Two of J.C. Penney’s landlords are trying to buy their way out of trouble.

Mall owners Simon Property Group and Brookfield Property Partners are said to be considering a joint bid to buy the beleaguered department store chain, the Wall Street Journal reported. Talks were first reported last week, and at the time, brand management company Authentic Brands Group was involved.

J.C. Penney filed for bankruptcy last month and experts say the landlords’ acquisition of the chain would be a move of self-preservation.

“They need J.C. Penney to be there, to keep the lights on,” retail consultant Soozan Baxter told the Journal.

By buying the chain, the landlords would assume control of certain property rights for their shopping centers, ensure that the retailer stays in business and at least postpone the challenge of finding new anchor tenants in a bleak retail landscape.

If J.C. Penney were to cease operations, both Simon and Brookfield, which respectively have 63 and 99 of its stores in malls around the country, could face a ripple effect of issues because of co-tenancy clauses in the leases of other retailers in those shopping centers. Such clauses protect small operators in malls that rely on anchor tenants for foot traffic.

The bankruptcy of Neiman Marcus and the accompanying co-tenancy agreements many retailers had in Hudson Yards provide an example of how the loss of a major tenant can imperil an entire mall.

When malls lose an anchor tenant and the space is not filled within a set period of time, these agreements can allow smaller tenants to terminate their leases with no strings attached.

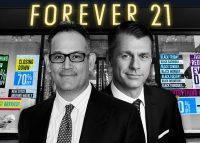

Simon and Brookfield have teamed up to buy major tenants before. They bought Forever 21 in February, and GGP, which Brookfield later acquired, teamed up with Simon to buy Aéropostale in 2016. [WSJ] — Erin Hudson

Read more