Trending

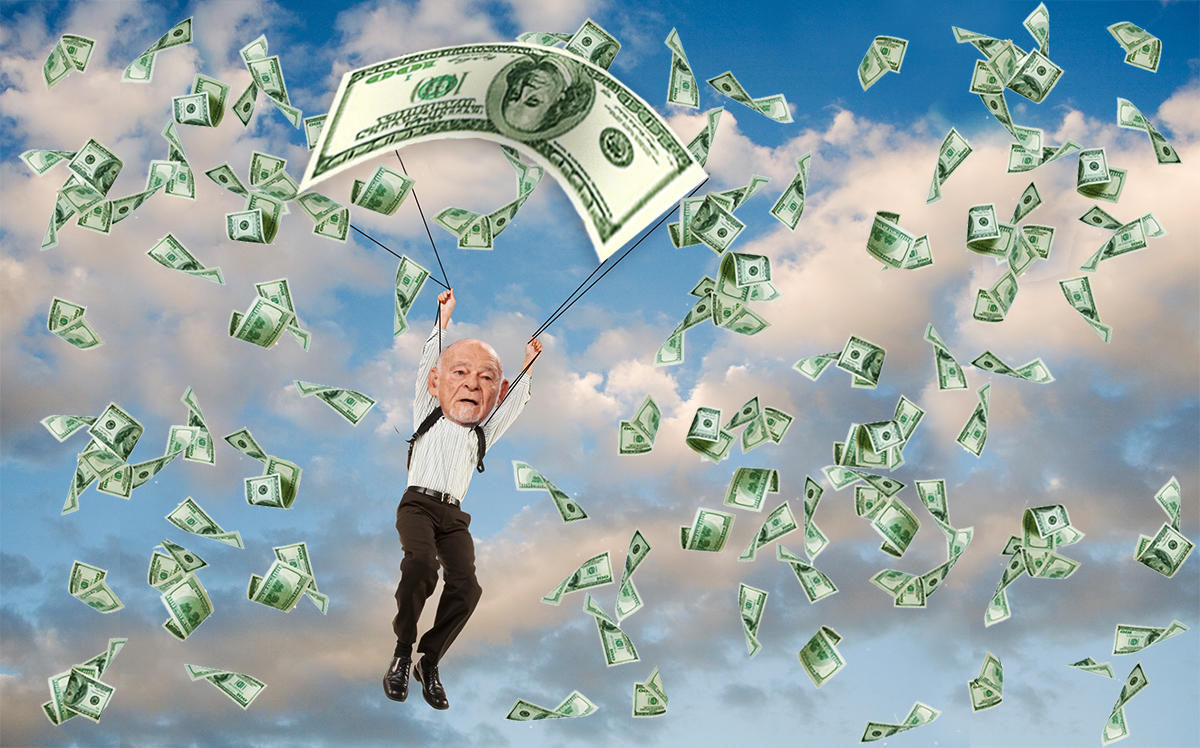

For Sam Zell, it’s all about “foreclosures and opportunities”

The Grave Dancer has billions in cash to deploy but will stay away from the sector he calls “a falling knife”

Sam Zell’s Equity Commonwealth real estate investment trust has $3.4 billion in cash ready to deploy in these times of distressed assets, but the self-described Grave Dancer isn’t ready to tango in one sector: Retail.

Zell, who is also chairman of Equity Residential and Equity Lifestyle Properties, said his companies “don’t buy markets, we buy deals.” And with retail real estate, he’ll likely steer clear, he said. In a Zoom interview with SkyBridge Capital founder Anthony Scaramucci, Zell called retail “still very much of a falling knife,” according to Crain’s Chicago.

Zell expects banks to be less forgiving with borrowers, choosing to jettison the “extend and pretend” strategy that many took during the last financial crisis. Banks tended to hold off on foreclosures back then, he said, with the hope those loans would resolve themselves as the economy recovered.

“I think the lending community this time around very much wants to, quote, clean the books,” Zell said, according to Crains. “And I think there are going to be a lot of foreclosures and opportunities.” He added that some investors who might have survived the last few months could falter when banks come knocking.

Zell built up a massive war chest of cash with a huge selloff of properties over the last several years. Equity Commonwealth sold around 150 office properties in recent years, leaving it with just five today.

Zell expects “some significant recovery” from the pandemic-fueled market crisis by year end, and appears optimistic about the economy generally.

“I think just what you have seen in the last few weeks since there’s been some partial openings of various places around the country, people have been willing to spend and in fact, seem to be very excited about the opportunity to get back into the commerce side of the world,” he told Scaramucci. [Crain’s Chicago] — Dennis Lynch