As the tri-county region enters the fourth year of this current real estate cycle, the preconstruction condo boom that began in Miami-Dade in 2011 with a focus on international buyers has spread to Broward, and to a lesser extent, up to Palm Beach, too.

The shift to the markets north of Miami-Dade, where preconstruction condo projects are generally priced cheaper on a per square foot basis, comes at a time when foreign buyers have less purchasing power due to the strengthening U.S. dollar and the slumping international economy.

Concurrently, consumer confidence is growing with domestic buyers — who tend to invest more actively in Broward and Palm Beach counties than in Miami-Dade — as the U.S. stock market hovers near record highs and the national unemployment rate sits at its lowest level in years.

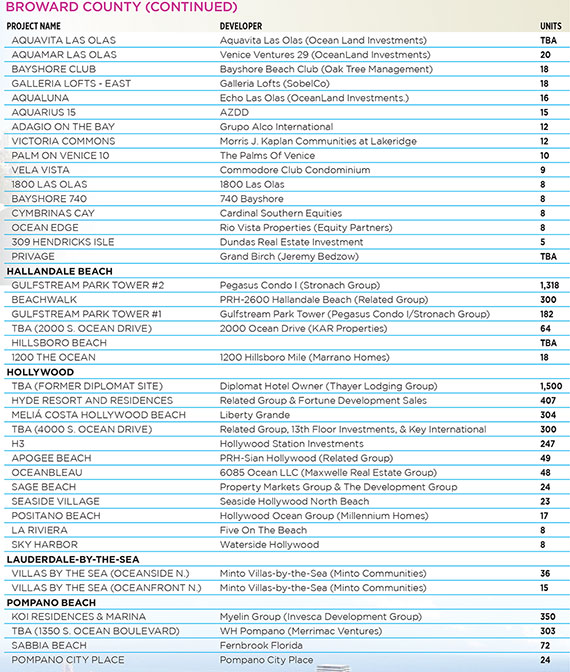

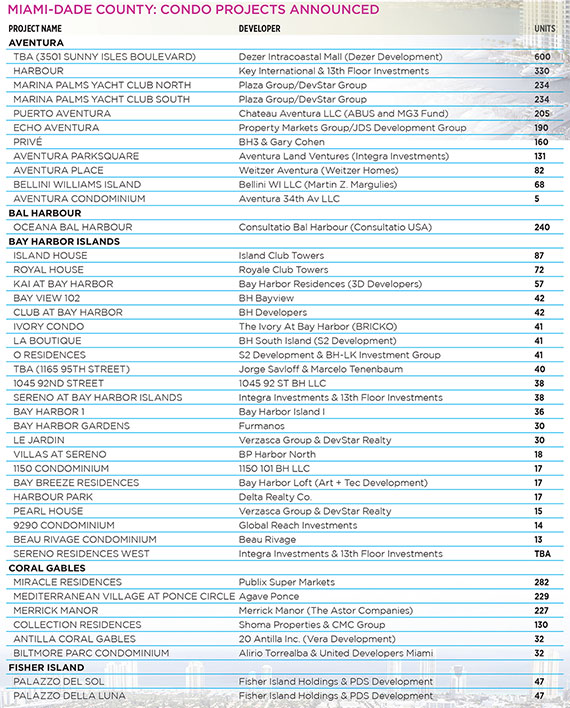

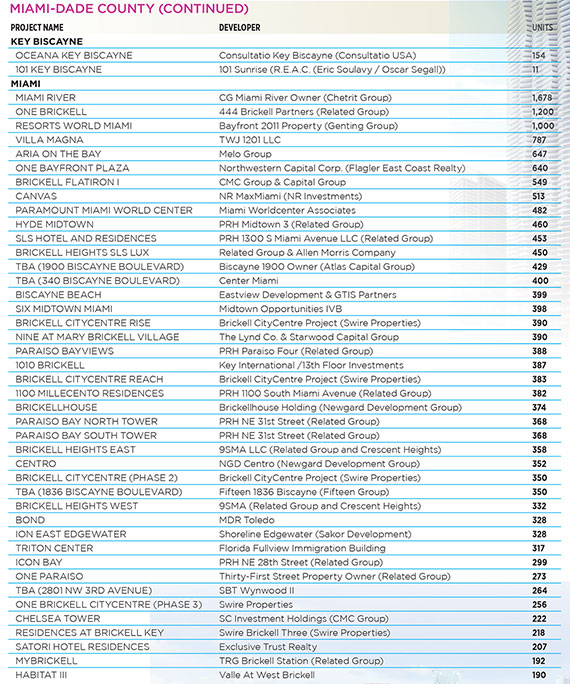

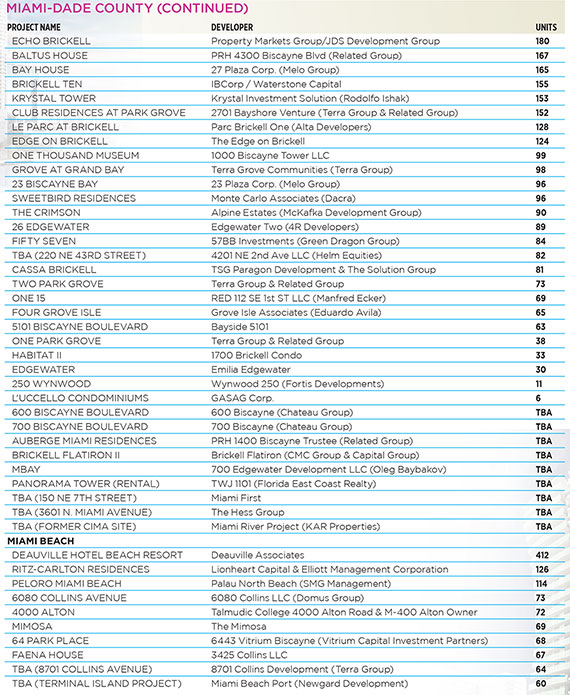

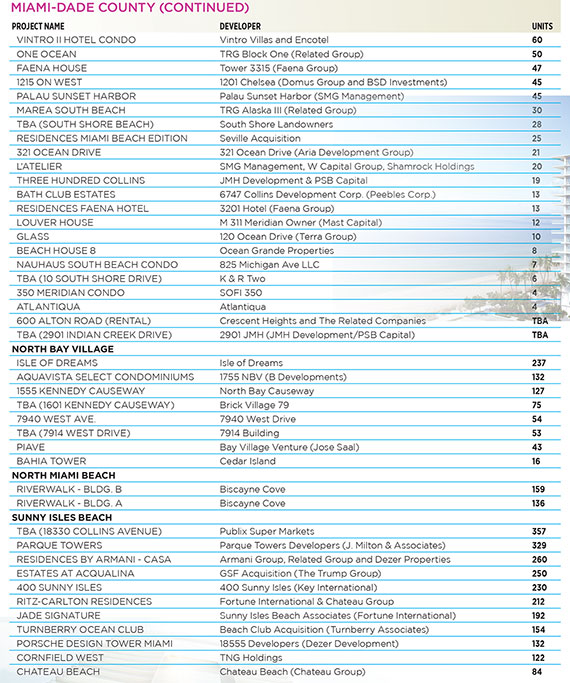

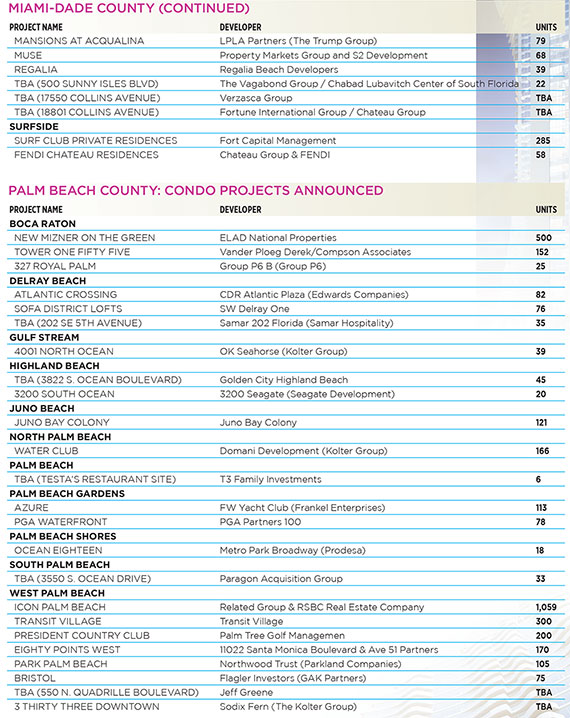

In the last 12 months, developers have announced plans to build nearly 135 new condo towers east of Interstate 95, with about 75 buildings in Miami-Dade, 42 in Broward and 16 in Palm Beach as of mid-March.

With the recently announced preconstruction projects, nearly 43,000 units are in the development pipeline in South Florida for this cycle.

Miami-Dade is still the most active area for preconstruction condo development in the region, with about 31,100 units announced. But the county’s regional market share fell by six points from a year earlier to 72 percent in March 2015.

As Miami-Dade’s share decreased, Broward’s proportion of the South Florida preconstruction condo market went up by about seven points from the previous year, to nearly 20 percent in 2015.

The big jump in the Broward share of the preconstruction market is being fueled by more than 4,800 new condo units that have been announced in the last year. As a result of the recent flurry of preconstruction projects, nearly 8,500 new condo units are in the pipeline for Broward as of mid-March.

For Palm Beach, the growth in preconstruction projects in the last year has reached nearly 800 new units, increasing the overall total for the county to more than 3,400 condos during this cycle.

The modest growth of preconstruction condo units in Palm Beach compared to Miami-Dade and Broward has led to a more than one point drop in South Florida market share, settling at eight percent in 2015.

The unanswered question going forward is whether domestic buyers — who have slowly entered the presale market during this cycle — will play a big enough role in South Florida’s preconstruction condo sector in the upcoming months and years to offset any slowdown in international investment.

Peter Zalewski is a real estate columnist for The Real Deal who founded Condo Vultures, a consultancy and publishing company, as well as Condo Vultures Realty and CVR Realty brokerages and the Condo Ratings Agency, an analytics firm. The Condo Ratings Agency operates CraneSpotters.com, a preconstruction condo projects website, in conjunction with the Miami Association of Realtors.