A new report shows that the time is right for homebuyers in Miami-Dade County, as rental rates have soared in recent years.

The study, conducted by RealtyTrac, compared rental rates and monthly house payments on three-bedroom homes throughout the United States.

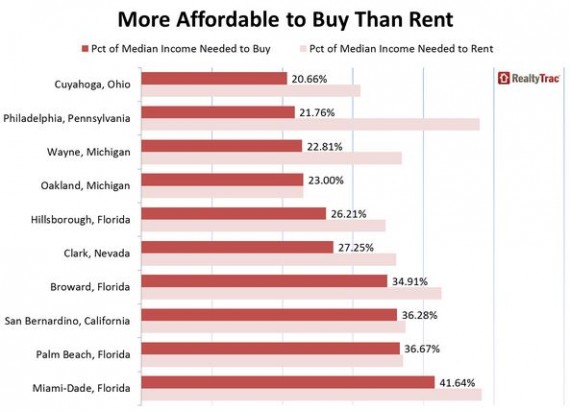

For the first half of 2015, rent in Miami-Dade cost nearly half of a household’s median income. Home payments, on the other hand, cost roughly 42 percent, according to the report.

Mike Pappas, president and CEO of the Keyes Co.

“The window is wide open for renters to take advantage of homeownership in South Florida today,” Mike Pappas, CEO and president of Keyes Company, said in a statement. “Rents have skyrocketed over the past few years and may be peaking, while interest rates are still at historic lows. With the tax savings from interest and real estate tax payments a tenant can own for less than they are currently paying in rent.”

Though there’s a significant gap between the two payments in Miami-Dade, three counties in the United States had disparities that ballooned past 10 percent. Rents in Philadelphia, for instance, cost nearly half the county’s median income. Monthly payments on a home, however, cost only 22 percent. The other two counties are Wayne, Michigan, and Cuyahoga, Ohio.

Despite this, income from buy-to-rent properties has decreased for the first half of this year. The report, again looking at three-bedroom homes, saw that income from buy-to-rent properties yielded smaller returns for more than half of the U.S. markets. — Sean Stewart-Muniz