The owners of a unit at Amethyst are suing Mast Capital over the dragged out condo buyout of the oceanfront Miami Beach property, which is now facing competition — or collaboration — from David Martin’s firm, Terra.

Clifford and Maria Greenhouse sued the Mast entity, as well as Old Republic National Title Insurance Company, over the $650,000 sale of their unit that has yet to close. They entered into a contract last year to sell unit 205, a 740-square-foot condo, to Mast.

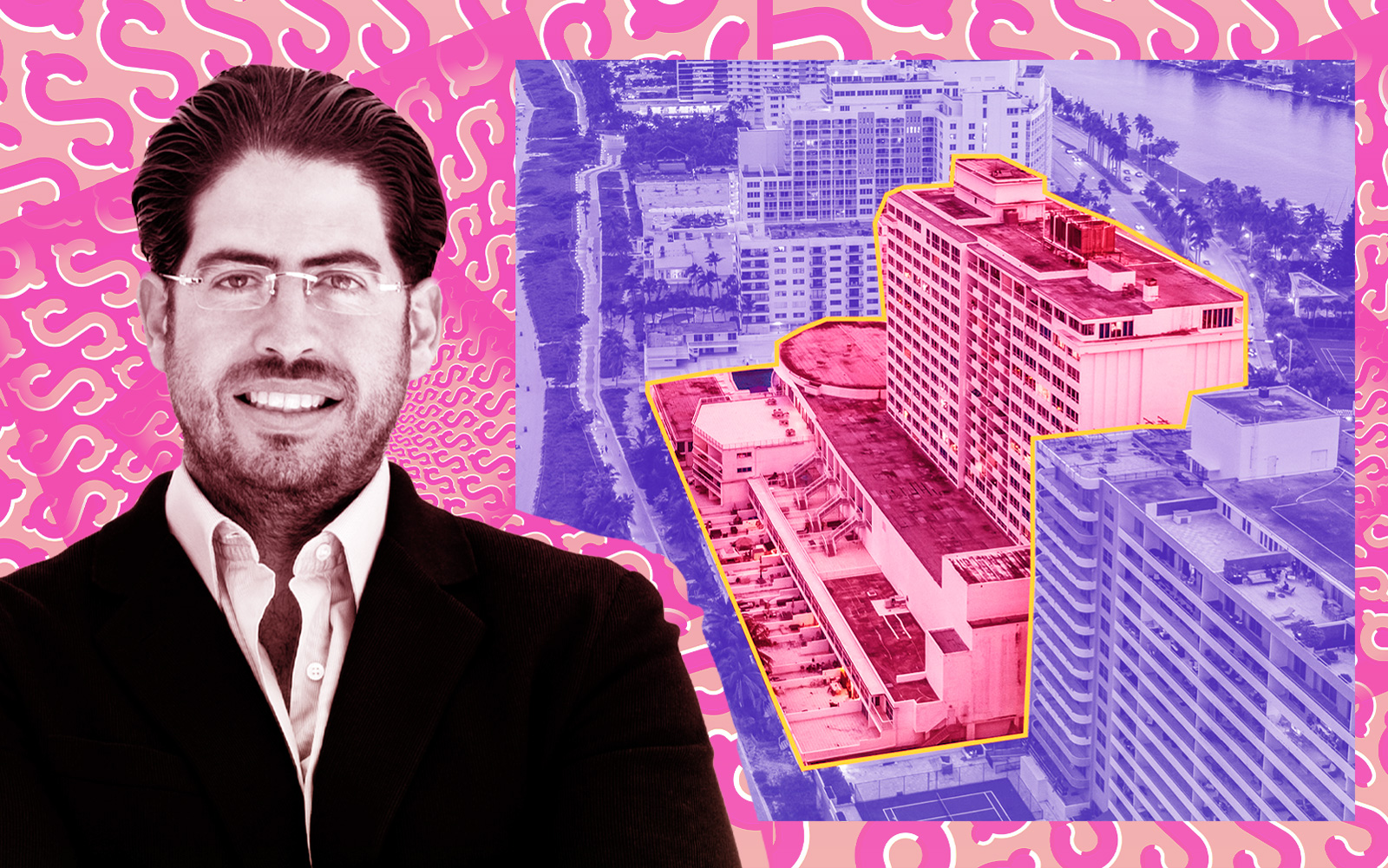

For more than two years, Mast Capital has been working on a bulk buyout of the Amethyst, an 11-story, 120-unit condominium at 5313 Collins Avenue. A group of owners allege that Mast Capital, led by Camilo Miguel Jr., has repeatedly extended the closing on a majority of units, leaving the deal in limbo and holding the owners hostage, The Real Deal previously reported.

Mast missed the original November 2022 closing date for most of the units. In anticipation of that date, some unit owners terminated leases with their tenants, others had their furniture moved, and some put deposits down on future home purchases that they’ve now lost.

The Greenhouses and other owners allege that the contract language allows the developer to extend the closing date in perpetuity.

“Many unit owners have lost deposits for other anticipated purchases or replacement housing, others no longer benefit from tenant revenue based on reliance upon Mast’s empty promises to close,” said attorney Robert Pelier, who represents the Greenhouses alongside attorney Aymee Gonzalez. “Yet others feel trapped by contract language whose enforceability, conscionability and legality is questionable at best.”

Pelier said he and Gonzalez are working with additional owners who are in similar positions.

The Greenhouses claim they could be “in legal limbo in perpetuity, forever bound by a contract under which the other party had no deadline for its performance,” the complaint alleges.

The Greenhouses are also alleging Mast breached their contract, and are seeking the $19,000 deposit, according to the complaint. Old Republic is currently holding a $5,000 deposit. The additional amount represents the full 3 percent of the purchase price that was to be held in escrow.

The Mast affiliate has spent just over $3 million acquiring at least eight units, property records show. It has paid $235,000 to $480,000 for the units it has purchased, ranging from about $300 per square foot to nearly $660 per square foot.

Terra also recently sent out offers to owners in the building. The two developers could work together on a condo termination and redevelopment of the property, but it is unclear if they will.

Mast does not control units owned by a group of 28 owners, which are needed to give the developer the minimum required to move forward with a condo termination. The developer canceled the contracts it had with the 28 owners, which were all contingent on each other closing, leaving those deals in limbo.

Terra is offering $850,000 each to the group of 28 owners, and $550,000 each to others. That would total more than $74 million if Terra could acquire the remaining 92 units. (It likely can’t because Mast owns some of the units, and is in contract to acquire many of the others.)

Mast Capital also owns the site next door, where the La Costa condo building will be torn down to make way for the Perigon, a luxury condo tower Mast will develop with its partner, billionaire Barry Sternlicht’s Starwood Capital Group.

Mast previously said that many owners who agreed to sell are concerned Amethyst is in “extreme disrepair.” But Amethyst, built in 1964, passed its 50-year recertification in 2014, and the building was considered structurally and electrically safe for occupation as recently as 2020, according to the city. Mast actually received two violations for unpermitted work in units it owns on the third floor.

Read more