Three years after closing its first real estate fund, Centerbridge Partners has found even more interest the second time around.

The private investment firm on Tuesday announced the closing of its second real estate fund, aptly named Centerbridge Partners Real Estate Fund II. The fund received $2.3 billion in capital commitments, easily exceeding its target of $1.5 billion.

The first fund closed in Dec. 2018. The second fund represented a 150 percent increase in committed capital from the first fund.

Centerbridge’s latest fund has its sights set on a variety of opportunities, including investments in self-storage and specialized storage, digital real estate, industrial and logistics, as well as residential. The company said the fund will also focus on areas benefiting from shifts in customer behavior, including leisure and experiential real estate.

Read more

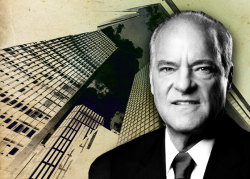

“The flexibility of our strategy and the breadth of our team’s capabilities position us well to invest strategically in this dynamic environment,” said senior managing director and head of real estate William Rahm. “We look forward to identifying a diverse range of investments where we see strong growth and an opportunity to create significant additional value for our investors.”

In its 15-year history, Centerbridge has invested more than $10 billion of equity in real estate properties, companies and loans and securities. The company’s real estate team is managing about $3.2 billion in real estate assets. As of the end of 2021, Centerbridge has approximately $33 billion in capital under management.

Real estate funds have proven to be big business for some of the largest investment firms in recent years.

In the last five years, Blackstone has raised almost $64 billion, more than the next three largest fundraisers combined. Data from Preqin from the same period previously reported by The Real Deal show the other top firms, including Brookfield Asset Management, Lone Star Funds and Starwood Capital Group, raised a combined $131 billion.