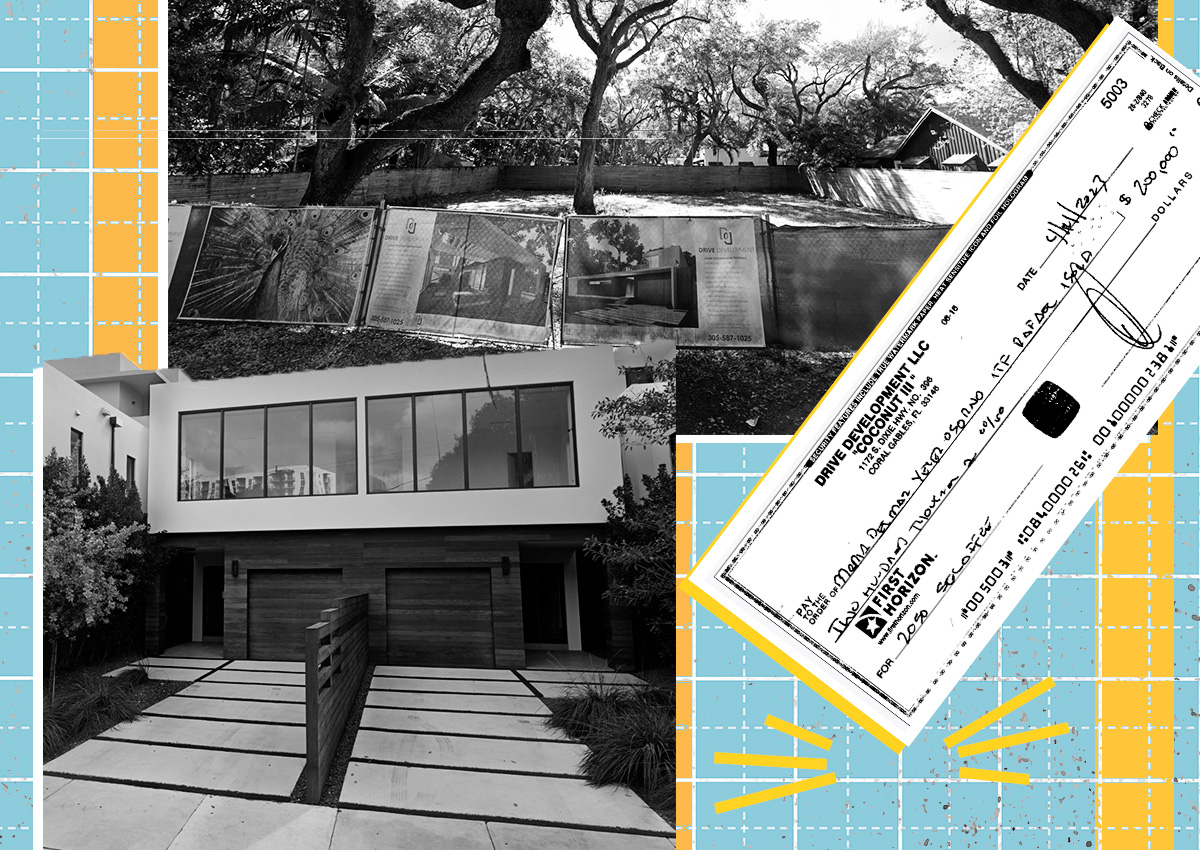

The receiver managing the properties tied to developer Doug Cox’s alleged fraud in Coconut Grove is seeking court approval for a bulk sale of the majority of the remaining townhouses.

The receiver, retired Miami-Dade Judge Alan Fine, filed a motion last week for the $18.2 million sale of the nine townhouses at 2955, 2957, 2960, 2962, 2978, 2980, 2984, 2986 and 2992 Coconut Avenue in Miami.

Mela Coconut Grove LLC, an entity managed by West Palm Beach attorneys Eric Giray and Lara Hanrahan, is the bidder. An individual buyer could come in and purchase one or more of the townhouses if they are “higher and better” offers, and Mela Coconut Grove LLC could outbid those buyers.

A hearing is scheduled for Friday.

“Through this bulk sale, we will be able to liquidate all of the secured debt and start the process of being able to know how much money will be left at the end of the day for creditors,” Fine told The Real Deal.

Separately, Fine is also requesting that the judge approve the $2.4 million sale of the townhouse at 2990 Coconut Avenue to David and Martha Blitz.

Cox and his partner, Nicole Pearl, allegedly crafted a scheme in which they sold homes and townhomes to multiple buyers while lying to lenders and investors, failed to obtain certificates of occupancy, and in some cases, built outside of what was permitted, according to lawsuits filed in recent years. The properties involved in the lawsuits are all scattered throughout Coconut Grove.

The final payment for Vivian Dimond, an investor, broker and developer who was hired by the receiver to obtain certificates of occupancy for the townhouses, was approved by Miami-Dade Circuit Court Judge Thomas Rebull last week. Dimond’s final payment was for nearly $47,000.

Thirty-two homebuyers who were owed a combined $34 million agreed to sign quit claim deeds this summer, and are among the creditors.

Paul Singerman, the receiver’s attorney, said that one townhouse still remains for sale, but they are actively negotiating the sale of that property as well.

The $18.2 million bid breaks down to $1.8 million each for four-bedroom units, $2.2 million each for five-bedroom units.

The receiver already sold other properties involved in the alleged scheme, including undeveloped lots to Phil Sylvester, who invested in Cox’s projects.

“We were in negotiations or conversations with a number of other parties, some were creditor buyers [victims of this fraud] and Mr. Sylvestor, before we got this bulk offer in writing,” Fine said, referring to the $18.2 million offer. He added that they’ve already received four proposed contracts on four of the nine units for higher prices. “We’re optimistic that we’ll be able to sell at better prices than it may otherwise appear.”

The sale or sales of the properties would close two business days after a court order is signed, Singerman and Fine said.

Many of the homes that Cox built sat nearly completed for months, and in some cases, years, even as buyers repeatedly tried to close on the properties. One of the lawsuits filed against Cox alleged he “willfully, deliberately, and intentionally failed to commence any construction” to “take advantage of the housing market increases (and profits)” in South Florida.

Read more