The days of red carpet parties for new condominium developments, with seemingly limitless budgets and endless guest lists, are gone. Amid decreasing demand — particularly from foreign buyers — several notable South Florida projects are being postponed or are missing key milestones.

In this tougher business climate, the marketing firms that represent new condo developments are competing even more fiercely for business. “It’s going to take knocking on a lot more doors to sell units,” said Andres Asion of Miami Real Estate Group. “Buyers are not buying the same day or the same week.”

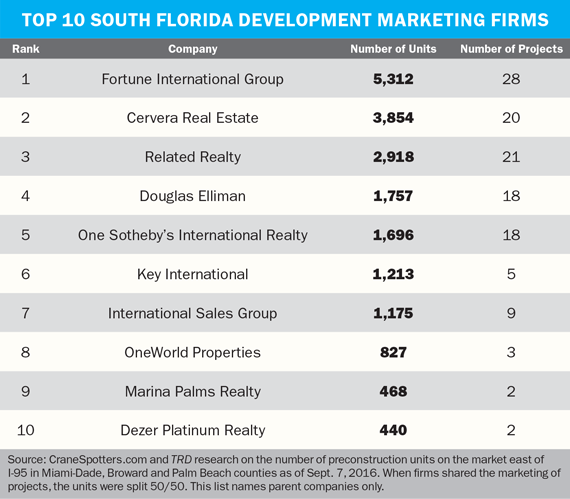

The Real Deal’s second ranking of new development marketing firms didn’t hold any surprises at the top. The three largest firms, ranked by the number of preconstruction units that they represent, reclaimed their top spots: Fortune International Group remained on top, followed by Cervera Real Estate and Related Realty.

Beneath the win-place-and-show results, there was some movement among the firms up and down the rankings, with Dezer Platinum Realty, the sales arm of Dezer Development, knocking CMC Real Estate off the list. Looking under the hood, though, it’s clear that players at all levels have to work harder to lure deep-pocketed condo buyers to Florida’s shores.

The projects

When asked whether Fortune would announce sales for more condo projects soon, CEO and President Edgardo Defortuna said “yes and no.” He said the company plans to take on the exclusive sales and marketing for at least two more developments, but this work wouldn’t be for the company’s own development arm. He declined to specify which projects Fortune would be handling, but said the firm would likely make an announcement during Art Basel in December.

“If properly presented and introduced, they’re going to be really successful,” Defortuna said, adding that rushing a project launch was not advisable.

“If properly presented and introduced, they’re going to be really successful,” Defortuna said, adding that rushing a project launch was not advisable.

As of September 2016, Fortune was handling the exclusive sales and marketing for 5,312 units, according to TRD’s tally. “We are really concentrating on what inventory we have,” Defortuna said.

At 1 Hotel & Homes in Miami Beach, represented by fourth-ranked Douglas Elliman, the majority of the remaining condos on the market are penthouses, which experts say can take longer to sell than other units. This summer, Starwood Capital and LeFrak, which joined forces to redevelop the property to create 239 condo units and 426 hotel rooms, received approval to market 1 Hotel & Homes in New York, a move the developers behind the Turnberry Ocean Club and Jade Signature in Sunny Isles Beach, among others, also made recently.

In another move that many market pros are pointing to as a sign of the times, Related has delayed construction of the Auberge Residences & Spa Miami — which was originally slated to start in 2017 — until at least the end of 2018. However, the developer’s marketing arm, Related Realty, is continuing to sell the condo project, which is still planned for three towers.

International Sales Group — the seventh-ranked firm on TRD’s list — reported in a survey of preconstruction projects that as of the second quarter of 2016, only 15 percent of the 290-unit Auberge development had sold.

But Boulevard 57, a 107-unit luxury condo project in Miami, suffered a worse fate than slow sales. The project, located at 5700 Biscayne Boulevard and marketed by One Sotheby’s International Realty, was canceled. Unitas Development Group — the developer behind the project, which was recently revealed to be backed by a wealthy Venezuelan oil magnate — suspended condo sales in July. Experts said that the development was launched at the wrong time, with the wrong unit configurations and the wrong market focus: Latin America.

“The market has certainly shifted,” said Vanessa Stabile, the vice president of development operations and marketing at One Sotheby’s, which is the fifth-ranked firm with nearly 1,696 units marketed in 18 projects. She said the strong dollar has put a damper on Latin American sales, while domestic sales have gone up.

From left: Daniel de la Vega, One Sotheby’s International; Edgardo Defortuna, Fortune International Group; Philip Gutman, Douglas Elliman

One Sotheby’s is homing in on those domestic buyers at The Fairchild, said Daniel de la Vega, president of the firm. The sales campaign for the 26-unit condo, which is slated for an opening in Coconut Grove in late 2018 or early 2019, launched at the end of the summer.

This shift in buyers also led to the kind of shakeup that has become more common in today’s market: One Sotheby’s was replaced by Douglas Elliman as the international sales consultant at the Ritz-Carlton Residences in Miami Beach. When Lionheart Capital initiated the project in late 2013, the developer was focused on international sales. By 2016, 65 percent of the inventory was presold, primarily to American buyers, and Lionheart hired Elliman to manage the remaining sales on the project, which has a total of 111 condos and 15 single-family villas. Previously, the marketing had been shared by One Sotheby’s and Premier Sales Group.

Philip Gutman, Elliman’s vice president of sales — who led the record $1.28 billion sellout of Las Vegas’ Cosmopolitan Resort & Casino — has brought a team of top Elliman agents in to push the roughly 50 units that are left at the Ritz-Carlton project.

While development marketing budgets, typically around 2 percent of the project’s total cost, haven’t changed, marketers are altering the way they allocate the funds. “One-and-a-half, two years ago, a lot of projects out there were doing big, elaborate parties with guest lists that didn’t make sense,” Gutman said. He said they’re now doing more curated events with smaller guest lists.

In the near future, Douglas Elliman will begin marketing the Monad Terrace project in Miami Beach, backed by JDS Development Group and New Valley, an investment firm owned by Douglas Elliman’s parent company, Vector Group.

“Although the developers would like to see more velocity, they’re still doing well,” Gutman said.

Player shuffle

Over at Fortune, the summer of 2016 brought big changes with the departures of Andrea Greenberg, vice president of marketing, and Asion, who headed Fortune’s development sales division for seven years.

Greenberg, who market pros describe as having been “like a fixture” at Fortune since 2000, has yet to announce her plans. Susie Glass assumed Greenberg’s former role. Glass came to Fortune from Douglas Elliman, where she was executive vice president of sales and marketing for Florida.

Asion oversaw 39 projects at Fortune, including SLS Brickell, the Paraiso towers, Hyde Midtown, One Ocean and Brickell Heights, with sales totaling $10 billion.

In July 2016, he told TRD that he would be returning to a company he had previously founded, Miami Real Estate Group, where he plans to continue working on new development sales and providing other real estate consulting services.

When asked about the departures, Defortuna told TRD that when “things evolve, you need to make changes and refresh people.”

Those exits occurred against a backdrop of comings and goings at several of the top condo marketing firms.

In 2015, One Sotheby’s hired 195 agents, representing about 35 percent of the brokerage, even as top executives Gus Rubio and Eloy Carmenate left to join Douglas Elliman. On the flip side, Fernando de Nuñez y Lugones jumped ship from Fortune to One Sotheby’s.

New foreign buyers

As top marketing firms juggle employee turnover and the shuffling of who handles what project, they’re also working to be more creative in their search for buyers. Domestic buyers have picked up some of the slack, but firms are looking farther afield, to countries such as Turkey, India and Israel — and of course, China.

Related, ISG and Cervera have all signed partnership deals with Homelink International, one of China’s biggest brokerages. However, while there’s been a lot of talk about the prospects for Chinese buyers, Chinese-backed developments and direct flights between Miami and China, real estate pros don’t expect the Chinese to replace Latin American buyers in the South Florida condo market.

Craig Studnicky, a principal at ISG, said that although his company has sold units at the W Fort Lauderdale and at Downtown Doral to Chinese buyers in 2016, buyers to the south are still a major focus of his firm’s preconstruction marketing efforts.

Studnicky is not the only one who remains sanguine about South American prospects. Those in the industry say they’re optimistic that Brazilians, whose economy is currently mired in recession, haven’t lost their appetite for buying South Florida condos, and that despite the headlines, interest is still strong among Venezuelans, Mexicans and, increasingly, Argentineans.