UPDATED, May 25, 3:05 p.m.: Two Roads Development closed on a $150 million bulk condo purchase in Miami’s Edgewater, where it plans to develop a multi-tower luxury project.

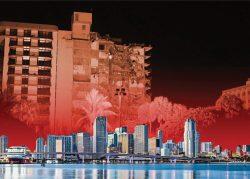

Two Roads, a West Palm Beach and Miami-based developer, gains a 3.5-acre waterfront site with the purchase of Biscayne 21, a 1960s-era condo. The deal is part of a growing trend of developers targeting older properties on South Florida’s waterfront in the wake of the deadly Surfside condo collapse.

The redevelopment of Biscayne 21, a 191-unit condo building at 2121 North Bayshore Drive, will mark the third condo project for Two Roads in Edgewater, following Biscayne Beach and Elysee. Bernardo Fort-Brescia of Arquitectonica will design the latest development, which will include branded residences and “ultra-luxe” condos, according to a press release.

Two Roads secured $150 million in financing, which breaks down to a $45 million mezzanine loan from Lionheart Strategic Management LLC, the asset management affiliate of Fisher Brothers, and a $105 million senior mortgage from Bank OZK. The developer will use the financing to prepare for the planned development, according to a press release.

The Real Deal first reported the news that Two Roads was in contract to purchase the property. Two Roads plans to build three towers of up to 649 feet tall — about 60 stories — with up to 750 units, Taylor Collins, a managing partner, previously said.

Read more

An Avison Young team led by John Crotty and Michael Fay represented the sellers, 176 unit owners. The unit owners banded together more than two years ago, hiring Avison Young to list their property to a bulk buyer.

In the release, Crotty said that the collective bargaining allowed the brokerage “to negotiate for a multiple of more than three times what the sellers would have sold their individual units for on a one-off basis.”

Joe Hernandez of Weiss Serota Helfman Cole & Bierman represented the unit owners.

Other buildings in South Florida have also joined together to market themselves to developers who will typically pay above market value for the units, especially along the water. In some parts of Miami-Dade, the only developable waterfront land left is home to older buildings that require expensive upkeep and maintenance.

Earlier this year, the Related Group and 13th Floor Investments offered $500 million to buy out the owners of Castle Beach Club, a roughly 18-story, 570-unit oceanfront condominium at 5445 Collins Avenue in Miami Beach.

Mast Capital and Starwood Capital Group recently began sales of The Perigon, a luxury condo planned for the oceanfront Miami Beach site of an older building that Mast bought out last year. That building, at 5333 Collins Avenue, was declared unsafe by the city last summer.