A Canadian real estate investor expanding its holdings into South Florida bought a Hallandale Beach office building for $16.5 million.

Soliman Corporation, based in Montreal, purchased the 1250 Building from Murray Family Associates, an affiliate of Hallandale Beach-based real estate firm KEI Properties, the buyer said. It’s roughly 80 percent occupied.

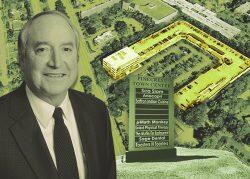

The 11-story building, at 1250 East Hallandale Beach Boulevard, includes a 400-space garage. The property totals 182,278 square feet across 2.7 acres, property records show.

Tenants include law and accounting firms, medical offices and a Premier Health & Fitness gym, according to Jeffrey Soliman, who started and leads Soliman Corporation.

KEI bought the property in 1998 from Tanner Valley for $4.3 million,.

Soliman said he plans to add value to the property, which was built in 1972, by revamping lobbies, hallways and other common areas, and increasing rents to market rate. Current rates now are $25 to $28 per square foot, he added.

A JLL office market report lists the average direct asking rents for both Class A and B buildings in the Southeast Broward County market at $30.57 a square foot, according to a fourth quarter report for 2020.

Rents also are higher in nearby Aventura to the south.

“The average rent at this building seems to be fairly below market when you are seeing office leasing deals being done throughout the second half of last year, which was the pandemic year, at $60 gross a square foot in Aventura,” Soliman said.

The 1250 Building also has upside potential as Hallandale Beach has little office product, he added.

Soliman is looking to invest throughout Florida in various asset classes, although he is wary of retail, as well as into industrial real estate in the Midwest, he said.

Hallandale Beach in recent years has caught the eye of investors and developers, primarily for its location between Miami and Fort Lauderdale. The Hallandale Oasis condominium project underway northeast of Gulfstream Park Racing and Casino will include a 10-story office tower.

In recent years, KEI, which leases commercial real estate, sold some of its other South Florida holdings. In 2018, the group sold industrial properties within the Park Central Business Park campus in Pompano Beach to San Francisco-based Berkeley Partners for $15 million.

Office transactions in South Florida have picked up this year as both big and small assets are trading. Among the whoppers is Blackstone Group’s purchase of the two office buildings at Brightline’s downtown Miami station for $230 million in March.

On the smaller end, Boca Raton-based IP Capital Partners bought Sunrise Corporate Plaza from Stiles Corp. for $25 million.

Read more