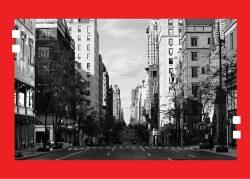

As U.S. retailers emerge from the pandemic’s record-lows for business, those in residential neighborhoods are showing signs of life while ones in central business districts remain as dormant as the offices around them.

Businesses in residential neighborhoods were recovering faster than small businesses in central business districts, according to an analysis from the Mastercard Economics Institute reported by Bloomberg. The report examined businesses in 28 metropolitan areas that accept credit cards.

Small and medium-sized businesses in residential areas saw an 8 percent increase in spending this year when compared to 2019 levels. In central business districts, the report said comparable businesses were down 33 percent in that same period.

New York City serves as a good microcosm for the larger trend. Bloomberg reported that in East Harlem and Brooklyn’s Sunset Park, businesses are exceeding sales totals from 2019. In Hudson Square and the Financial District, performance is lackluster.

A lack of office workers is likely responsible for the struggle of retailers in central business districts that historically relied on foot traffic customers. As more companies embrace remote or hybrid work arrangements — and as more push back office returns — retailers are struggling to replace those sales.

Staying in business has been a challenge regardless of location for small retailers during the pandemic. Bloomberg, reported one in four small retailers in the United States shut down within the first six months of the pandemic. Meanwhile, only one in 12 large retailers faced the same closures.

The analysis mirrors conclusions from a new report by the Real Estate Board of New York details more of the city’s retail struggles. Nearly 30 percent of retail storefronts in the Grand Central and Midtown East business districts were vacant this summer, more than doubling pre-pandemic vacancy rates. The Madison Avenue shopping corridor also saw vacancy rates of 28 percent, up from 19 percent in 2018.

Read more

[Bloomberg] — Holden Walter-Warner