The “It” buildings in each of The Real Deal’s markets are condo developments that typify the moment in their regions, according to brokers, insiders and our reporters’ carefully honed instincts. You can read the full series here.

A crop of ultra-luxury developments are underway in Miami. But only a few have the right combination of magnetism, potential for success and likelihood of being completed in a timely manner.

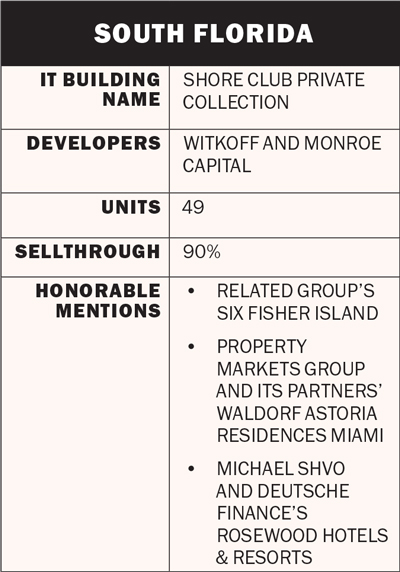

At the top of the heap is Shore Club Private Collection, an Auberge-branded project under construction in Miami Beach. Witkoff, led by Alex Witkoff, and Ted Koenig’s Monroe Capital are developing the 49-unit condo and 75-key hotel on the strip developers are now calling “billionaires’ beach.”

Shore Club is a combination of a restored circa-1939 building and a new 20-story tower. There’s also a 6,000-square-foot single-family beach house. Robert A.M. Stern Architects designed everything. Condos will range from 1,900 square feet to more than 10,000 square feet.

The development is 90 percent presold, and construction is moving.

That’s much further along than the nearby competition, which includes the Rosewood-branded Raleigh redevelopment.

Douglas Elliman’s Fredrik Eklund, who is on the sales team, said he wanted to buy into a project developed by Witkoff and designed by RAMSA.

He was one of the first buyers to sign a contract.

“There were no renderings, marketing or floorplan yet,” he said. “I bought it sight unseen.”

“It’s just really the best floorplans I’ve ever seen,” he added. “Size is right, and lastly, it’s 3 acres. It’s a very large compound with all that greenery, and the amenities are insane.”

Picture what sold him: Botanical gardens that connect throughout the property, a library and cocktail lounge, Auberge-operated restaurants and a fitness center with private training suites, spa and pools.

Mysterious, record-breaking sales always boost a project’s allure, and Shore Club has them. A hidden buyer is under contract to pay more than $11,000 per square foot, a total purchase price of $120 million, for the penthouse. That would blow the existing price-per-foot record in Miami out of the water, nearly doubling it.

A separate deal, in the $70 million range, is also in the works to a Middle Eastern buyer, sources told TRD.

Like Miami’s “it” buildings of the past, such as Alan Faena and Len Blavatnik’s Faena House, most of the current top properties have fewer units, waterfront views and pricing at the very top end of the market. Shore Club has several close contenders.

On Fisher Island, a wealthy enclave that’s only accessible by boat or helicopter, the Related Group and its partners are building a 10-story, 50-unit building called the Residences at Six Fisher Island. When the developers launched sales in 2022, asking prices averaged $30 million and penthouses started at double that. The project is pricey, exclusive and will set records once completed, but it’s less buzzy.

Property Markets Group and its partners’ Waldorf Astoria Residences Miami at 300 Biscayne Boulevard is Miami’s first supertall, at 1,049 feet. Designed by Carlos Ott with Sieger Suarez Architects to appear like a stack of glass cubes, it’s another honorable mention “it” building — though it’ll be much denser than the Shore Club, with 387 condos and 205 hotel rooms.

Last year, its developers secured $668 million in construction financing, the largest condo construction loan in Florida. The Waldorf is more than 90 percent sold.

The Shore Club’s competition also includes Michael Shvo’s Raleigh project a few blocks south on Collins Avenue. Shvo and Deutsche Finance are redeveloping three hotels into a Rosewood Hotels & Resorts-branded 44-unit condo and 60-key hotel, designed by Peter Marino. When Shvo launched sales, the firm took a very hush-hush approach. Pricing was private and visits to the sales center were invitation-only. That strategy — which has worked for other developers — backfired for Shvo, and sales suffered.