Chanel is betting on its founder’s slogan: Fashion changes, but style endures.

The luxury French fashion company is spending more than $4,000 per square foot on the buildout of its flagship store in the Miami Design District, sources told The Real Deal. Based on its roughly 10,000-square-foot space, that means Chanel is investing at least $40 million into the construction.

That’s the equivalent of the combined sales of more than 5,000 Chanel flap bags.

TRD previously reported the store’s location across from Gucci at the entrance to Paradise Plaza on 41st Street in Miami. Gucci is on the west side, and Chanel will open on the east side.

New York architect Peter Marino, who has designed stores for Chanel around the world, is also designing the Miami location. The multi-level store is expected to open in time for Art Basel in early December, sources said.

Marino is also involved in the redevelopment of the Raleigh Hotel site that Michael Shvo and his partners are planning in Miami Beach.

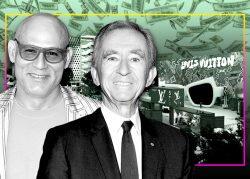

Chanel’s landlord in the Design District is a partnership between Craig Robins’ Dacra, partner LVMH affiliate L Catterton Real Estate, and Brookfield Property Partners. Dacra and L Catterton each own nearly 39 percent stakes in the Design District, while Brookfield owns 22.5 percent.

Robins, CEO of Dacra, declined to comment. Chanel and Marino did not immediately respond to a request for comment.

The Design District has long pursued Chanel, which has just one other South Florida store at the rival Bal Harbour Shops, a high-end open-air shopping center in the midst of a major expansion. Chanel has been a tenant there since the early 1990s.

Read more

Chariff Realty Group broker Lyle Chariff, who is not involved in the Chanel lease but is active in the Design District, said Chanel is likely looking to set itself apart from its competitors and remain consistent with its brand. It is “all about design and image” and the race to become the next “masterpiece” in the design-driven neighborhood, he said.

The high price-per-square-foot cost of construction can be attributed to the rising costs and limited availability of specialty materials and construction labor, as well as soft costs like architecture and design, Chariff said.

“If they had come into this market five years ago and they were the first, it would have [cost] significantly less because the standards were lower,” he said.

The luxury retail market has thrived in South Florida throughout the pandemic. In the Design District, Louis Vuitton is working on a larger men’s store, while Marc Jacobs, Amiri and a handful of restaurants are under construction.