A judge awarded Israeli investor Benny Shabtai a $4.6 million judgment in his lawsuit against HFZ Capital Group over the failed Shore Club Miami Beach redevelopment.

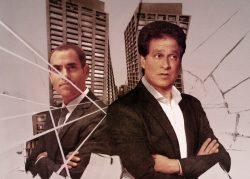

New York-based HFZ, led by Ziel Feldman, lost its ownership of the historic Shore Club when Monroe Capital foreclosed on the property. Monroe brought on Witkoff as its partner to renovate and redevelop the oceanfront Art Deco hotel at 1901 Collins Avenue.

Monroe and Witkoff are now on the hook for the judgment tied to the lawsuit that Shabtai, a former HFZ investor, filed last year. The ruling marks the latest update in HFZ’s demise, which has been documented through a number of legal battles with former partners and lenders.

Read more

Shabtai’s investment in the Shore Club dates back to 2013, when Fortress and HFZ joined SC Philips Clark to redevelop the property into a luxury condo and hotel.

In exchange for Shabtai’s $3.5 million investment in 2013, he was to receive a 3.34 percent Class B interest in the HFZ Shore Club project, according to court documents. The following year, Shabtai and HFZ agreed that Shabtai would redeem his interest to purchase a unit on the 18th floor, and that he had the right to buy the rest of that floor for $1,800 per square foot, court documents show.

HFZ ended up canceling plans for the Fasano-branded development. It returned buyers’ deposits when the condo market slowed down in 2018 and let the property fall into disrepair, a number of lawsuits allege. The hotel has been closed since the pandemic started more than two years ago.

Shabtai sued HFZ and affiliates of the company that owned the Shore Club in May 2021 in New York.

A spokesperson for Witkoff disagreed with the judge’s decision, which it called “an inherited claim that is all about HFZ and their relationship with a former investor.” In a statement to The Real Deal, the spokesperson said that Witkoff plans to appeal.

Shabtai’s attorneys have alleged that the investor “never pledged any of his equity” in connection with the loans that Monroe ultimately used to foreclose on HFZ. Once Monroe took over the property, Monroe and the Shore Club entities “intentionally, in bad faith, and without notice” to Shabtai divested him of his ownership and dissolved HFZ Shore Club “so that they could avoid their obligation to pay him the money owed to him,” court documents allege.

With interest and other fees, the judgment awarded to Shabtai exceeds $5 million, court records show. Shabtai is a watch mogul whose family made about $500 million in 2014 when they sold their majority stake in the instant messaging app Viber to Rakuten, according to published reports. Shabtai was also Raymond Weil’s exclusive watch distributor in the U.S.

Shabtai’s attorney, Kristin Pendergrass of New York-based Schwartz Sladkus Reich Greenberg Atlas, declined to comment.

Feldman of HFZ did not respond to a request for comment.

Witkoff’s spokesperson said the company will “aggressively litigate any inherited claims from HFZ’s past troubles that are not meritorious or simply brought by litigious plaintiffs in search of a deep pocket” and that the lawsuit has “nothing at all to do with” Witkoff and Monroe’s partnership and plans for the project.

Witkoff and Monroe are planning a major redevelopment and expansion of the Shore Club, one of a handful of Art Deco hotels along Collins Avenue that are expected to be restored and renovated. The project calls for luxury condos and hotel rooms.

A handful of lawsuits involving the Shore Club have been filed over the past two years. In July, SC Philips Clark, a former owner, sued Witkoff and Monroe, alleging that it was illegally stripped of its ownership in the hotel through what it called a “crooked and secretive land grab.” Witkoff’s spokesperson called the lawsuit “baseless.”