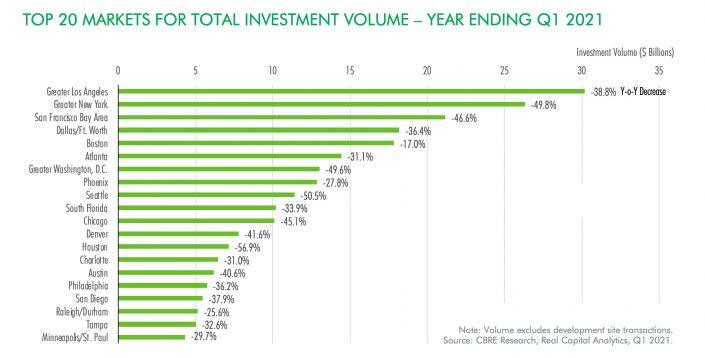

Commercial real estate investment fell across the U.S. in the year since the coronavirus pandemic began, with Houston, Seattle, New York and San Francisco seeing the biggest declines.

Greater Los Angeles was the top recipient of CRE investment, with more than $30 billion in deals in the 12-month period ending in March, according to a new report from CBRE. That’s a 39 percent year-over-year decline, less severe than the 57 percent drop in Houston, the 50 percent declines in Seattle and the New York region or the 47 percent slide in the San Francisco Bay area.

“Markets like New York and San Francisco were harder hit as remote working and pandemic uncertainty led to large declines in office investment,” CBRE analysts wrote in the report. The top 20 markets saw a 38 percent decline in investment volume on average.

Meanwhile, markets like Boston, Phoenix and Raleigh-Durham, North Carolina “appeared more resilient due to relatively strong job growth,” according to the report.

Investment in Boston office and industrial properties increased over the past year. Richmond, Virginia and Raleigh-Durham recorded large increases in office investment, while multifamily deal volume rose significantly in markets like Indianapolis, Jacksonville, Florida and Charlotte, North Carolina.

In the first quarter alone, U.S. CRE investment volume fell 28 percent from the first quarter of 2020 to $92 billion. “Among major property types, industrial and multifamily continued to outperform,” CBRE analysts wrote, noting that they expect a strong recovery in the latter half of the year.

The struggling hotel sector saw investment pick up as well, although half of the quarter’s hotel deal volume came from a single megadeal — Colony Capital’s $2.8 billion sale of a 197-property, 22,676-room portfolio to Highgate Hotels, which was announced last fall and closed in March.

Different types of investors have also responded differently to the pandemic. Investment by public companies and real estate investment trusts fell 75 percent year-over-year to $5.6 billion in the first quarter, while deal volume declined by 19 percent for private investors and 18 percent for foreign investors.

Three countries — Canada, South Korea and Singapore — accounted for more than half of all foreign investment in U.S. commercial real estate in the first quarter. “Foreign investors increasingly allocated capital to growing office markets in the Sun Belt, such as Austin and Charlotte,” according to the report.

Read more

Commercial mortgage-backed securities lending fell 29 percent in the first quarter from a year earlier and down 53 percent for the 12 months ended in March. Meanwhile, multifamily mortgages from government agencies like Fannie Mae, Freddie Mac and the HUD all rose by double digits.

Another challenge facing the CMBS sector is elevated delinquency rates. While 7.5 percent of CMBS loans are currently delinquent, delinquency rates for loans from banks, life insurance companies, Fannie and Freddie were all around 1 percent or lower.

“Despite small upticks, all bank loan delinquency rates remained low compared with the last cycle,” the report notes.