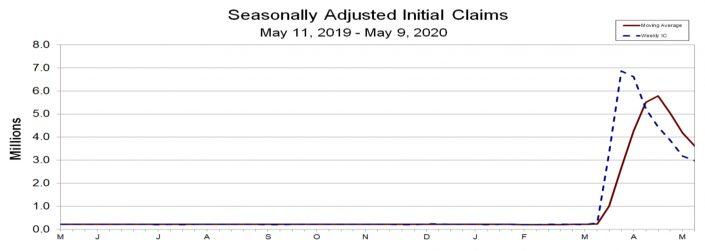

Unemployment claims totaled 2.98 million last week. That’s the good news.

It was the first dip below 3 million since mid-March, when claims numbered a mere 282,000 (and represented a jump at the time from the usual 210,00 or so).

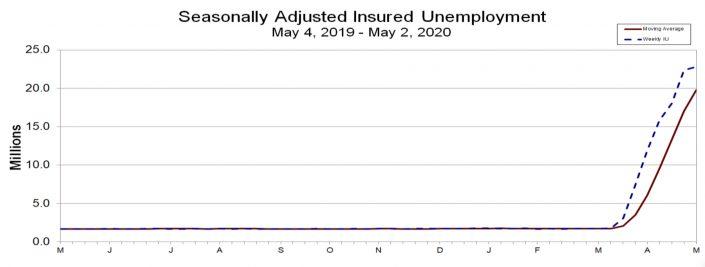

Last week’s tally was down by more than half from the spike to nearly 7 million unemployment claims seen at the end of March, but still well above the peak of 650,000 weekly claims during the Great Recession. The total number of applications since the beginning of the coronavirus crisis has now reached 36.5 million.

Read more

“The numbers are very high, but they’re stepping down every week, and I see no reason why that decline in filings wouldn’t continue,” former Council of Economic Advisers chief economist Keith Hall told the Wall Street Journal. “Employers are likely poised to bring people back, but right now we’re in a holding pattern.”

The seasonally adjusted unemployment figures do not include independent contractors and self-employed people — including real estate brokers — who were ineligible for unemployment benefits prior to the pandemic. About 800,000 such claims were filed last week, down from over 1 million the week before.

Florida, Georgia and Connecticut had the highest number of new claims last week, with more than 200,000 each, and all saw increases in applications from the week before.

The slight overall drop in new unemployment claims comes as cities, counties and states have begun laying out plans to reopen their economies. Other positive economic indicators have included an uptick in hotel occupancy in major U.S. cities as well as continued growth in home purchase mortgage applications.

Analysts will be keeping an eye on these figures as the national response to the pandemic enters a new phase.

“I don’t think we’ll be able to draw conclusions yet because there’s a lot of noise in data, and other factors are at play,” Moody’s Analytics director of economic research Adam Kamins told the Journal. “But it may start to point us in the direction of understanding what the upside to reopening is.” [WSJ] — Kevin Sun