Every day, The Real Deal rounds up South Florida’s biggest real estate news, from breaking news and scoops to announcements and deals. We update this page throughout the day. Please send any tips or deals to tips@therealdeal.com

This page was last updated at 5:30 p.m.

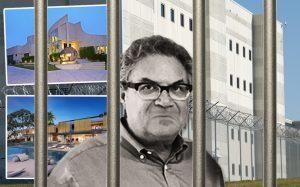

Robert Shapiro pleaded guilty to leading a $1.3 billion fraud that defrauded over 7,000 real estate investors (Credit: iStock)

Robert Shapiro gets 25 years in prison for massive Ponzi scheme. On Tuesday, a federal court judge sentenced Shapiro to that maximum, closing the criminal chapter on what has been a two-year-long saga surrounding the massive fraud perpetrated by Shapiro’s now-defunct Sherman Oaks-based investment firm, Woodbridge Group of Companies. [TRD]

Compass Florida taps former Facebook exec to lead operations. Digital marketing and social media executive Christian Martinez was tapped to be the regional president of Compass Florida. [TRD]

Fisher Island (Credit: Michael Au via Flickr)

Power struggle between Fisher Island association’s directors ignites lawsuit. Fisher Island Community Association board members Michael Ashkin, Jeff Horowitz, Marc Peperzak and George Pearlman are suing the board’s five other directors appointed by developer Fisher Island Holdings over future development in the wealthy enclave and unpaid transportation services. [TRD]

Downtown Coral Gables office building asks $40M. A Miami developer is looking to sell 999 Ponce, a Coral Gables office building, for $39.5 million. Property records show a company controlled by Xavier Rosales of Key Biscayne, who owns Weda Developers, acquired the building at 999 Ponce de Leon Boulevard in 2005 for nearly $21 million. [TRD]

MGM Resorts International is selling the Bellagio on the Las Vegas Strip. A joint venture controlled by a Blackstone Group real estate investment trust will own the Bellagio in a deal valued at $4.25 billion. MGM will have a 5 percent stake in the joint venture and will continue to operate the hotel and casino, which it will rent for $245 million a year. [WSJ]

London real estate at the heart of mysterious Vatican scandal. An internal probe that’s led to at least five Vatican staffers’ suspension is focused on a Chelsea building that the Holy See bought from Italian financier Raffaele Mincione, according to the Wall Street Journal. [TRD]

Ken Stiles and The Westerra development site in Sunrise (Credit: Stiles Corp.)

Stiles sells site of planned Sunrise mixed-use project. Stiles Corp. sold 29 acres in Sunrise for $34 million where it had planned to build a mixed-use project with more than 750 residential units. [TRD]

Two Florida medical marijuana licenses are on the market for $95M. Aubrey Logan-Holland of Blue Dream Industries is listing one license for $40 million that allows the owner to operate up to 30 retail stores, according to the Miami Herald. He is offering another license for about $55 million which allows someone to open 35 retail stores. There are only 22 businesses licensed to sell marijuana in Florida and only 13 are active. [Miami Herald]

The former home of the Graves Museum of Archaeology and Natural History hits the market for $10M. The two-story building at 481 South Federal Highway in Dania Beach is home to the Gallery of Amazing Things, which is an auction house, consignment store and event hall, according to the Miami Herald. [MiamiHerald]

Bridge Development Partners scored a construction loan for a new industrial complex in Davie. Property records show Bridge 595 LLC closed on a $60.28 million loan for the properties at 2650 and 2700 Bridge Way. [TRD]

JPMorgan Chase & Co. reports Q3 profit up 8 percent. The country’s largest bank reported a profit of $9.08 billion, or $2.68 a share, according to the Wall Street Journal. The bank has reported year-over-year profit gains for each of the past seven quarters. [WSJ]