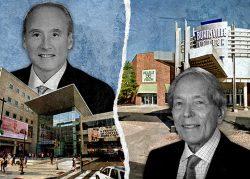

In November, with mall owners getting crushed, Washington Prime Group CEO Lou Conforti said that bankruptcy was off the table. But in March, it was reported that the mall REIT was preparing for the filing.

Now it has done the deed.

Washington Prime Group filed for Chapter 11 bankruptcy Sunday. The company has secured $100 million of funding for day-to-day operations while it goes through the process.

The real estate investment trust, which owns more than 100 malls, has $4 billion in assets and $3.5 billion in debts, according to court filings in the Southern District of Texas.

“The company’s financial restructuring will enable WPG to right-size its balance sheet and position the company for success going forward,” Conforti said in a statement. “The company expects operations to continue in the ordinary course for the benefit of our guests, tenants, vendors, stakeholders and colleagues.”

Read more

The restructuring support agreement provides for a deleveraging of Washington Prime Group’s balance sheet by nearly $950 million through exchanging unsecured notes for equity, a $190 million paydown of its revolving credit and term loan facilities and a $325 million equity rights offering, backstopped by SVPGlobal.

The plan has the support of creditors, led by SVPGlobal, that hold 73 percent of the principal amount outstanding of the secured corporate debt and 67 percent of the principal amount outstanding of the unsecured notes.

The REIT was formed when it spun off from Simon Property Group in 2014.

However, like many other mall operators, the company struggled when the pandemic sent foot traffic and rent revenue plunging. Washington Prime Group collected just 52 percent of the rent due in the second quarter of 2020.

Washington Prime Group joins CBL & Associates Properties and Pennsylvania REIT, both of which filed for chapter 11 bankruptcy in November.