South Florida developers scored a surge of more than $1.2 billion in construction loans in recent weeks, in stark contrast to other top regions across the country.

The financing comes even as high interest rates and soaring insurance premiums have held new developments hostage.

Much of the recently secured financing is for condo towers and some mixed-use projects. Another $1 billion-plus in South Florida condo construction loans are expected to close early this year, sources told The Real Deal.

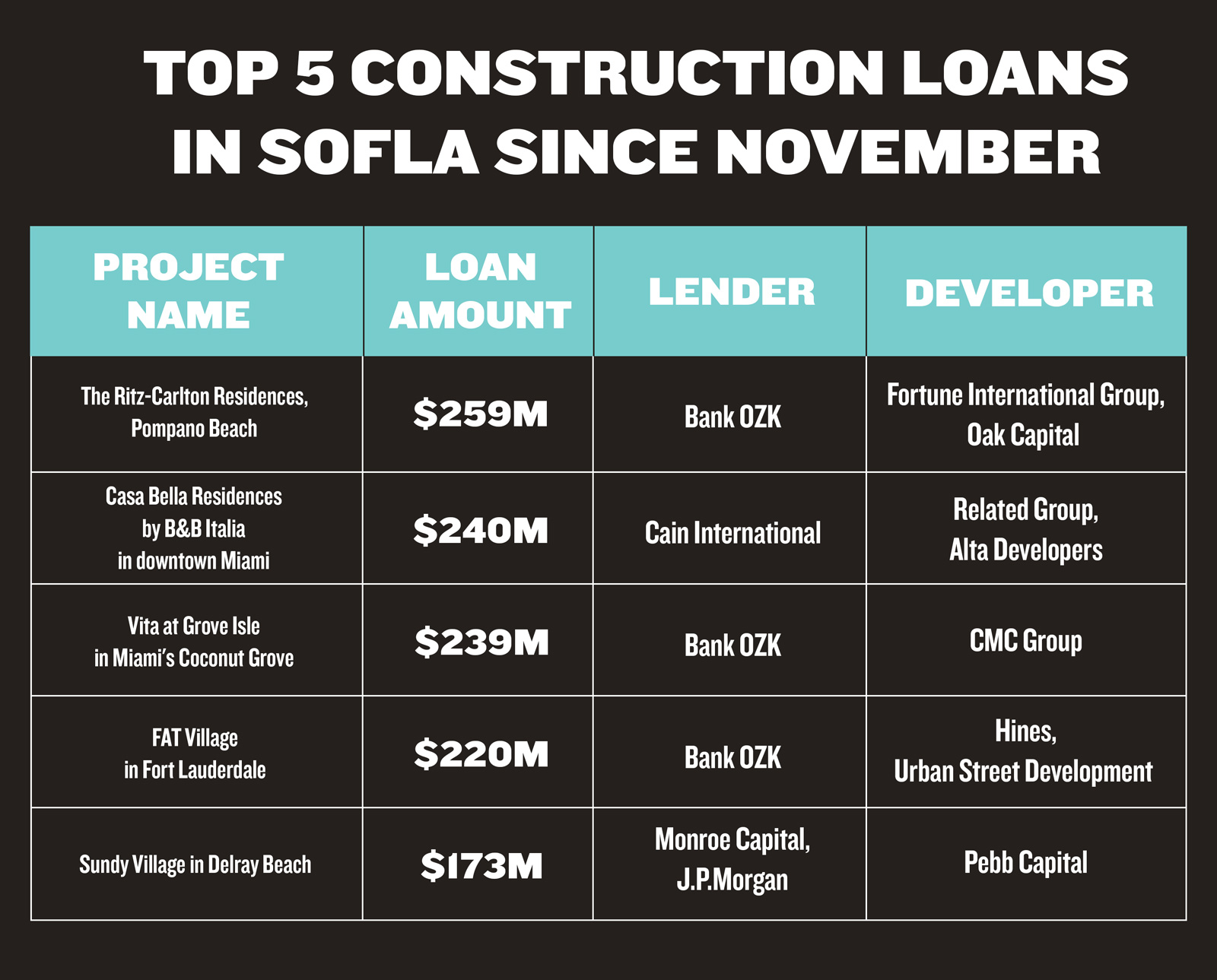

Bank OZK remains the top lender for condo construction in the tri-county region. Of the top five loans to close since November totaling $1.1 billion, Bank OZK provided $718 million.

The largest loan in the past two months is the $259 million construction financing for The Ritz-Carlton Residences, Pompano Beach. Bank OZK provided the loan in December to Fortune International Group and Oak Capital for the luxury branded condominium project. At the end of the month, Ugo Colombo’s CMC Group secured a $239 million loan, also from Bank OZK, for Vita at Grove Isle, a waterfront condo building under construction in Miami’s Coconut Grove. The Ritz was more than 90 percent presold, while Vita was more than 70 percent presold at the time.

In South Florida, condo developers can use much, if not all, of their buyers’ deposits for construction, so banks and other lenders are more willing to finance projects with strong presales, experts say. The risk for lenders is lower.

But that doesn’t mean those deals are easy. Many of the loans represent smaller portions of the capital stack than they would have two or three years ago. If a lender was willing to provide 65 percent loan to value before, now they are offering closer to 50 percent, sources said. Some deals require multiple lenders so as to have less leverage than before.

For several projects, it’s now or never. Condo developers risk their presale contracts becoming invalid if they don’t move forward with construction.

Ben Jacobson, a partner at Miami-based Forman Capital, expects additional condo loans to close in the first half of the year.

“Those deals will still get done in a good market, bad market,” Jacobson said. “The market overreacts to that stuff.”

Still, it’s more challenging for borrowers looking to finance construction of other property types, including hotels, office buildings and high-end rental developments.

“Everything is complicated, everything is hard,” said Suzanne Amaducci, head of Miami-based law firm Bilzin Sumberg’s real estate practice. “Interest rates are very high. A lot of deals don’t pencil out right now.”

Amaducci said she recently was involved in refinancing a hotel with a very low loan to value, which “should have been a no-brainer,” she said. “I’m shocked that it was difficult.”

Limited lending capacity

Multifamily broker Denny St. Romain of CBRE said he’s received more calls since the end of the year from developers that “normally don’t engage us for construction financing.” He’s working with developers seeking half a dozen construction loans averaging just over $50 million each, including four in South Florida.

Prospective borrowers are having to widen their search because the banks they have relationships with have been and continue to limit their construction lending, he said.

Debt funds have stepped in to fill the void, but they offer more expensive terms. Developers are “getting hit both ways,” St. Romain said. “You’re getting less leverage than you’d like and paying more for it.”

Capacity for lending will depend on what happens with interest rates and with existing loans, said Peter Mekras, president of Miami-based Aztec Group. Though the Federal Reserve is expected to make cuts this year, they likely won’t be substantial. And some lenders and borrowers have worked out extensions for existing loans, further constraining the system.

Construction starts slowed as a result of high interest rates and the soaring cost of construction, insurance, land and more. That slowdown in groundbreakings and vertical construction will continue for at least the next six months, sources said.

“How many projects will reach a point of success and retire those former loans?” Mekras said. Once repaid, those lenders will be back in the market. “They’re in the business of making another loan.”

Hoping for relief

Developers that can move forward with their projects will be “taking advantage of construction pricing that we believe will be at its lowest level within this development cycle,” said Asi Cymbal, a developer with projects in Miami Gardens, Fort Lauderdale and Dania Beach.

“We’re not out of the woods yet, but for the first time in a while I’ve heard an eagerness to get back into the market,” Cymbal said. Cymbal will be in the market for construction financing this year for his mixed-use development planned in Fort Lauderdale.

Calixto Garcia-Velez, president of Banesco USA, agreed. “Construction work is starting to diminish. The expectation is that prices will likely start to come down as sub[contractors] aren’t as busy as they were in the last couple of years,” he said.

Garcia-Velez said Banesco didn’t stop lending over the past year-plus, but the bank is cautious regarding financing offices, hotels and high-end multifamily rental projects. Banesco is also more conservative in its underwriting, as rent growth has slowed or is falling, depending on the asset class.

Amaducci, of Bilzin Sumberg, said the sentiment is that rates will come down slightly, but she expects it will be a “bumpy year.”

At the recent Commercial Real Estate Finance Council conference in Miami Beach, “there was a lot of debate about what coming down meant,” she said. “It’s a guessing game as to how much [rates] will go down.”

Read more