UPDATED, June 20, 2023, 2:05 p.m.:

Safe Harbor Equity is seeking foreclosure on two hotels in Miami and Miami Beach that are owned by Henley Investments, tied to a $13 million loan.

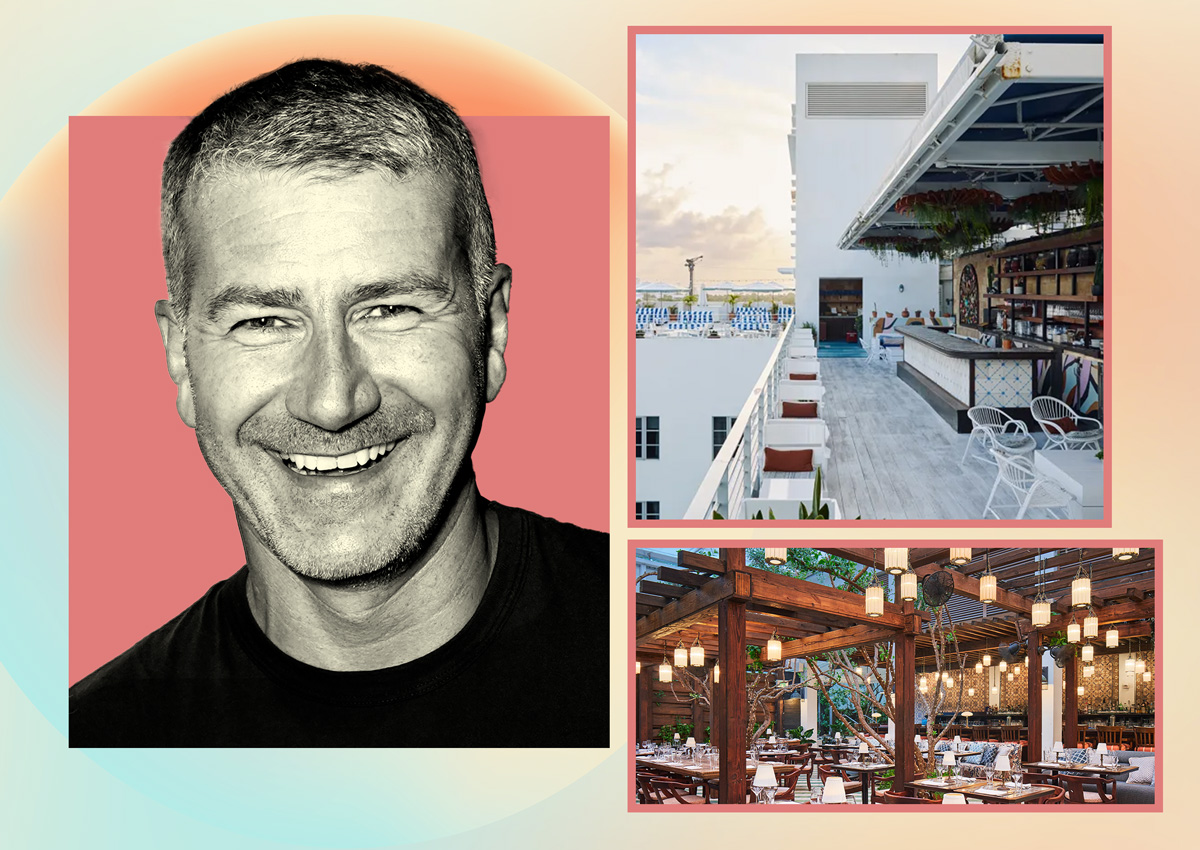

The properties include the 26-unit Pretty Swell hotel at 321 Collins Avenue and the 33-room Life House hotel at 528 Southwest Ninth Avenue in Miami’s Little Havana. The Miami Beach property is a former hostel. Both are operated by Life House, a New York-based hotel start-up that partnered with Henley on four properties in Miami-Dade County.

Henley paid $15.4 million for the two hotels in 2018.

The U.S. arm of Henley secured an $11.5 million loan from the original lender, MIOF Credit 1, in April 2018 when it acquired the properties, records show. The lender boosted the mortgage to $13 million a year later, according to the foreclosure complaint. In June 2020, right after the pandemic shutdown hit South Florida, the lender and borrower agreed to move the maturity date to December 31, 2022, and again at a later date to March 31 of this year.

Safe Harbor, led by Ralph Serrano, purchased the note in May, after the Henley affiliate missed another deadline to pay off or refinance the loan, the complaint alleges.

Under the third loan modification, Henley agreed it would owe the lender 24 percent interest if it were to default, the complaint alleges.

Life House said that Henley owed Life House about $1 million when the pandemic shutdown occurred, plus guest refunds and unpaid employee salaries, for the two hotels, according to a spokesperson for Life House. Life House sued Henley, and as part of the settlement was owed a portion of the proceeds of both hotels if Henley sold them. The spokesperson said that Life House has been paying rent on time to Henley for the last more than two years.

A spokesperson for Henley declined to comment. Safe Harbor did not immediately respond to a request for comment.

The Life House spokesperson added that Henley hasn’t been able to sell the hotels in part because of high interest rates and the dramatic increase in property insurance rates, which have made the two hotels “less financially appealing” at Henley’s asking prices. The property at 321 Collins Avenue is on the market for $7.1 million, according to a Compass listing.

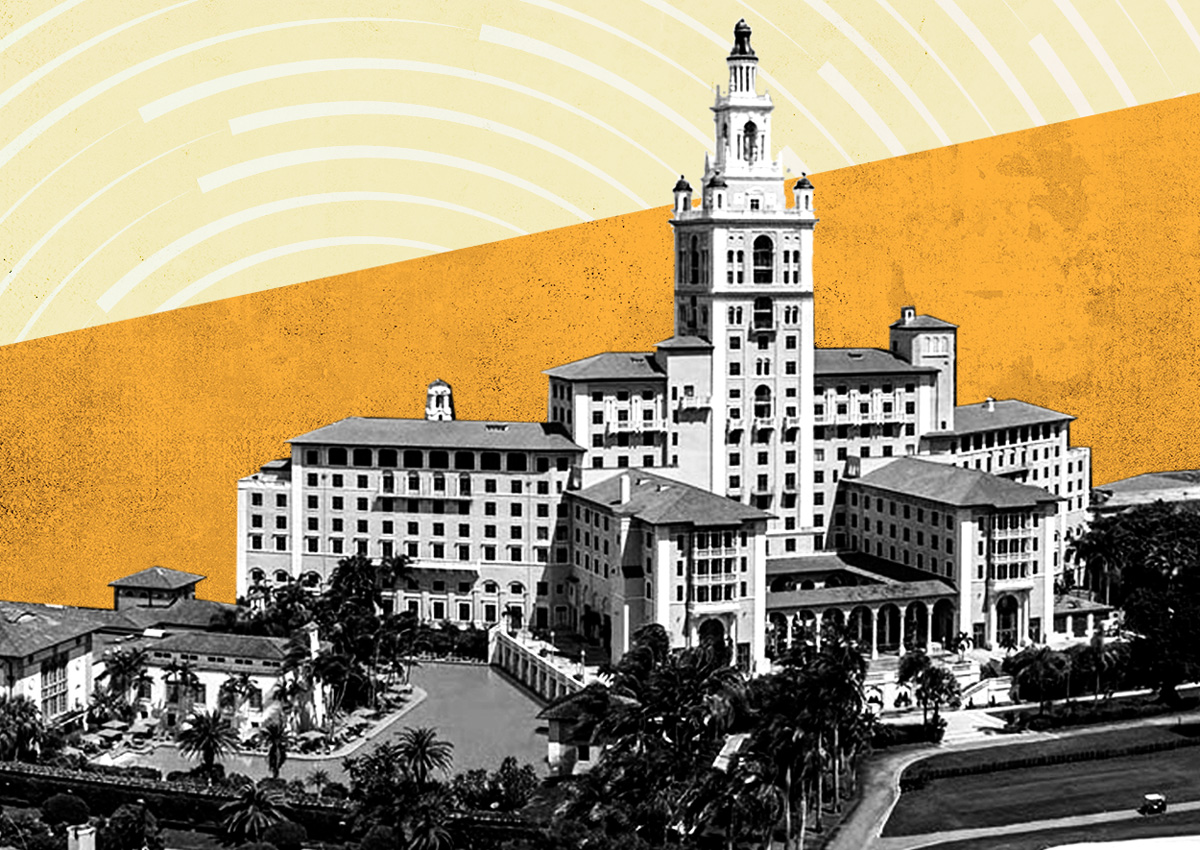

It’s not the first Life House and Henley property that has fallen into foreclosure. In September 2020, Leste Group and its partner, Moto Capital Group, completed an out-of-court UCC foreclosure of the 81-key hotel at 350 Ocean Drive in Miami Beach. Last fall, the mezzanine lenders that took control of the property, originally called the Lord Balfour, sold it for $39.3 million, or $485,000 per key.

The former Henley-owned hotel at 2216 Park Avenue is also facing foreclosure over an allegedly unpaid $13.9 million mortgage.

South Florida’s hotel market struggled at the start of the pandemic, and some hotels were seized by lenders or sold at deep discounts. But the region’s hospitality market began to recover when lockdowns were quickly lifted in Florida, eventually leading to record average daily rates and occupancy at some properties.

Earlier this month, the real estate investment trust Service Properties Trust paid $164.5 million to acquire Miami Beach’s Nautilus Hotel at 1825 Collins Avenue. The 250-key Art Deco resort traded for nearly $700,000 per key.

Read more