The Miami City Commission unanimously accepted the data of an affordable housing master plan created by Florida International University, during a special meeting on Friday.

However, city commissioners want to analyze the report’s suggestions on how to leverage $85 million in bond money for affordable housing to up to $6 billion, in order to build 32,000 affordable units over the next 10 years.

A couple of commissioners also balked at the idea of handing over $85 million to a “Miami Affordable Housing Finance Corp.” board, appointed by commissioners, as the report suggests.

Kevin Greiner, a fellow at FIU’s Jorge M. Perez Metropolitan Center that created the affordable housing report, said the finance corporation was actually suggested by city staff to make the process more efficient. “The issue going forward is one of scale, we need to ramp it up,” he told the commission.

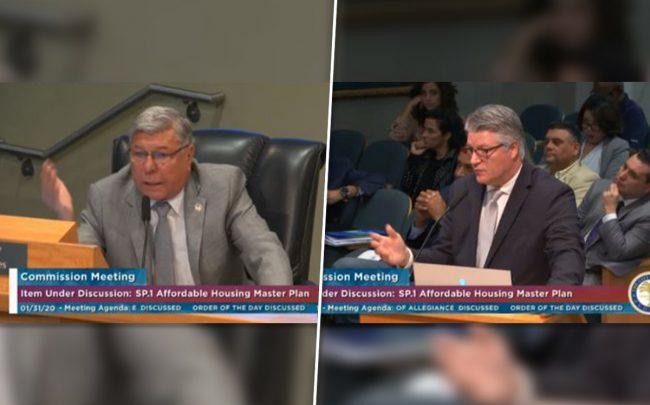

Manolo Reyes and Kevin Greiner

Commissioner Manolo Reyes wanted to make sure that the city at least approves the data of the report that spells out the dire need that Miami has, as well as the fact that the median income within the city of Miami is significantly lower than that of the county. Reyes has been frustrated that Housing and Urban Development guidelines currently use Miami-Dade County’s area median income of $54,900. The city of Miami’s area median income was $33,999, and, as the report stated, the median income for renters citywide is $28,650.

The report, which cost the city $110,000, also points out that 57 percent of Miami households pay more than 30 percent of their incomes on housing, and that 1,286 affordable housing units are lost each year due to inflating land costs.

Accepting the report’s findings is critical for the issuance of $85 million in bond money, said Miami City Attorney Victoria Mendez.

At first, commissioner Joe Carollo advised against accepting the plan, even if it means delaying the bond money. He said he was suspicious that some of the data wasn’t accurate, and feared that the city of Miami will be hit with an adverse ruling from the Securities and Exchange Commission again. “The city has already had two major strikes,” Carollo said. “We get a third strike and it’s game over. Three strikes and you’re out.”

Carollo was suspicious because the median household income for renters for District 1, District 3 and District 5 were exactly the same: $22,760. The report also stated that District 3 and District 5 each had 20,854 units that were more than 50 years of age.

Edward “Ned” Murray, associate director of the Metropolitan Center, assured the commission that the data was taken directly from block by block data provided by the 2013-2017 census. Carollo relented after his colleagues agreed that the Metropolitan Center must turn over its raw data.

Carollo also questioned the report’s claims that it can leverage $4 to $6 billion with private loans, philanthropic donations, grants, and fees. He pointed out that the report claimed that $200 to $800 million could be raised by charging investors who leave their condos or homes empty most of the year an “empty unit fee.” Such a practice has been declared illegal in Florida, Carollo said.

Nevertheless, charging linkage fees to developers for the purpose of creating an affordable housing fund is legal in Florida, Greiner said. Through that method, between $200 and $800 million could be raised.

Finally, Carollo lamented that only a few paragraphs were devoted to creating homeownership housing in Miami. Carollo has proposed obtaining $250 million in loans and grants for such a project, which will be analyzed by city staff and an independent board of builders.

Reyes said he wants all the ideas to be analyzed by builders and financiers to see how feasible the recommendations truly are.

Dozens of affordable housing advocates, and developers, lined up to encourage the passage of the report. At the same time, developers pointed out that regulations that current zoning regulations make it impossible for smaller developers to build affordable housing on smaller lots. Complicating things further are long permitting times at the city, as well high fees for connecting sewer lines.

“Your permitting process is probably the most unfriendly process that there is,” said Albert Milo, senior vice president of Related Urban Development, the affordable housing division for the Related Group. “It is difficult for us larger builders. It is almost impossible for smaller builders. It’s impossible for them to wait because they’re trying to invest their money.”