The special servicer for an $850 million CMBS deal has accused Hudson’s Bay Company of engaging in a “clandestine corporate shell game” as it took the department store operator private, a move that undermined the creditworthiness of the loan, which now faces default. And as with many other real estate-related court cases lately, Covid-19 is a focus.

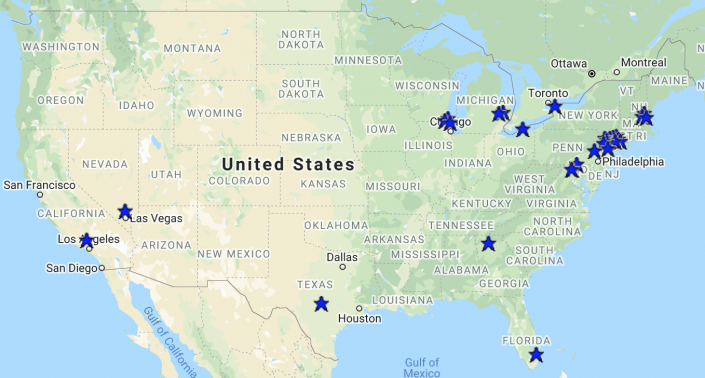

The CMBS loan provided by JPMorgan Chase, Bank of America, and Column Financial is secured by 24 Lord & Taylor stores and 10 Saks Fifth Avenue stores across 15 states. As the parent company of both brands at the time, Hudson’s Bay was the tenant at all 34 stores and a partial landlord through a joint venture with mall operator Simon Property Group.

Hudson’s Bay was also the guarantor of rent payments at the stores. But over the past several months, the now-private company “engaged in deliberate and concealed corporate restructurings that stripped assets” from the original parent company and “transferred them to newly formed, foreign entities,” special servicer Situs claimed in its federal lawsuit against Hudson’s Bay. That alleged action violated “loan documents and related guarantees,” according to the complaint, filed Monday in New York on behalf of the CMBS trust.

The suit also accuses Hudson’s Bay of improperly using the coronavirus as an excuse for not addressing concerns about the asset transfer, which it called “an opportunity to try to smokescreen their numerous breaches of their obligations.” A number of real estate-related lawsuits have emerged in recent weeks that allege defendants improperly use Covid-19 as an excuse to break off signed deals or terminate leases. In late February, Hudson’s Bay shareholders approved the move to take the company private in what was seen months earlier as a $1.3 billion deal.

Hudson’s Bay said it rejects the lawsuit’s accusations. In a statement, a company spokesperson said the Simon Property joint venture was the loan borrower while Hudson’s Bay was “simply a guarantor of lease obligations” under the terms of the joint venture. “To suggest that HBC has violated any loan document provisions is categorically false,” the spokesperson added.

“Empty shell”

Situs claims to have only discovered the alleged scheme in April after Hudson’s Bay fell behind on rent payments. Following negotiations to address the shortfall, Situs says it was informed that a signature block on a document had to be changed because Hudson’s Bay Company, the entity that guaranteed rent payments, no longer existed.

In its place, the lawsuit says, was “an empty shell” called Hudson’s Bay Company ULC, all of whose assets and liabilities had been transferred to a Bermuda-based limited partnership whose general partner is controlled by Hudson’s Bay CEO Richard Baker, and whose limited partners include the Abu Dhabi Investment Council.

Situs says that these transfers were improper because loan documents required the CMBS trust to approve of — or at least be informed of — the transactions. Hudson’s Bay, for its part, says the restructuring was “driven entirely by tax considerations” and that the servicer’s concerns are “irrelevant distractions,” according to correspondence included in the lawsuit.

But Situs claims “defendants simply do not have the right to deliberately and secretly violate the contractual restrictions on such corporate maneuvers and then, when caught, declare it to be all fine.”

Situs did not respond to a request for comment.

Read more

The CMBS loan was transferred to special servicing on April 23, “due to the borrower’s failure to make the April debt service payment,” according to servicer commentary provided to Trepp.

The special servicer is now seeking a declaratory judgment to void the allegedly improper transfers, a temporary restraining order to prohibit Hudson’s Bay from engaging in additional restructurings and transfers, and an order expediting discovery for documentation of the transfers.

Situs pointed to reports that Lord & Taylor may liquidate its stores upon reopening following coronavirus-related shutdowns nationwide, and that Hudson’s Bay may attempt to acquire bankrupt rival Neiman Marcus.

Hudson’s Bay sold Lord & Taylor to clothing rental service Le Tote last August for $100 million, but remains the guarantor for rent payments at the Lord & Taylor properties in the loan portfolio.