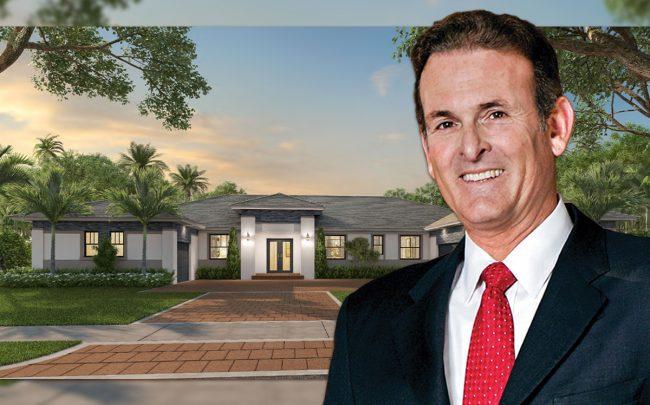

Lennar’s Stuart Miller and a rendering of a Sierra Ranch home

Lennar Corp. closed on an 89-acre development site in Davie for $18.6 million where it plans to build the home community Sierra Ranch. Amzak International, led by David Schack, sold the property at 1950 South Hiatus Road to the Miami-based homebuilder, which plans to build 79 single-family homes on the site. [TRD]

Prestige Imports inked a three-month deal for a pop-up in the Miami Design District. CEO Brett David will use the 9,000-square-foot space at 3841 Northwest Second Avenue to display supercars and hypercars, Luminaire pieces, and art from David Rosen Galleries. It opens Oct. 9 and will run through the end of this year, according to a spokesperson.

Compiled by Katherine Kallergis