Domestic travel picked up this year, in some cases surpassing 2019 levels, and average daily room rates increased, boosting confidence in South Florida’s hotel market.

The result was a bump in hotel investment sales, following a slow 2020, when only two sales topped $100 million. This year, as the market recovered, a number of properties traded hands, ranging from boutique hotels to major resorts.

This year’s top 10 deals ranged from the $54 million sale of the Fort Lauderdale Marriott Pompano Beach to the $270 million sale of the Margaritaville Hollywood Beach Resort.

Map by Adam Farence

Still, some hotels were seized by their lenders or sold at deep discounts. And other owners took advantage of low interest rates and refinanced their properties.

Here’s a look at the top hotel trades to close this year in South Florida, according to data from Real Capital Analytics, CoStar and Colliers International:

Pebblebrook buys Margaritaville Hollywood Beach Resort for $270 million

Pebblebrook Hotel Trust President and CEO Jon Bortz with Margaritaville Hollywood Beach Resort (Margaritaville, Pebblebrook)

One of the country’s largest hotel owners acquired the Margaritaville Hollywood Beach Resort in Hollywood for $270 million, or nearly $732,000 per key. KSL Capital Partners sold the 369-key Jimmy Buffett-inspired resort at 1111 North Ocean Drive to Pebblebrook Hotel Trust, a real estate investment trust based in Maryland.

The 18-story Margaritaville includes an 11,000-square-foot spa, oceanside pools, an 11th-floor pool and 30,000 square feet of indoor and outdoor meeting space. It sits on 4.6 acres.

Swire Properties sells East, Miami to joint venture for $174 million

Kieran Bowers of Swire Properties with East (Getty, Facebook via EAST, Miami)

Hong Kong developer Swire Properties, which built Brickell City Centre, sold East, Miami, a hotel tower at the mixed-use development. The $174 million sale, which equated to nearly $500,000 per room, closed in October. A joint venture of funds managed by Trinity Fund Advisors and funds managed by Certares Real Estate Management purchased the 40-story, 352-key hotel at 788 Brickell Plaza.

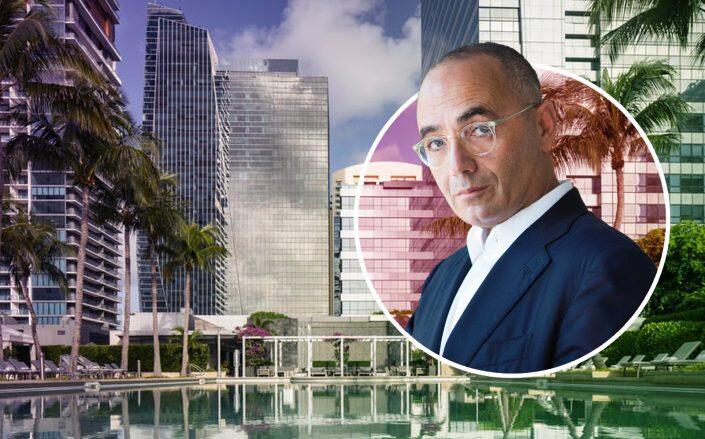

Fort Partners buys Four Seasons Brickell hotel for $130M

Nadim Ashi of Fort Partners with the hotel (Four Seasons, Fort)

The developer of the ultra-luxury Four Seasons at the Surf Club in Surfside acquired the Four Seasons Miami hotel in Brickell for about $130 million, a deal that gave Fort Partners control of all four Four Seasons properties in South Florida.

New York-based Westbrook Partners sold the hotel at 1435 Brickell Avenue. The 221-key hotel is part of the 70-story mixed-use tower that also includes office space, residential condos, an Equinox gym, retail space and a parking garage, none of which was included in the deal.

The sale broke down to about $588,000 per room. Miami-based Fort Partners financed the purchase with a $105 million loan from New York-based Madison Realty Capital.

B Ocean Resort Fort Lauderdale trades for $127M

Keith Gelb, Managing Member and Co-Founder, Rockpoint Group (Rockpoint Group, B Hotels & Resorts, iStock)

Rockpoint Group and InSite Group teamed up to acquire the former Yankee Clipper hotel in Fort Lauderdale for $126.9 million in October. The sale of the beachfront B Ocean Resort Fort Lauderdale included the adjacent parking lot and properties at 1101, 1127 and 1140 Seabreeze Boulevard, 1136 and 1140 Holiday Drive, and 3048 and 3054 Harbor Drive.

The Carlyle Group sold the properties. The hotel sale broke down to about $245,000 per room. The hotel originally was developed as the Yankee Clipper in 1956.

Wheelock pays $106M for The Ben hotel near downtown West Palm Beach

Tim Hodes, Principal, Head of Hotel Acquisitions, Wheelock Street Capital; The Ben West Palm Beach at 251 North Narcissus Avenue (Wheelock Street Capital; The Ben West Palm Beach)

Wheelock Street Capital paid $106.4 million for The Ben West Palm Beach, a new hotel near the city’s downtown. Concord Hospitality Enterprises Company, a hotel management, ownership and development company based in Raleigh, North Carolina, sold the 208-key hotel at 251 North Narcissus Avenue for more than $511,000 per key. Wheelock financed the deal with a $101.1 million loan from Wells Fargo.

The hotel opened last year and is an Autograph property, under the Marriott brand. Miami-based Mayan Properties was a partner in the hotel development. It is part of a 435,000-square-foot, mixed-use Flagler Banyan Square development with residential, dining and retail that sits on the former site of West Palm Beach’s city hall.