Every day, The Real Deal rounds up South Florida’s biggest real estate news, from breaking news and scoops to announcements and deals. We update this page throughout the day. Please send any tips or deals to tips@therealdeal.com

This page was last updated at 6:00 p.m.

Feds say FIU, FDOT and contractors at fault for deadly bridge collapse. The National Transportation Safety Board determined that FIU and FDOT, along with the project’s design team ,did not exercise common sense in leaving the road underneath the bridge open during emergency construction work on the bridge, according to the Miami Herald. [Miami Herald]

Infinity Real Estate is looking to sell the commercial component of Paramount Bay in Edgewater. The firm hired Tony Arellano and Devlin Marinoff of Dwntwn Realty Advisors to list the 16,500-square-foot building at 2063 Biscayne Boulevard in Miami. It’s on the market for $11.6 million.

David Beall and 303 East Dilido Drive (Credit: LinkedIn, Relator, and iStock)

Pinkberry franchisee lands sweet deal for Venetian Islands home. Pinkberry franchisee David Beall closed on a Venetian Islands home in Miami Beach for $6 million, 28 percent off the original asking price. Thomas and Patricia Kennedy sold the 5,641-square-foot house at 303 East Dilido Drive to Beall and his wife, Lauren, records show. [TRD]

Miami Gardens commercial site sells for $19M. Concorde Group Holdings sold two commercial buildings near Miami Gardens for $19.4 million, a 61 percent increase from the last sale price in 2016. [TRD]

From left: Cushman & Wakefield’s Wayne Ramoski, Skyler Stein and Gian Rodriguez with 8390 Northwest 25th Street (Credit: Cushman & Wakefield and LoopNet)

On Cue: Florida Grand Opera sells its Doral headquarters for $7M. Florida Grand Opera sold the 35,779-square-foot building at 8390 Northwest 25th Street for $7 million or $196 per square foot, according to a press release. Miami-based Imagik International Corp., which makes in-flight entertainment systems, bought the property. [TRD]

Crocker Partners withdraws plans and two lawsuits tied to Midtown Boca. The Boca-based firm is one of a handful of developers that planned to build on the 300-acre Midtown Boca site, but now “the coalition has fallen apart due to the city’s obstructionist tactics,” said Angelo Bianco, Crocker’s managing partner. [TRD]

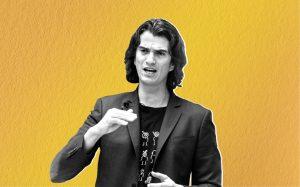

Former WeWork CEO Adam Neumann (Credit: Getty Images, iStock)

Days before bailout, WeWork founder scrambled for $100M loan. As WeWork hustled to secure a rescue package, its former CEO was under intense pressure to shore up his own finances. Last week Adam Neumann paid a $150,000 deposit to secure a $100 million loan to refinance his interest in a Chelsea development site, people familiar with the matter told The Real Deal. [TRD]

President Donald Trump (Credit: Getty Images)

White House sees Camp David as best site for G7. President Donald Trump reversed his decision to hold the G7 summit at Trump Doral after facing backlash, according to the Miami Herald. Now, White House officials believe that Camp David is the best option for hosting the summit since other sites are likely fully booked. [Miami Herald]

Royal Bank Plaza in Toronto (Credit: Wikipedia)

Google backs away from Toronto lease with WeWork. The tech giant is now planning to lease space from co-working firm IWG Plc instead of WeWork after months of negotiations with the troubled company, according to Bloomberg. Google signed a multiyear deal for about 24,000 square feet across two floors at IWG’s Spaces location in Royal Bank Plaza. [Bloomberg]

Opportunity Zone funds are falling behind expectations. Opportunity Zone funds, on average, raised less than 15 percent of their goals, according to a new analysis by Novogradac & Co., a San Francisco accounting firm that advises fund managers and investors on tax incentives, the Wall Street Journal reported. [WSJ]

Compiled by Keith Larsen