Commercial real estate firm Ryan Companies scored a $28.2 million construction loan for its planned Kendall e-commerce warehouse and bought the development site for $12 million.

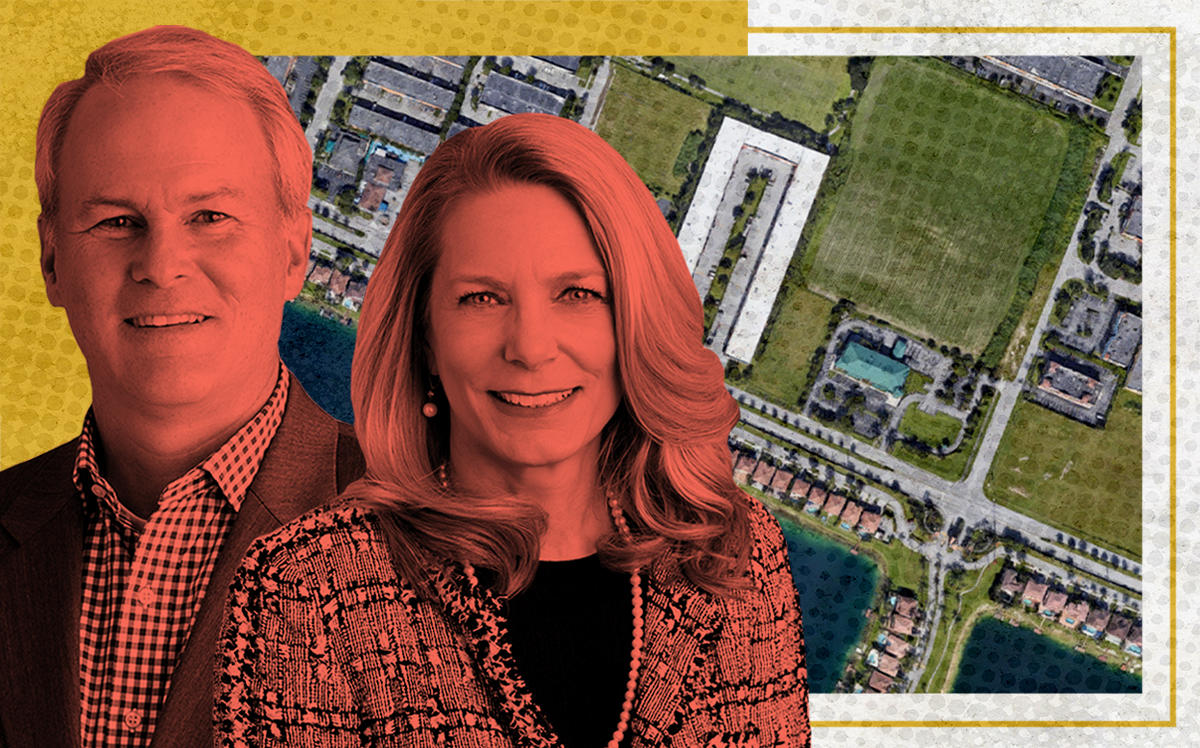

Records show that Ryan Companies affiliate Kendall Property Owner bought the 10 acres on the intersection of Southwest 136th Street and 132nd Avenue from TCAG, managed by Raquel Carro. Associated Bank issued the loan.

Miami-Dade County last year approved Ryan’s plans to build a 65,536-square-foot warehouse aimed at e-commerce on the Kendall property, county documents show.

Records show the seller, TCAG, acquired the site in 2020 in two deals, one for each lot. It bought one lot for $485,000 from Ronald Scherfer and William Pintzow, and the second lot for $408,400 from Melvin and Linda Wolfe, property records show.

Minneapolis, Minnesota-based Ryan, led by Brian Murray and Lisa Kro, also is a real estate designer, financier, manager and builder of multifamily, hospitality, office, retail, senior living, health care and mixed-use properties, according to its website.

Ryan’s other Florida projects include construction of Jacksonville Electrical Association’s headquarters and a medical plaza in Brandon, but the warehouse in Kendall appears to be its first South Florida development.

The Industrial market has remained robust during the pandemic, unlike other asset classes, in large part because of pent-up demand tied to online shopping. In Miami-Dade, e-commerce tenants leased a record 2 million square feet of space last year, according to a JLL fourth quarter report.

Read more

Investors are scooping up industrial development sites at top-dollar prices. Most recently, Avra Jain, Joe Del Vecchio and Terra’s David Martin opted out of building an indoor sports facility on their Liberty City land, and sold it to logistics real estate investor Xebec Realty for $8 million.

Alliance last month bought a Lake Worth Beach industrial property for $17 million, and, in January, STAG Industrial bought Palm Beach County industrial properties spanning 20 acres for $32 million.