Shopping centers again dominated South Florida’s retail sales landscape, with Publix leading the charge. In the past year, the top 10 retail deals rang up a combined $556 million, compared to a combined $490 million for the top sales in 2023.

In 2024, the 10 largest sales represented 2.1 million square feet of retail space that sold for an average of roughly $340 per square foot. Publix, the Lakeland, Florida-based grocery chain, accounted for two purchases, paying a total of $110 million for shopping centers anchored by its stores in Coral Springs and Davie.

Here are the top retail sales in South Florida this year, based on data obtained by Colliers and CBRE:

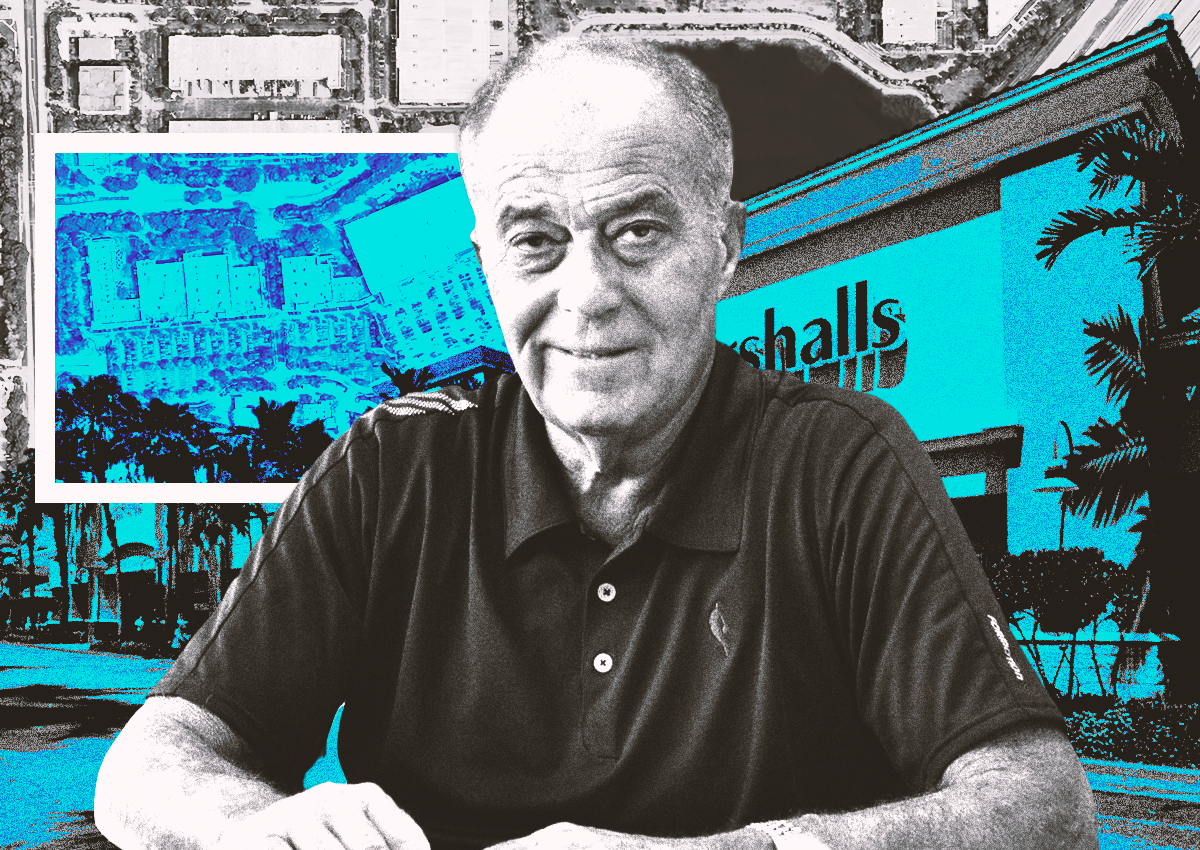

$84M | Midtown Miami | Benderson Development

Beachwood, Ohio-based Site Centers Corp., developer of Shops at Midtown Miami, sold the retail center in September for $83.7 million, or roughly $241 a square foot. The buyer, a New York-based firm led by President Randy Benderson, acquired a 347,740-square-foot building with a garage at 3401 North Miami Avenue. Anchor tenants include Target, Marshalls and Dick’s Sporting Goods. Benderson’s purchase was $4.7 million below last year’s top retail sale. In 2023, Edens paid $88.4 million for Shadowood Square, a shopping plaza consisting of 11 buildings anchored by Sprouts Farmers Market.

$70M | Plantation | Pine Tree

Site Centers also sold the second priciest retail property of the past 12 months. Northbrook, Illinois-based Pine Tree entered the South Florida market in June by paying $70 million for The Fountains, a three-building shopping center in Plantation anchored by Kohl’s, Dick’s Sporting Goods and Marshall’s big box stores. Pine Tree acquired the 438,051-square-foot retail plaza for $160 a square foot. Although Site Centers took a slight hit, selling The Fountains for $2.5 million below the previous sale price in 2004. Pine Tree’s acquisition was $12 million higher than 2023’s second largest retail deal. Last year, Miami-based Orion Capital Partners paid $58 million for Greenery Mall, a shopping plaza and office building in Kendall.

$62M | Miami | IMC Equity Group

IMC Equity Group, a North Miami-based firm led by Yoram Izhak, picked up Miracle Marketplace, a six-story, 614,000-square-foot retail building in Miami, for $62 million, or $252 a square foot. Chicago-based Heitman sold the 3.5-acre site in November at a 32.6 percent markdown compared to its purchase price more than a decade ago. In 2013, Heitman paid $92 million for Miracle Marketplace, which features Burlington, Nordstrom Rack and Marshalls as tenants. IMC’s purchase was $6 million higher than last year’s third largest retail deal: the $56 million acquisition of 1600 Pines Market, a Publix-anchored shopping center in Pembroke Pines, by a subsidiary of Marc Rowan’s Apollo Global Management.

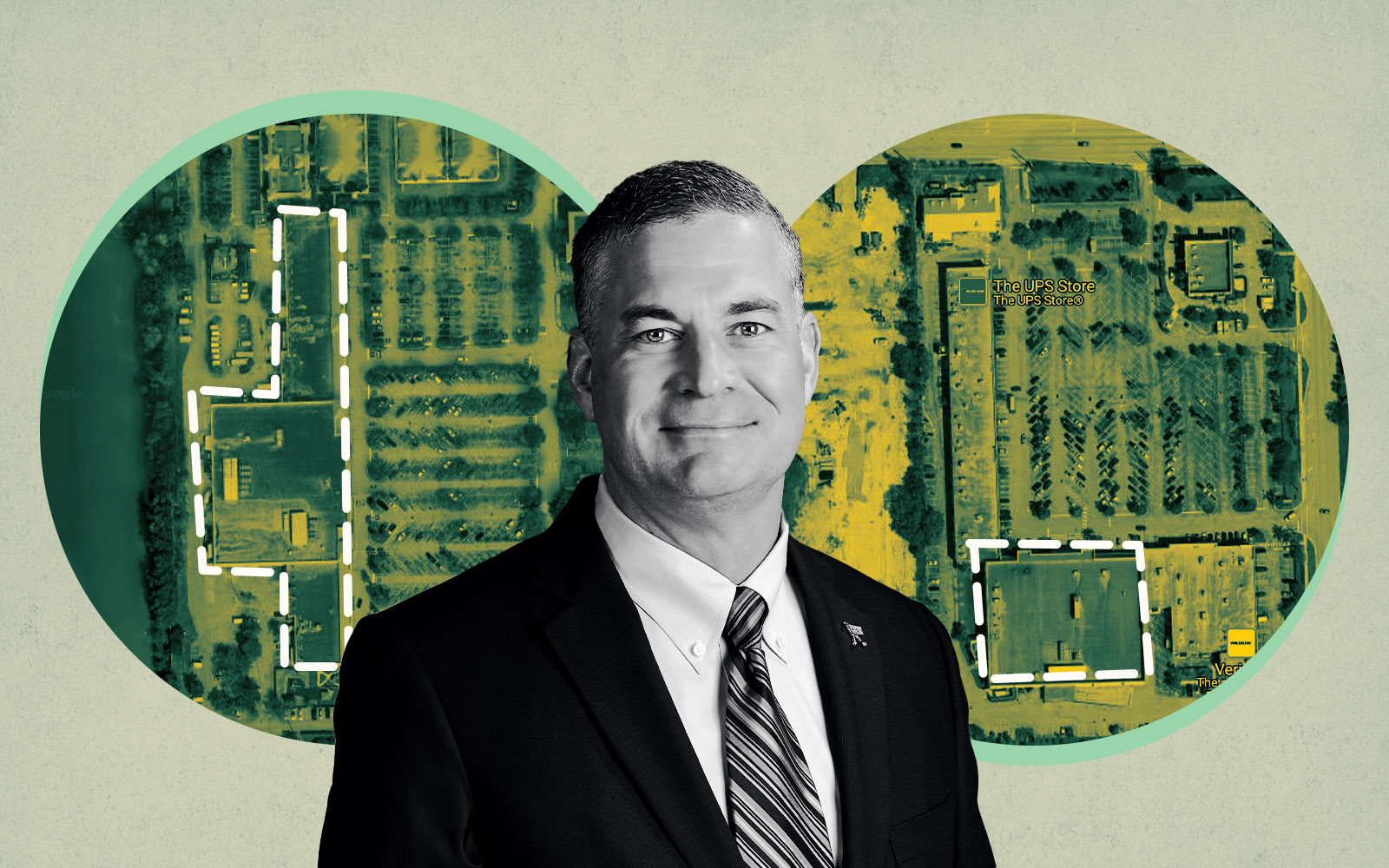

$59M | Coral Springs | Publix

Publix, led by CEO Kevin Murphy, kicked off its buying binge this past year with a $58.5 million purchase of Ramblewood Square Shopping Center in Coral Springs. In May, the buyer paid $370 a square foot for the 157,914-square-foot shopping center anchored by a Publix supermarket. The seller, another affiliate of Apollo, paid $21 million for the 15-acre property in 2019. Publix’s acquisition is $3.5 million above 2023’s fourth highest retail trade. Last year, Dream Motor Group paid $55 million for a Mercedes-Benz dealership in Coral Gables.

$51M | Davie | Publix

In September, five months after its Coral Springs purchase, Publix expanded its South Florida portfolio by paying $50.7 million for Davie Shopping Center, also anchored by one of its grocery stores. The deal breaks down to $444 a square foot for a quartet of single-story buildings sold by Boca Raton-based Southeast Centers and Newark, New Jersey-based PGIM, the real estate arm of Prudential. The joint venture paid $11.1 million for the 12-acre site in 2003. Publix’s Davie purchase was $1.5 million higher than 2023’s fifth largest retail sale when Longpoint Realty Partners paid $49.2 million for Trail Plaza, a Fresco y Mas supermarket-anchored shopping center in unincorporated Miami-Dade County.

$49M | Fort Lauderdale | BH Group, Pebb Enterprises and Related Group

In May, a partnership between three South Florida firms paid $48.5 million for The Quay at 17th Street, a 7-acre site in Fort Lauderdale that includes a shopping center, a two-story office building and a six-yacht marina. Aventura-based BH Group, led by Liat and Isaac Toledano; Boca Raton-based Pebb Enterprises, led by Ian Weiner; and Coconut Grove-based Related Group, led by Jorge Pérez, plan to redevelop the property. It has city approvals for a new mixed-use project with 361 residential units and 12,000 square feet of retail and restaurants. The Quay at 17th Street deal is $6.5 million more than last year’s sixth highest retail trade. In 2023, Morgan Auto Group paid $42 million for a Coconut Creek car dealership.

$48M | North Miami Beach | Avi Dishi and Elysee Investments

The joint venture of Avi Dishi and Elysee Investments acquired Aventura Plaza, a 66,329-square-foot retail center and a two-story, 23,554-square-foot office building in North Miami Beach, for $48 million in February. An entity managed by Marilyn Klompus in Sunny Isles Beach sold the 6.7-acre site anchored by Ace Hardware and Plum Market. Dishi and Elysee’s purchase is $7 million above 2023’s seventh biggest retail sale: real estate investor Yevgeniy Yermakov’s $41 million acquisition of a Boynton Beach shopping center anchored by a Publix supermarket.

$46M | North Miami Beach | Taillard Capital, Tuesday Properties, Ark Ventures and Strategic Capital Alliance

In another North Miami Beach trade, four partners bought the Mall at 163rd Street, a struggling indoor mall, for $46 million in March. Taillard Capital, Tuesday Properties, Ark Ventures and Strategic Capital Alliance paid roughly $90 a square foot for the 500,000-plus-square-foot mall. The seller, New York-based Brixmor Property Group, purchased the mall and two outparcels for $20 million in 1998. Brixmor sold the outparcels in 2000 and 2003 for a total of $18.1 million. The Mall at 163rd Street deal is $7 million higher than last year’s eighth priciest retail sale when BPS Partners paid $39 million for a Jupiter strip mall.

$42M | Miramar | RK Centers

RK Centers, led by Miami Heat minority owner Ranaan Katz, dived into this year’s shopping center buying craze with a $42.3 million acquisition of a two-building retail complex in Miramar. In November, Katz’s firm bought Fountains of Miramar from a joint venture between Lacera and Stockbridge Capital. The deal breaks down to $287 a square foot for the 147,281-square-foot shopping center, which is anchored by Home Depot, Marshalls, HomeGoods, Ross Dress for Less and Pet Supermarket. The sellers paid $40 million for the 15-acre site in 2018. The Fountains of Miramar deal is $10.3 million above last year’s ninth largest retail sale. In 2023, Soloviev Group purchased a five-building strip mall in Delray Beach for $32 million.

$40M | Pinecrest | University of Miami

In July, the University of Miami dropped $40 million for a Macy’s furniture store, buying it from the New York-based department store chain. The deal breaks down to $514 per square foot for the 78,000-square-foot building in Pinecrest. The purchase is $13 million higher than the 10th highest retail deal last year when Bucksbaum Properties bought a Juno Beach shopping center for $27 million.