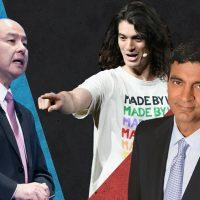

Adam Neumann’s golden parachute is the gift that keeps on giving.

As part of his exit package from the flex-office company, Neumann received an approximately $245 million stock award in February, a benefit that other early shareholders didn’t receive, Wall Street Journal reported.

That benefit was a part of a renegotiation of Neumann’s 2019 deal to leave the company he co-founded. In addition to the stock, Neumann received $200 million in cash, as well as the refinancing of a $432 million loan. The new terms were intended to settle an ongoing dispute between Neumann and SoftBank, one of WeWork’s biggest financial backers, sources familiar with the matter told the publication.

Read more

The renegotiated terms were made public in SEC filings as part of WeWork’s merger with the special-purpose acquisition company BowX Acquisition Corp. The company is planning to go public via the SPAC merger later this year, following an aborted attempt to do so in 2019.

After Neumann’s departure, WeWork sold several companies that the company acquired under his leadership, which led to big losses: The company purchased 10 investments for $759 million in cash and WeWork stock, but only garnered $164 million, the publication reported.

More than 90 percent of WeWork’s staff held stock options when SoftBank bailed out the company in 2019, the publication reported. The company downsized and thousands of employees that were laid off had to forgo all of their options.

So how did Neumann get away with such a hefty stock award? He controlled the company while holding stock with 10 times the votes of a normal share, an expert told the publication. Thus, SoftBank was paying him to give up that control.

[WSJ] — Cordilia James