Across Florida, Seritage Growth Properties, the publicly traded Sears REIT, has been working quickly to repurpose old Sears and Kmart stores since the department store retailer went bankrupt in 2018 and closed more than 100 stores in the U.S. A year ago, the firm transformed an 88,400-square-foot Hialeah Kmart into a shopping plaza featuring Bed, Bath & Beyond, Ross Dress for Less and dd’s Discount. Nearby, the company plans to convert a recently shuttered Sears store and auto center at the Westfield Mall into a movie theater and retail spaces that will house Ulta Beauty, Five Below and Panera Bread. In Gainesville, Seritage redeveloped another Kmart store, totaling 139,100 square feet, into an office building for the Florida Clinical Practice Association and the University of Florida College of Medicine.

The strategy is paying off. According to Seritage’s Q4 2019 quarterly report, the firm is collecting new national retail rents averaging $20.35 a square foot compared to $7.51 a square foot that was being paid by Sears and Kmart. In Miami-Dade County, average asking retail rents were $38.18 per square foot in Q4 2019, up from $34.81 during the same period in 2018, according to Colliers International. Seritage also increased the share of non-Sears tenants from 54.3 percent in 2018 to 83.3 percent last year.

The demise of Sears, Kmart, Sports Authority, Toys ‘R’ Us and other major department store retailers in recent years jolted big box landlords in South Florida and across the country. To fill their empty massive stores, some property owners have followed Seritage’s formula of splitting up a big box to attract discount apparel companies such as Ross and Burlington, which do not need as much space as a traditional department store. Others have been lucky enough to fill entire stores by luring grocery chains like Sprout and furniture retailers like At Home.

“Seritage and all other landlords are taking advantage of what were low rents from Sears and Kmarts and creating a value-add opportunity by leasing to higher paying tenants,” Alan Esquenazi of Colliers International said.

Infill ideas

A few landlords, such as shopping center developer Raanan Katz, are planning ambitious mixed-use projects on former big box sites. Katz’s company RK Centers wants to transform the site of a Sears building in Fort Lauderdale into a massive development that would have four towers with 854 residential units, a 192-room hotel, 11,065 square feet for restaurants, cafes and a food hall and 86,990 square feet for retail, office and art gallery spaces. In the city’s burgeoning Flagler Village neighborhood, the proposed project was first presented at a Fort Lauderdale design review committee meeting in January.

In Lantana, a small town in Palm Beach County, Miami-based builder Saglo Development Corp. wants to redevelop a Kmart on an 18.6-acre site on Hypoluxo Road and South Dixie Highway into an apartment complex. A preliminary plan shows five four-story residential buildings with 209 units, a clubhouse, pool and 508 parking spaces. In January, the Lantana Town Council voted to approve a land use map change for the property from commercial to mixed-use.

Nick Banks, a principal and managing director with Avison Young, said shopping centers formerly anchored by big box stores are usually well located in the heart of mostly residential areas with strong traffic counts, good access and ample parking.

“This makes malls excellent candidates for redevelopment for other uses,” Banks said. “Multifamily options in these projects help bring residents to the doorstep of remaining retailers. Furthermore, cities are in favor of infill development like this as the pathway to achieving increased density.”

Despite vacancies caused by national chains faltering, big box retail is stable overall in South Florida, Colliers’ Esquenazi said.

“In certain markets, I have a lot of new vacancies and rental rates are going down,” Esquenazi said. “That is not the case in Florida. We had a solid year. Rental rates are better than we’ve had in three years.”

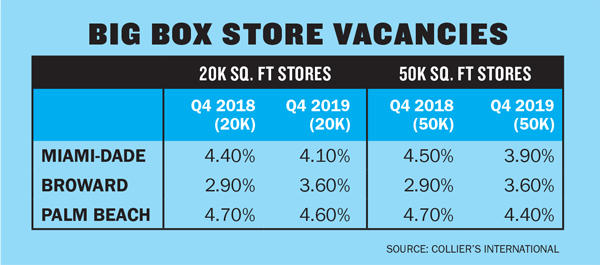

According to a Colliers International Q4 2019 report, the vacancy rate for big box retail stores in South Florida is below 5 percent with properties in Miami-Dade faring slightly better than those in Broward (see chart on page 30).

There’s a perception that landlords are not finding new tenants because big box stores will remain vacant for long periods of time even when there are signed leases, Esquenazi said.

“It takes about a year to fill the space,” he said. “But it’s not due to a lack of demand. The negotiations, getting letters of intent, signing the lease, obtaining permits and starting construction takes a number of months to complete.”

Esquenazi said his practice specializes in big box stores and represents chains, such as Target, Kohl’s and 24-Hour Fitness, among many others that are adding new locations in South Florida. Dick’s Sporting Goods, for instance, took over shuttered Sports Authority stores in at least five South Florida locations, including Sawgrass Mills Mall, Midtown Miami, Dadeland Station and Aventura.

“Obviously, Dick’s knew where Sports Authority’s best stores were and jumped on them,” Esquenazi said. “Dick’s is one example of expanding retailers. Then you have your off-price retailers like TJ Maxx, Burlington, Ross and Marshalls that remain strong.”

Supermarket rescue

Grocers are another hot category that helps boost big box-anchored shopping centers, said Ian Weiner, president and CEO of Pebb Enterprises, a Boca Raton-based commercial real estate investment firm. It took nearly two years to land the right tenant to fill a large chunk of a 42,000-square-foot store that housed a Sports Authority at the Shoppes at Isla Verde in Wellington, Weiner said.

“Rather than replacing it with any big box, we were looking for a tenant that could change the dynamics of the shopping center,” he said. “In today’s environment retailers are also being extra cautious in making decisions. Quick deals are not easy to come by.”

In July 2018, Pebb announced Sprouts, a fast-growing grocery chain offering fresh, natural and organic products, was opening its first South Florida location, taking 30,000 square feet in the former Sports Authority space. A month later, Pebb sold the Shoppes at Isla Verde — which has a Best Buy, Ulta Beauty, and Petco — to MetLife Investment Management for $73.75 million. Pebb still handles leasing and property management for the 207,030-square-foot outdoor shopping center.

“Adding Sprouts increased the value of the shopping center,” Weiner said. “It adds a lot more foot traffic having a grocer versus a Sports Authority, and the investor pool is a lot better for grocery store-anchored shopping centers.”

Last year, Pebb was also able to find a large tenant to fill an 126,000-square-foot big box store that was once occupied by Gander Mountain, an outdoor apparel company that filed for bankruptcy in 2018, after liquidating merchandise, laying off employees and closing 30 to 40 stores. The home décor superstore At Home signed a 10-year lease and opened its doors last May. Pebb bought the 13-acre Gander Mountain site in April 2018 for $2.6 million.

“We bought it knowing we had potential options like splitting it up or doing an alternative use like industrial,” Weiner said. “But splitting up a big box space is very costly to do. So the best solution is to get a tenant that can absorb the entire space.”

Each project varies, but it can cost $50 to $100 a square foot to reconfigure a big box for smaller tenants, Weiner said.

The benefit of splitting a big box store is that a landlord can charge a higher rate per square foot for smaller spaces, said Claudio Mekler, CEO of Miami Manager, a commercial real estate firm based in Sunrise. Mekler said a Sears Home vacated a nearly 5,000 square foot space at the Miami Manager-owned Village Shoppes of Coconut Creek in June 2017. Belfort Gym, a tenant at another Miami Manager property totalling 5,963 square feet, was looking to downsize its space by half.

Mekler said he convinced the gym owners to take half of the space in the former Sears Home store. He then leased Belfort’s old space to another existing tenant, Salon 360, that wanted to expand its square footage.

“Between Belfort and Salon 360, Miami Manager increased its income at these two properties by almost 32 percent compared to the income generated by the old Sears lease,” Mekler said. “Although the other half of the Sears space consisting of 2,338 square is still vacant, we know with the aggressive approach it will be leased shortly.”