When Douglas Elliman made its debut as a publicly traded company in December, it did so with significant momentum, coming off a record-shattering 2021 in which it nearly matched its output from the previous two years combined.

The brokerage reported $51.2 billion in sales last year, according to an SEC filing last week, up from $29.1 billion in 2020 and $28.8 billion in 2019. Elliman reported 32,405 transactions for the year, also a record, up from 22,686 in 2020 and 23,479 in 2019.

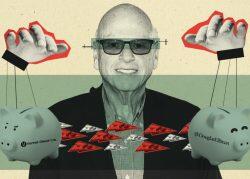

“We are enormously proud of our unflagging agents, managers and staff across the country who all contributed to the enormous success we achieved in 2021,” said CEO Howard Lorber in a statement.

Like other brokerages, Elliman had a slow start to 2020, with just under $11 billion worth of deals brokered in the first half of the year as lockdowns halted the market. But its $10.4 billion in sales in the fourth quarter helped push it past 2019 for the full year, momentum which continued into 2021.

The brokerage achieved $10.1 billion across 7,094 deals in the first quarter of last year. In every quarter thereafter, it recorded more than 8,000 transactions.

“2021 proved to be a banner year, culminating with our greatest listing yet: DOUG trading on the New York Stock Exchange,” Lorber said in a statement.

Douglas Elliman began trading on the New York Stock Exchange in December, the result of a spinoff from former parent company Vector Group.

In the third quarter, its most recent earnings report and its last before the spinoff, the brokerage’s net income was $25.1 million, compared to $11.8 million a year prior. Closed sales volume was $12.6 billion, a 62 percent year-over-year increase. It debuted with $200 million in net cash on its balance sheet and no debt.

Its stock price, however, is down nearly 40 percent from its debut, trading at $7.43 as of midday Wednesday.

Read more