Cushman & Wakefield is expanding its offerings in a hot rental market, adding lending and loan services to its multifamily capabilities.

The company agreed to pay $500 million for a 40 percent stake in Greystone’s agency, Federal Housing Administration and servicing business, according to the Wall Street Journal. Cushman will be able to make loans to buyers and owners, as well as service those loans.

Greystone — a giant in the rental lending business, originating $16.6 billion in loans in 2020 — will continue to operate the business, according to the Journal. The deal between Cushman and Greystone is expected to close by the end of the year.

Cushman was already heavily involved in rentals, serving as a brokerage in representing sellers in more than $11 billion worth of deals in 2020. The company also acquired Pinnacle Property Management Services last year as Cushman marches towards a full slate of multifamily services.

The rental apartment market has been on the rise in recent years. Additionally, August rents rose in 30 of the top American cities, the first time since the pandemic that all cities experienced growth. The national average rent that month hit $1,539, a 10.3 percent increase from the previous year.

Amid high rents and high home sale prices alike, bidding wars have reportedly broken out in New York City, a phenomenon usually seen in the housing market.

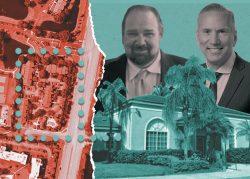

Greystone is active in the multifamily market, particularly in South Florida. Earlier this year, the company sold the 94-unit Villas at Cove Crossing in Lantana to real estate tycoon Benjamin Mallah for $9.9 million. The deal worked out to more than $105,000 per unit.

More recently, Greystone Servicing provided a $23.5 million loan to Circle Capital for the $34.7 million purchase of the Vue on 67th apartment complex in Davie.

Read more

[WSJ] — Holden Walter-Warner