Blackstone is acquiring Bluerock Residential, a real estate investment trust focused on multifamily properties, for $3.6 billion as part of the investment giant’s continued push into the rental market.

New York-based Bluerock Residential Growth REIT announced Monday that it had reached an agreement to sell its outstanding common stock to affiliates of Blackstone Real Estate for $24.25 per share — an all-cash deal that Bluerock said represented a 125 percent premium over it closing price on Sept. 15, when it was first revealed that the multifamily developer and landlord was exploring a sale.

After closing at $15.44 on Friday, shares in Bluerock had surged more than 75 percent to $27.11 as of 4:00 pm Monday.

Blackstone will acquire 30 rental properties comprising about 11,000 units in the deal, along with a loan book secured by 24 multifamily assets. The garden-style properties are around 20 years old, on average, and are mostly based in Sun Belt markets like Atlanta, Phoenix and Orlando.

The deal comes a month after Blackstone secured nearly $1.1 billion in debt to refinance an existing multifamily portfolio spanning about 5,450 units across 13 properties, primarily in Florida, Georgia and Texas.

Not included in the transaction are Bluerock’s approximately 3,400 single-family rental homes, which the firm said are being spun off into a new REIT known as Bluerock Homes Trust.

“Bluerock’s portfolio consists of high-quality multifamily properties in markets across the U.S. experiencing some of the strongest fundamentals,” said Asim Hamid, Senior Managing Director at Blackstone Real Estate, in a statement. “We look forward to bringing our best-in-class management to these properties.”

Morgan Stanley and Eastdil Secured advised Bluerock on the sale, which is expected to close in the second quarter of next year.

Bluerock had been exploring a sale or a recapitalization since September, Bloomberg first reported.

Blackstone’s residential ambitions, meanwhile, have grown increasingly apparent in recent months.

In June, it was announced the investment giant was getting back into the single-family rental business with a $6 billion acquisition of rent-to-own specialist Home Partners of America.

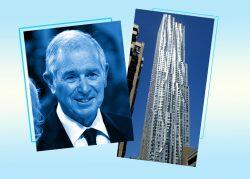

The firm has been making moves in the multifamily market, too. On Sunday, Bloomberg reported that Blackstone is nearing a deal to acquire 8 Spruce Street — the Frank Gehry-designed luxury rental tower in Lower Manhattan — from Brookfield Asset Management and Nuveen for $930 million in what would be one of the city’s largest multifamily deals since the onset of the pandemic.

Read more