Trending

Mezz lender forecloses on Ocean Drive hotel in South Beach

Owner Henley faced $37M in unpaid debt

The pandemic brought especially bad timing for the owner of a South Beach hotel, which purchased it last year, embarked on a multimillion-dollar renovation, and ended up losing its investment.

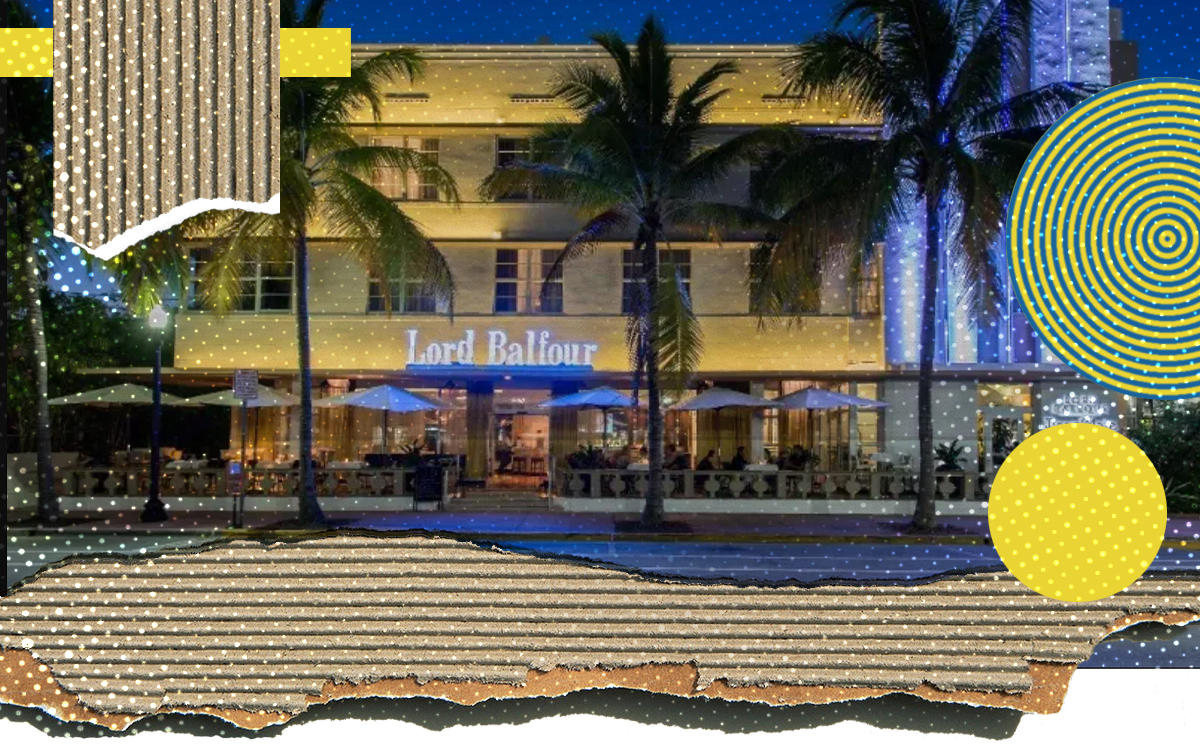

Leste Group and its partner, Moto Capital Group, last month foreclosed on the newly renovated Lord Balfour Hotel on Ocean Drive, The Real Deal has learned.

The mezzanine lenders completed an out-of-court UCC foreclosure of the 81-key hotel at 350 Ocean Drive, according to sources. Senior lender Värde Partners had an intercreditor agreement with Leste and Moto Capital, which held the mezzanine loan and assumed all obligations related to the property, and now control it.

Hotel borrowers nationwide are facing the threat of foreclosure by their senior lenders, as well as UCC foreclosures from mezzanine lenders, the latter of which are often faster.

In August of last year, the U.S. arm of Henley, a United Kingdom-based private equity firm, paid nearly $35 million for the Lord Balfour. Slated to become a Life House property, it marked the fourth deal for Henley and Life House.

At the time, Henley said it would invest more than another $5 million into the hotel for renovations. Henley completed renovating all the rooms, suites and common areas of the hotel, which was built in 1940. It was under renovation even prior to the pandemic, and remains closed.

The property’s unpaid debt totaled about $37 million, including Värde’s loan and the mezzanine debt, according to sources.

Leste, an alternative asset manager based in Brazil, and Miami-based investment management firm Moto Capital are considering multiple options for the property, the sources said.

Life House said in a statement that it looks forward to working with the future owner to open as a Life House “in good time.” A spokesperson said Life House is “excited to open the beautiful, contextual and landmark hotel,” but that it understands “the economic hardships faced by owners across the world during these unprecedented times,” according to a statement.

Read more

Henley did not respond to a request for comment.

More UCC foreclosures are expected in South Florida as some hotel owners opt to walk away from whatever equity they have in their properties. Experts say many highly leveraged borrowers are at a crossroads, deciding among selling at a discount, throwing the keys back to their lenders, or buying more time from lenders.

Without a federal bailout, an estimated 38,000 U.S. hotels could close permanently, while another 28,000 are at risk of being foreclosed on, according to the American Hotel & Lodging Association.

Last month, the Luxe Rodeo Drive Hotel in Beverly Hills closed for good, after having embarked on a full renovation just before Covid hit.