Miami-Dade County is short more than 90,000 affordable units, as residents struggle to find and keep attainable housing across South Florida.

The county is lacking 90,181 units for households earning below 80 percent of the area median income, which comes out to about $75,000 a year, according to a report released by the nonprofit Miami Homes For All.

Miami-Dade is facing the “largest affordability crisis” in the country, Annie Lord, executive director of Miami Homes For All, said at an affordable housing presentation on Tuesday, held at the Beacon Council’s Brickell headquarters in Miami.

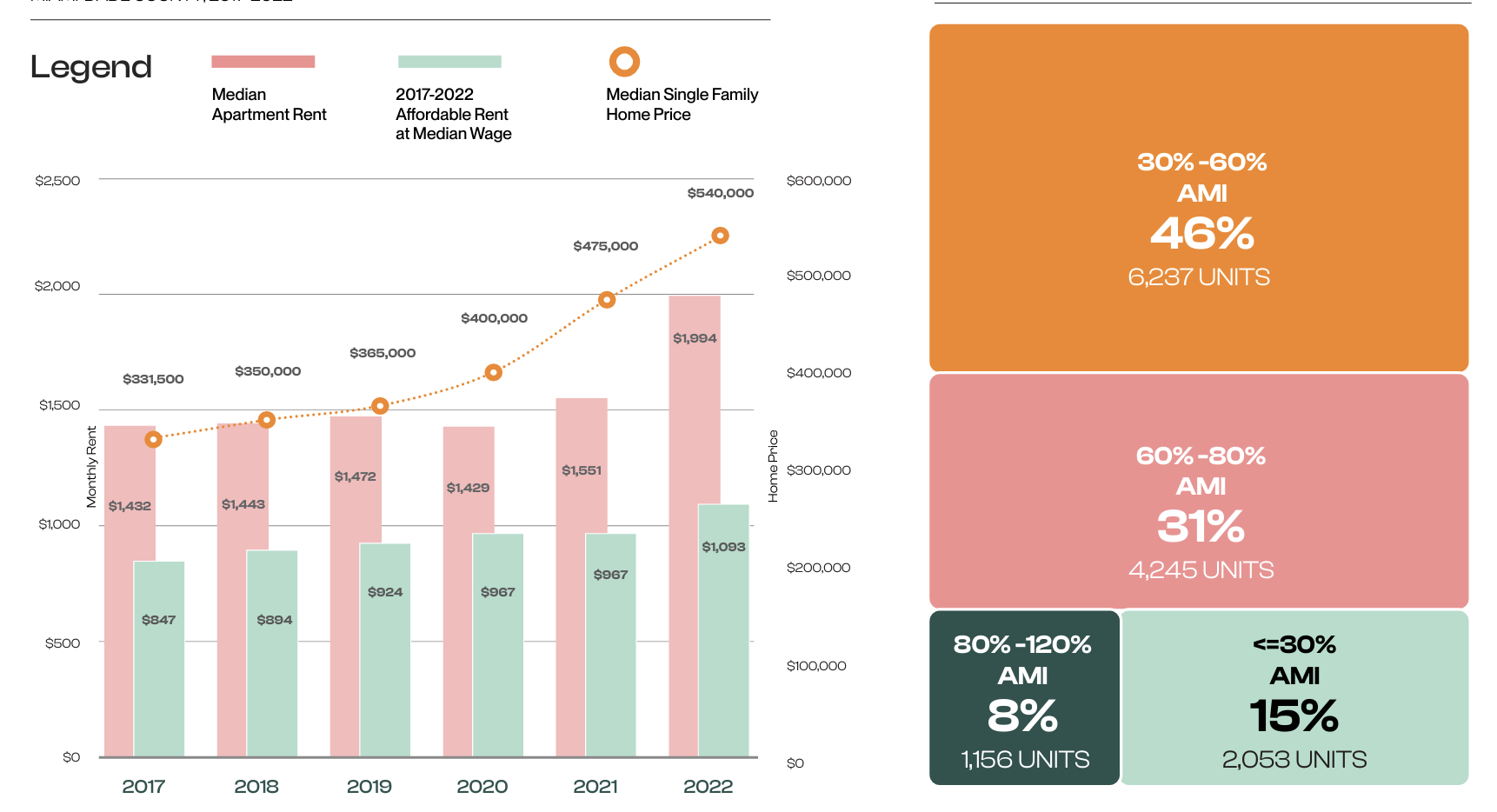

The report determined that about 14,000 units spread across 101 projects are in the pipeline, but do not yet have financing. That breaks down to:

- 6,237 units for households earning 30 percent to 60 percent of AMI (46 percent of the pipeline)

- 4,245 units for households earning 60 percent to 80 percent of AMI (31 percent of the pipeline)

- 1,156 units for households earning 80 percent to 120 percent of AMI (8 percent of the pipeline)

- 2,053 units for households earning less than 30 percent of AMI (15 percent of the pipeline)

These projects will require about $1.5 billion in funding, which could then unlock additional subsidies and other forms of funding to the tune of another $3.3 billion, said Marvin Wilmoth, managing principal of Intersection Ventures, at the presentation.

Two years after Miami-Dade County Mayor Daniella Levine Cava declared an affordable housing crisis, she said rents are still too high, and spoke about the workforce being driven out of Miami-Dade as a result.

Housing prices, on the rise for more than a decade, have also skyrocketed. The median price of a single-family home in Miami-Dade increased 14 percent, year-over-year, in March to $650,000, according to the Miami Association of Realtors. The median condo price rose 11 percent to $445,000.

“We have boomed, our growth, the most recovered economy, is a wonderful feather in our cap. But we know that unfortunately, the net result was a huge cost of living increase, particularly animated by the cost of housing,” the mayor said. “It’s affecting both homeowners and renters, and it has brought incredible challenges to this community.”

Levine Cava had proposed a $2.5 billion general obligation bond that would include funding for affordable housing, but she later postponed that due to opposition. At the Miami Homes For All event, she said the bond “needs to be bigger.”

Touting her administration’s accomplishments, Levine Cava said 68 multifamily developments with 8,700 units secured county funding this quarter; about 1,300 of those are more than 50 percent completed.

“Our county has doubled our investment in affordable and workforce housing projects,” since 2021, she added.

Florida’s Live Local Act was not discussed during the presentation. The legislation, signed into law last year, provides tax and zoning incentives to developers that incorporate workforce housing into their projects. It’s largely referred to as an affordable housing law, but it will primarily benefit renters making up to 120 percent of AMI.

Still, Levine Cava and others spoke about not relying solely on federal or local funding to get affordable housing projects off the ground.

“We have to get our construction companies and our developers to think realistically about the needs of this community because it’s at our own peril,” Levine Cava said. “If we drive out the workforce, which we already are doing, we’re at 1.4% unemployment, that is not a good sign. That is not healthy, and it means that we do not have the workers that we need to support our economy.”