Condo associations in Bay Harbor Islands and Miami Beach hired brokers to list their properties for sale in a bulk purchase, as older buildings increasingly field buyout offers from developers looking for redevelopment sites.

The condo board of the 30-unit Bay Harbor Towers, at 10141 and 10143 East Bay Harbor Drive, hired Blanca Commercial Real Estate and MSP Group to market the 1-acre property, said MSP Group CEO Deme Mekras. Mekras is co-listing the building with Cary Cohen of Blanca.

The three-story, waterfront Art Deco building was constructed in 1956, property records show.

Read more

It’s unpriced.

Mekras said the unit owners “recognize that the highest and best use of their property” is the land, and that they plan to take advantage of the hot real estate market.

“We will be achieving a significant premium on a prorata basis for their units as compared to their ‘retail’ value in one-off sales,” he wrote via email.

Bay Harbor Islands, a two-island town north of Indian Creek, has increasingly attracted developers who include Bruce Eichner and Ugo Colombo.

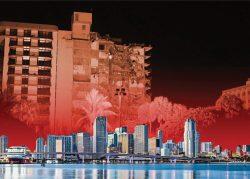

Across South Florida, investors and developers are singling out older waterfront buildings, especially those in need of repairs and on densely zoned land, due to a lack of available undeveloped property. The collapse of the Champlain Towers South in Surfside this summer accelerated this trend, industry experts say.

Farther south along the ocean in Miami Beach, the unit owners of Castle Beach Club at 5445 Collins Avenue tapped a Colliers South Florida team led by Ken Krasnow and Gerard Yetming to list their 4-acre, 570-unit development for sale, also unpriced. The property has 576 feet of beach frontage.

The building was constructed in 1966, and the majority of units are rented out as short-term rentals. The property is zoned RM-3, allowing for more than 500,000 square feet of development and 150 units per acre, or close to 600 units overall.

Yetming said the condo association was approached by developers who made bulk offers. Unsolicited offers can often divide unit owners and make a deal less likely, brokers say. An older building may receive a number of offers over the years before a buyout is successful.

“They got the sense that there was really strong demand for the development site and said,

‘Let’s hire a national brokerage firm,’’’ Yetming added.

The land is more valuable than the individual units, he said.

The building received an unsafe structure violation from the city of Miami Beach in July that required emergency shoring. The notice cited concrete spalling and cracking in the garage.

“Like any 60-year building in Miami Beach, they’re going to need to do some work to maintain the building,” Yetming said.

Farther north in Surfside, the site of the deadly Champlain Towers South collapse is in contract to sell to a stalking horse bidder, though an auction is still planned for this summer. That site, measured as 1.88 acres, was appraised at $95.6 million. Based on that price, the Castle Beach Club site could be valued at about $200 million.