The U.S. homeownership rate is now at its highest point in six years, signaling continued confidence in the market despite anxiety that the current cycle is nearing an end. Rates dipped in most big cities, which have priced out many potential buyers.

According to fourth-quarter U.S. Census data released Thursday, 65.1 percent of Americans owned their own homes. While that represented a slight increase from the 64.8 percent from the third quarter, it highlights the sustained recovery of the U.S. home-buying market following the last housing crash.

One economist called the uptick a positive event for the larger economy.

“The homeownership rate is a great indicator of middle-class financial well being, so to see that rate go up is good,” said Danielle Hale, chief economist at Realtor.com.

The release comes as pending home sales dipped in December — usually a slower period — though for the year, contract signings are up.

In the New York metropolitan area, the homeownership rate dropped to 50.4 percent from 51 percent in the third quarter, according to the Census Bureau. Rates were flat in Los Angeles, but inched up in Chicago and Miami.

By age group, homeownership rose year-over-year for all cohorts, including those under 35 years old, except for those between 35 and 44 years old, according to the data.

“Some of them would’ve been entry-level buyers during the last housing boom,” Hale said. “They’re still having a hard time recovering after that.”

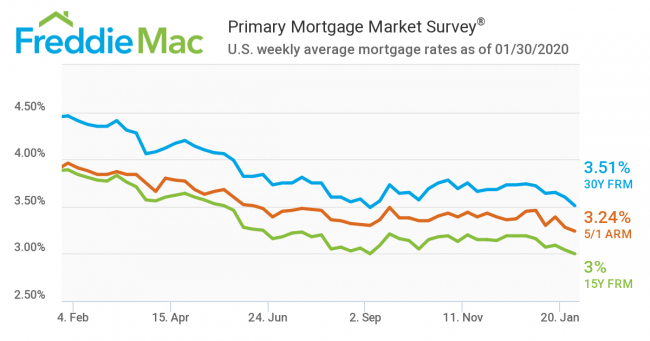

Also on Thursday, a day after the Federal Reserve maintained the range of its benchmark interest rate, Freddie Mac dropped its 30-year mortgage rate to 3.51 percent. That’s a 95 basis-point fall from the year before.

Hale said the drop is a reflection of stock market volatility — in part because of deepening concerns over the outbreak of the coronavirus and its impact on an already slowing global economy.

“The uncertainty’s not great for instilling confidence, but the lower mortgage rates will help home buyers in the market,” she said.

Write to Mary Diduch at md@therealdeal.com